“Half the money I spend on advertising is wasted; the trouble is, I don’t know which half,” the old adage goes. Advertising is as much art as science, even in a digital age when trillions of ad impressions are served to the world’s internet users on PCs, smartphones, and TVs.

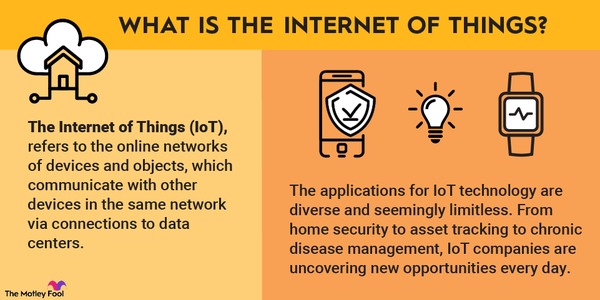

The advertising technology, or adtech, industry aims to improve the process of buying and selling ads with software and other tools. Using massive computing power and technologies such as artificial intelligence, adtech companies can help advertisers make better use of their ad spending and help publishers better monetize their content.

Best Adtech Stocks in 2024

There’s no shortage of adtech companies looking to snag a piece of an industry worth hundreds of billions of dollars. Here are five adtech stocks that investors should consider:

1. The Trade Desk

The Trade Desk (TTD 1.38%) serves the buy side of the digital advertising market. The company’s self-service platform allows ad buyers to create and manage digital advertising campaigns across all major channels.

When the internet was young, digital advertising wasn’t all that complicated. An advertiser could effectively reach audiences with display ads, and devices were limited to PCs. Today, people are spending their time using PCs, smartphones, tablets, and connected TVs, and they’re consuming content through websites, mobile apps, social media, and streaming services.

The Trade Desk’s AI-powered, cloud-based platform churns through massive amounts of data to automate the ad-buying process. The company enables advertisers to reach their audience across channels, and data from one channel can be used to inform decisions about a different channel. For The Trade Desk’s advertising agency and service provider customers, the platform greatly simplifies the process of launching a modern digital advertising campaign.

Not only is The Trade Desk rapidly increasing revenue, but it’s also highly profitable. Revenue soared 43% in 2021 to $1.2 billion, and net income was almost $140 million. The company increased revenue by another 39% in the first six months of 2022, and customer retention hovered above 95%.

Connected TV, a category that includes devices such as Roku and Xbox, is one of the company’s biggest long-term opportunities as ad-based streaming services proliferate. More than 15,000 advertisers used The Trade Desk for CTV last year. With global digital ad spending expected to approach $800 billion by 2025, The Trade Desk’s market opportunity is enormous.

2. PubMatic

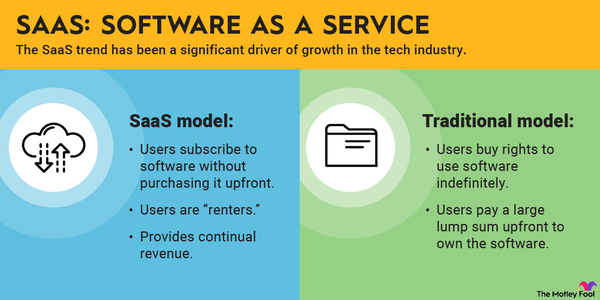

While The Trade Desk focuses on ad buyers, PubMatic’s (PUBM 0.6%) sell-side platform enables publishers and app developers to better monetize their content. Of course, a publisher could go it alone and sell ad space directly. But the process is time-consuming and labor-intensive, and there’s no guarantee money isn’t being left on the table.

PubMatic’s home-grown cloud platform processed an astounding 92 trillion ad impressions in 2021 for its roughly 1,450 publishers. The company’s platform is integrated with major buy-side platforms, including The Trade Desk, providing a vast array of ad inventory to tens of thousands of advertisers.

PubMatic’s approach to infrastructure is unique. Instead of relying on a cloud computing provider, PubMatic owns and operates its own hardware. This makes the business more capital-intensive, but it saves PubMatic from massive cloud computing bills that would eat into its profits. Over the past two years, PubMatic has leveraged its infrastructure to knock down the cost of revenue per million ad impressions by about 50%.

