Artificial intelligence (AI) is taking nearly every corner of the business world by storm, and companies are finding new ways to use AI in finance.

Artificial intelligence plays a role in the algorithms and quantitative modeling companies use to manage money, and fintech companies are using a wide range of applications of AI in finance to make their businesses more efficient and better service customers.

Upstart (UPST 0.79%), for example, uses AI models to screen borrowers and establish forecasts on creditworthiness that it considers to be more accurate than credit scores.

Other fintech companies are also embracing AI as a way to differentiate themselves from legacy institutions like banks, and even banks have embraced artificial intelligence for things like customer service, fraud detection, and analyzing market data.

With ChatGPT setting off a new revolution in AI, we could just be seeing the start of AI in the financial industry as these companies find new ways to use this breakthrough technology.

What is AI?

What is AI?

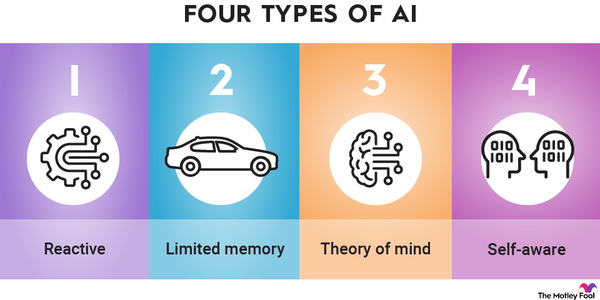

If you're like many investors, you probably have a sense of what artificial intelligence is, but have trouble defining it.

Generally, artificial intelligence is the ability of computers and machines to perform tasks that normally require human intelligence, such as identifying a type of plant with just a picture of it.

Artificial Intelligence

Machine learning, which means the ability of computers to teach themselves things using pattern recognition from the data they sample, might be the best-known application of artificial intelligence. This is the technology that underpins image and speech recognition used by companies like Meta Platforms (META -0.52%) to screen out banned images like nudity or Apple's (AAPL 1.27%) Siri to understand spoken language.

Other forms of AI include natural language processing, robotics, computer vision, and neural networks. Natural language processing and large language models (LLM) form the basis of chatbots like ChatGPT.

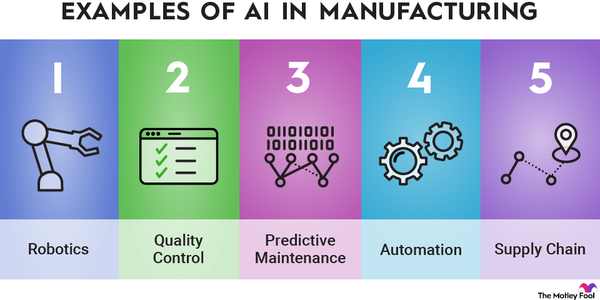

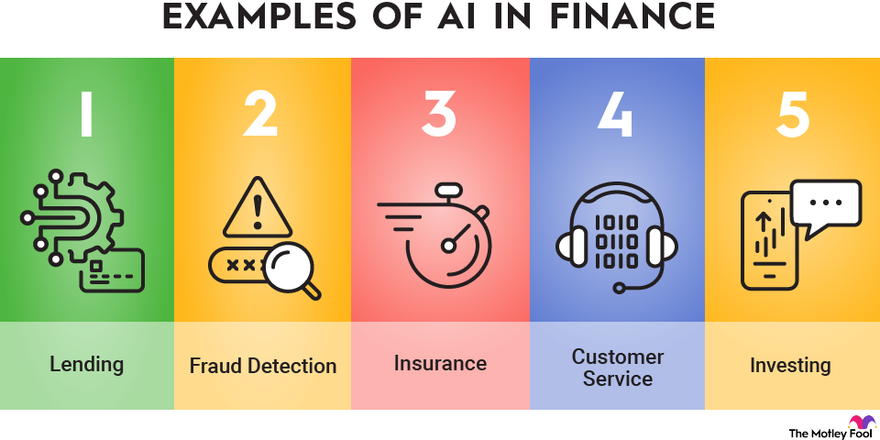

Examples of AI in finance

Examples of AI in finance

In finance, natural language processing and the algorithms that power machine learning are becoming especially impactful. Keep reading to see how AI is used in the finance industry.

1. AI in lending

1. AI in lending

One of the most common applications of artificial intelligence in finance is in lending. Machine learning algorithms and pattern recognition allow businesses to go beyond the typical examination of credit scores and credit histories to rate borrowers' creditworthiness when applying for credit cards and other loans.

AI lending platforms like those of Upstart and C3.ai (AI 0.09%) can help lenders approve more borrowers, lower default rates, and reduce the risk of fraud.

