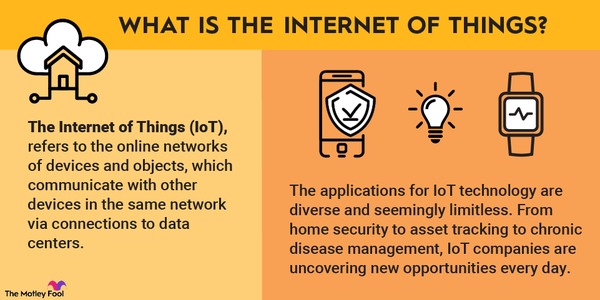

The technology sector is vast, comprising gadget makers, software developers, wireless providers, streaming services, semiconductor companies, and cloud computing providers, to name just a few. Any company that sells a product or service heavily infused with technology likely belongs to the tech sector.

What are Tech Stocks?

What are Tech Stocks?

Hardware Companies

These design and build devices such as:

- Personal computers.

- Smartphones.

- Fitness trackers.

- Smart speakers.

- Enterprise equipment, such as servers and networking gear.

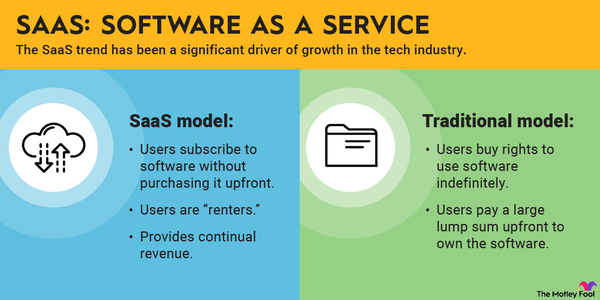

Software Companies

These design the software that runs on hardware, such as:

- Operating systems.

- Databases.

- Cybersecurity software.

- Productivity software.

Software companies are increasingly moving to a software-as-a-service model where customers buy a subscription to a program instead of a one-time license. The arrangement generates recurring revenue for the software company.

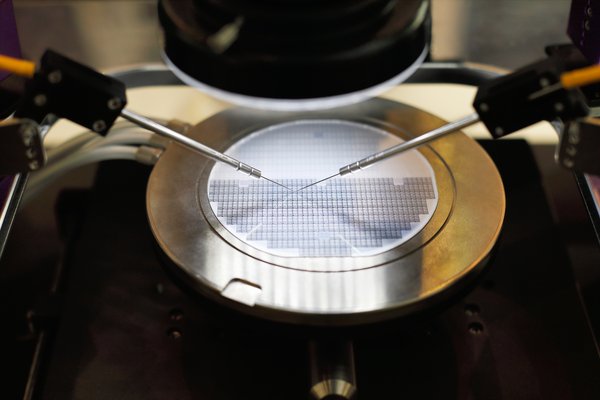

Semiconductor chips power the hardware. Semiconductor companies design and/or manufacture central processing units, graphics processing units, memory chips, and a wide variety of other chips that help to run today’s devices.

Telecom companies that provide wireless services are part of the tech sector. So are the video streaming companies that provide easy access to high-quality content, and the cloud computing providers that power those streaming services.

The best tech stocks in 2024

The best tech stocks in 2024

Many of the most valuable companies in the world are technology companies. These are some of the most dominant and impressive tech stocks that investors should consider:

- Amazon.com (AMZN -2.56%) is the leading online retailer and leading provider of cloud computing infrastructure.

- Microsoft (MSFT -1.27%) is a dominant software company known for its Windows PC operating system and Office productivity software. Microsoft is also the second-largest provider of cloud infrastructure.

- Apple (AAPL -1.22%) makes the iPhone, iPad, and Mac computers. Intense customer loyalty ensures plenty of repeat customers, and a growing array of services makes Apple’s ecosystem sticky.

- Intel (INTC -2.4%) is one of the largest semiconductor companies in the world. Intel designs and manufactures central processing units (CPUs) for PCs and servers, as well as specialty chips for uses such as artificial intelligence. The company is betting big on manufacturing, with plans to make chips for other companies.

- Netflix (NFLX -9.09%) is the top dog in the video streaming industry, spending billions of dollars each year on content to keep its subscriber base hooked.

- Meta Platforms (META -4.13%) is the largest social media company, with more than 2 billion daily active users across Facebook, Instagram, Messenger, and WhatsApp. The company sees virtual reality as its future.

- Alphabet (GOOG -1.1%) (GOOGL -1.23%) is the parent company of online search giant Google and the popular Android operating system for smartphones.

Meta (formerly Facebook), Amazon, Apple, Netflix, and Alphabet (Google) are sometimes grouped together as the FAANG stocks. The companies dominate their industries, and their stocks have produced impressive returns during the past decade. That winning streak ended in 2022, though, when almost every major tech stock fell, along with the broader market.

Tech stocks, COVID-19, and the bear market

Tech stocks, COVID-19, and the bear market

It was impossible to predict in March 2020 how tech companies would fare as the COVID-19 pandemic shut down economies and led to massive job losses. Some tech companies saw immediate negative impacts. Alphabet and Meta, for example, suffered from big slowdowns in revenue growth as hard-hit industries such as travel and hospitality pulled back on advertising.

