Cryptocurrency investing can be a wild ride. To give yourself the best chance of success, it's important to think not just about buying but also when to sell crypto.

When investing in stocks, a good rule is to buy and hold for at least five years. Crypto is an entirely different and much more volatile market, so the traditional rules don't always apply. Keep reading to learn how to know when to sell crypto and the factors to consider in this decision.

When to sell

When should you sell crypto?

Here are the situations when you should consider selling a cryptocurrency investment:

The value has doubled or tripled since you bought it.

If your investment has shot up in value, you should probably sell at least a portion of it. For example, you could sell what you originally invested, and then you're playing with house money going forward.

Because of how volatile crypto is, profits can disappear quickly. Take at least some of your profits as a hedge against potential losses in the future.

You no longer believe in its long-term success.

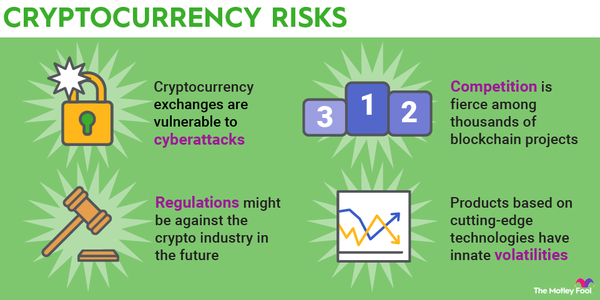

Part of investing in crypto is knowing when to cut your losses. This can be difficult since people are often very passionate about the cryptocurrencies they buy. That's why it's important not to get overly attached to any project. Here are a few signs that a cryptocurrency may be on the way down:

- There isn't much development going on.

- You have doubts about the management team.

- The community that supports it is getting smaller and smaller.

You've found better investment opportunities.

Cryptocurrencies and blockchain technology are advancing rapidly. When Litecoin (LTC 0.98%) launched in 2011, it was a dramatic improvement on Bitcoin (BTC 0.85%) in terms of transaction processing. Since then, plenty of new cryptocurrencies have left Litecoin in the dust.

If other cryptocurrencies have surpassed one of your current crypto holdings in a key area, it makes sense to sell. You can get out before it loses too much ground and free up cash to invest in something better.

When to hold

When you shouldn't sell crypto

There are no firm rules on when you shouldn't sell crypto. The most important thing to remember here is that you shouldn't panic-sell because the price has dropped. If you still think it has long-term value, hang on to it.

Panic-selling is a decision that many crypto investors later regret. They buy when a cryptocurrency is at a high, sell when the price plummets, and then miss out if the price bounces back.

If the price has dropped and you no longer think the cryptocurrency is a good investment, then you should sell. However, a price drop should never be the only reason you sell.

Things to consider

Things to consider before selling crypto

Here are the most important things to consider before selling crypto:

How much will you sell? You don't need to sell everything, especially if it has increased in value. You could sell a portion of your holdings to rebalance your portfolio and hang on to the rest if you still think the cryptocurrency will be a winner going forward.

What are the tax implications? If the cryptocurrency has increased in value, you'll owe crypto taxes. It's taxed as long-term gains if you held the crypto for more than 365 days.

Long-term capital gains have lower tax rates than short-term gains, which are taxed as ordinary income. If you're close to the year mark, consider waiting to sell your crypto until after it passes that long-term gains threshold.

Things to consider before buying crypto

Here are the most important things to consider before buying crypto:

What makes this cryptocurrency a good investment? It's easy to get swept away by the hype surrounding a popular cryptocurrency. Whenever you invest in a cryptocurrency, make sure you've researched it thoroughly and that you believe it's a sound long-term investment.

How much will you invest? Putting your entire life savings in crypto is a bad move. A smart rule of thumb is to have no more than 5% to 10% of your investment portfolio in the crypto market.

Related Crypto Topics

Should I buy?

Is now a good time to buy and hold cryptocurrency?

Yes, now is a good time to buy and hold cryptocurrency. The key is to pick quality cryptocurrencies with legitimate use cases because they have the best chance of long-term success.

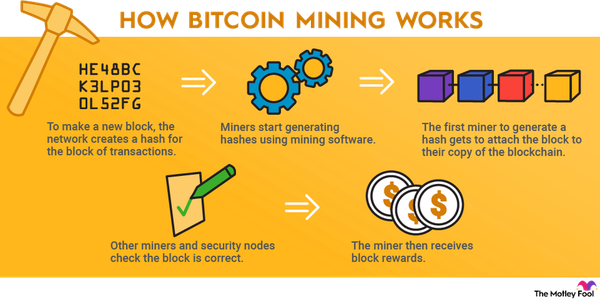

Two recommendations for new investors are the two coins at the top of the market, Bitcoin and Ethereum (ETH 0.9%). Bitcoin leads the crypto market as a whole and has become popular as a digital store of value. Ethereum launched the first programmable blockchain. It's now the most popular option for decentralized finance (DeFi) platforms that provide an alternative to traditional financial services.

There are plenty of other worthwhile cryptocurrency investments available, including other coins and cryptocurrency stocks. If you spend some time researching, you can find quality investments to buy and hold.