C3 AI says its smart lending platform helps financial institutions streamline their credit origination process and reduce borrower risks. For example, it promises a 30% reduction in the time required to approve a loan applicant. It's also achieved a $100 million increase in application volume and loan acceptance yield.

With rising interest rates, the banking crisis, and increasing pressure on borrowers, shares of Upstart have come crashing down as its growth has stalled. But that's no reason to doubt the underlying AI technology behind this business, as AI and machine-learning algorithms are designed to make inferences and judgments using large amounts of data.

2. AI in fraud detection

2. AI in fraud detection

Fraud is a serious problem for banks and financial institutions, so it shouldn't be surprising that they're embracing new technologies to prevent it.

Much like AI algorithms do with lending or cybersecurity, in fraud detection, machine learning algorithms can sort through large volumes of transaction data to flag suspicious activity and possible fraud.

These algorithms can suggest risk rules for banks to help block nefarious activity like suspicious logins, identity theft attempts, and fraudulent transactions.

A number of startups are working AI fraud detection programs, and IBM (NASDAQ:IBM) has an AI program under IBM Watson Studio that improves fraud detection, fraud prediction, and fraud prevention.

3. AI in insurance

3. AI in insurance

Insurance is a close cousin of finance as both industries rely on financial modeling and need to accurately estimate risk in order to be successful.

One insurance company that has embraced AI is Lemonade (LMND -0.46%), which has been an AI-based company since its launch nearly a decade ago.

Lemonade uses AI for customer service with chatbots that interface with customers to offer quotes and process claims. Those algorithms can process claims at lightning speed. In 2016, it set a record when AI-Jim, its AI claims processing agent, paid a theft claim in just three seconds. The company says it settles close to half of its claims today using AI technology.

Fraud detection algorithms are also necessary in insurance. That technology helps make high-speed claims processing possible, better serving customers.

Lemonade says it expects to take advantage of new generative AI technologies, seeing them as an accelerant, and it plans to deliver significant savings with the help of ChatGPT and related technologies.

4. AI in customer service

4. AI in customer service

Customer service is crucial in the banking industry and good customer service can often differentiate one institution from another and retain valuable customers, including high-net-worth individuals.

Banks use AI for customer service in a wide range of activities, including receiving queries through a chatbot or a voice recognition application.

If you've contacted your bank recently, there's a good chance you've engaged with an AI chatbot or a voice recognition system.

AI chatbots help companies respond quickly to customers, and it also has the potential to be used for new products, including product recommendation, new account sign-ups, and even credit products.

AI chatbots help banks save money on labor in customer service as well.

In addition to chatbots, banks use AI to help recommend products for customers and manage money.

Chatbots

5. AI in investing

5. AI in investing

Finally, artificial intelligence is also being used for investing platforms in recommending stock picks and content for users.

Robinhood (NYSE:HOOD) is probably the best example of this kind of platform among financial stocks. The popular trading app has used AI to differentiate itself from competitors and recommend investment opportunities based on things like risk tolerance and investing style and history. Its AI tools help personalize the user experience.

A new app called Magnifi takes AI another step further, using ChatGPT and other programs to give personalized investment advice, similar to the way ChatGPT can be used as a copilot for coding. Magnifi also acts like a trading platform that can give details on stock performance and allows users to execute trades.

Related investing topics

Will AI change the world of finance?

The financial industry encompasses a number of subsectors, from banking to insurance to fintech, and it's a highly competitive industry as banks and other operators are constantly looking for an edge on one another.

That explains why artificial intelligence is already gaining broad adoption in the financial services industry with the use of chatbots, machine learning algorithms, and in other ways.

While finance will always require a human touch and human judgment for some decisions and relationships, organizations are likely to outsource more work to AI algorithms and other tools like chatbots as the technology improves.

The cost-saving potential of artificial intelligence only adds to its appeal to banks and other financial companies. If you're looking for an investment opportunity, consider some of the stocks above, as well as other AI stocks or AI ETFs if you're looking for a broad-based approach to the sector.

FAQs

AI in Finance FAQs

What is AI in finance?

Artificial Intelligence (AI) in finance refers to the use of machine learning to enhance how financial institutions analyze and manage investments.

How is AI being used in finance?

AI is being used in finance in a variety of ways, including investing, lending, fraud detection, risk analysis for insurance, and even customer service.

Will AI replace humans in finance?

It is highly unlikely that AI will replace humans in the finance industry. There are too many decisions that require personal judgement for humans to be fully replaced by AI in investing. However, the cost-saving potential of artificial intelligence allows for decisions to be made more rapidly and inexpensively, so it is likely that AI will continue to grow throughout the finance industry in the future.