Other tech companies flourished. Amazon benefited from booming e-commerce sales as shoppers shied away from stores, and Netflix enjoyed a surge in subscribers as home-bound consumers had more time to watch TV. Insatiable demand for PCs, smartphones, and other gadgets boosted sales for Intel, Microsoft, and Apple. A potent combination of limited options for consumers to spend their money and unprecedented stimulus cash helped many tech companies report record revenue and profits.

But 2022 was the beginning of the end of the pandemic bonanza. Sky-high inflation led the Federal Reserve Board to rapidly increase interest rates, putting pressure on consumer spending. Shortages turned into gluts as supply chains improved and pandemic-level demand subsided. The stock market tumbled, entering bear market territory. Tech stocks were among the worst performers.

- Amazon greatly increased its e-commerce and cloud computing capacity during 2020 and 2021 to meet staggering levels of demand. The company overbuilt on the e-commerce side, and it spent the second half of 2022 closing and delaying some warehouses in an effort to bring down costs. The cloud computing business also started to slow down a bit in 2022, and the company may be facing a similar excess capacity problem there. Record profits during the pandemic have quickly faded away, with the company reporting a $3.8 billion net loss in the first quarter of 2023 alone.

- Microsoft benefited from strong PC sales during the pandemic. The PC market experienced a renaissance, with sales volumes rising to the highest levels in a decade and ending a long streak of declines. Working and learning from home, combined with stimulus cash, helped fuel the boom. That boom has now turned into a historic bust. Global PC shipments were down 16% in 2022, and they slumped 30% year over year in the first quarter of 2023. Amid this historic downturn, Microsoft is betting big on artificial intelligence.

Artificial Intelligence

- Intel has also been hit hard by the declining PC market. After watching its market share slip away to rival Advanced Micro Devices (AMD -5.44%) over the past few years, Intel struck back in 2021 and 2022 with its Alder Lake and Raptor Lake PC CPUs. The products were big winners, but they’ve been selling into the worst market for PCs in years. This is all happening as Intel invests tens of billions of dollars annually to build out its manufacturing capacity just as the semiconductor market enters a downturn.

- Netflix added subscribers at a record pace in 2020, but its fortunes turned as competition ramped up. Netflix lost some subscribers in North America in 2021, partly due to demand being pulled forward and partly due to an explosion of high-quality alternatives. Disney’s (DIS 0.16%) Disney+ rapidly gained subscribers, Warner Bros. Discovery's Max grew in popularity, and a raft of smaller streaming services gave consumers more choices than ever. Netflix has been put on the defensive, changing its tune on ad-supported plans and working to cut costs.

- Facebook changed its name to Meta Platforms in 2021 to emphasize its focus on virtual reality and the metaverse. Advertising revenue from its social media apps is still its main source of revenue. Although sales recovered after the initial pandemic weakness, a tough economy in 2022 and privacy changes from Apple on iOS devices have presented new challenges. As the advertising business struggles, Meta is pouring billions of dollars annually into its metaverse efforts, and it has almost nothing to show for it so far.

- Alphabet’s revenue growth slowed dramatically in 2022, with revenue up just 6% year over year in the third quarter. Alphabet’s Google Cloud business is growing rapidly, but its core advertising business is running up against a worsening economy. Beyond macroeconomic issues, Alphabet’s cash-cow search businesses may be facing an existential threat from AI-powered services. OpenAI’s ChatGPT took the world by storm in late 2022, and Microsoft is a major investor.

Related investing topics

How to analyze tech stocks

How to analyze tech stocks

For mature tech companies that produce profits, the price-to-earnings ratio is a useful metric. Divide stock price by per-share earnings, and you get a multiple that tells you how highly the market values the company’s current earnings. The higher the multiple, the more value the market is placing on future earnings growth.

Many tech companies aren’t profitable, so the price-to-earnings ratio can’t evaluate them. Revenue growth matters more for younger companies. If you’re investing in something unproven, you want to make sure it has solid growth prospects.

For unprofitable tech companies, it’s also important that the bottom line be moving from losses toward profits. As a company grows, it should become more efficient, especially when it comes to the sales and marketing spending necessary to close deals. If it’s not, or if spending is growing as a percentage of revenue, that could indicate something is wrong.

Ultimately, a good tech stock is one that trades at a reasonable valuation, given its growth prospects. Accurately figuring out those growth prospects is the hard part. If you expect earnings to skyrocket in the coming years, paying a premium for the stock can make sense. But if you’re wrong about those growth prospects, your investment may not work out.

Investing in an exchange-traded fund (ETF) that focuses on tech stocks is one way to avoid making mistakes. The Ark Innovation ETF (ARKK -2.12%) is one option, although the fund’s bets on high-flying tech stocks may ultimately prove riskier than investing in the tech giants listed above.

Investing in tech stocks can be risky, but you can reduce your risk by investing only when you feel confident their growth prospects justify their valuations.