The intense focus on keeping costs down has led to impressive profits. PubMatic’s revenue surged 53% in 2021 to $226.9 million, and it produced net income of $56.6 million. Growth is slowing a bit this year, but PubMatic is still putting up solid numbers. Revenue jumped 27% in the second quarter, and net income remained squarely in positive territory even as costs rose.

With double-digit revenue growth and lofty profit margins, PubMatic is certainly worth a look.

3. Magnite

Like PubMatic, Magnite (MGNI -1.42%) operates a sell-side digital advertising platform. The company was formed in 2020 by the merger of The Rubicon Project and Telaria, the latter of which focused on connected TV and video publishers. Magnite is about twice the size of PubMatic, with revenue of $468.4 million last year.

Neither Magnite nor PubMatic owns any media properties, so their interests are squarely aligned with their publisher customers. Unlike PubMatic, Magnite makes use of cloud computing providers to handle some of its processing. Magnite adopts a hybrid approach, mixing servers hosted at data centers around the world with cloud platforms.

Although this type of infrastructure makes it easy to handle sudden spikes in demand, such as prime-time viewing on connected TVs, Magnite hasn’t been able to produce PubMatic-level profits. PubMatic managed a gross margin of 74% in 2021, while Magnite’s gross margin was just 57%. Magnite essentially broke even last year, partly a reflection of the investments it’s making in growth and partly due to its less-efficient infrastructure.

Being the biggest independent sell-side player, Magnite is certainly a stock to consider, especially considering the stock was down almost 90% from its all-time high as of October 2022. But investors should keep a close eye on the bottom line.

4. Digital Turbine

Digital Turbine (APPS -3.48%) is in the business of helping wireless carriers and device manufacturers manage and monetize devices. DigitalTurbine’s solution enables app installation at activation and during the lifetime of the device. Third-party advertisers pay for each install or action, allowing carriers and original equipment manufacturers to generate additional revenue.

Various acquisitions have expanded the scope of Digital Turbine’s offerings. Through the acquisitions of Mobile Posse, AdColony, Appreciate, and Fyber, the company enables broader monetization over the lifetime of devices.

Digital Turbine has powered more than 4 billion app preloads, and it has more than 40 long-term agreements with companies, including Verizon (VZ -0.77%), AT&T (T -1.2%), and Samsung. The company changed how it reported revenue earlier this year, backing out revenue share costs related to some of its acquisitions. Even with much lower reported revenue, Digital Turbine’s results are impressive.

Revenue rose 19% in the latest quarter to $188.6 million, partly due to acquisitions, and the company generated net income of $15 million. Digital Turbine spends little on operating costs, so even though it must shell out considerable sums on license fees and revenue share expenses, the company is able to produce a healthy profit.

Digital Turbine stock has tumbled this year, bringing the company’s market capitalization down to just $1.6 billion. The macroeconomic environment will certainly take a toll on Digital Turbine’s results, especially considering that a chunk of its revenue depends on healthy smartphone sales. But this is a profitable business that should bounce back once the economic seas calm down.

Related investing topics

5. DoubleVerify

Advertisers have no shortage of options when it comes to buying ads, but it’s still a challenge to determine if those ads are paying off. Publishers, social media companies, and other platforms often self-report data related to advertising, which is not always accurate. For example, publisher Gannett (GCI 4.09%) was passing inaccurate data to online advertisers for nine months before discovering the problem.

DoubleVerify (DV -1.85%) aims to solve this problem for advertisers with its digital media measurement and analytics platform. Integrated across the digital advertising industry, DoubleVerify provides insights into advertising performance and metrics that give advertisers peace of mind. On top of knowing whether their ads are performing well, advertisers also want to make sure their ads aren’t being hit by fraud and are being displayed in places suitable for their brand.

Around 4.5 trillion media transactions were measured through DoubleVerify’s platform last year, generating $332.7 million of revenue. Revenue totaled $109.8 million in the most recent quarter, growing by 43%, and the company reported a net income of $10.3 million. Upsells of premium-priced products such as Authentic Brand Suitability are helping to drive sales higher.

As advertisers lose faith in self-reported data, DoubleVerify is ready to deliver the accurate metrics necessary to run successful ad campaigns.