Investor interest is surging in all things AI, so it shouldn't come as a surprise that artificial intelligence (AI) start-ups are also popping up on investors' radars.

With the launch of ChatGPT in November 2022, the potential for AI has crystallized across the business world and among investors, and the implications for the new technology are vast.

Among them is a new race among start-ups to challenge ChatGPT and, separately, to come up with the next big thing in AI.

Not surprisingly, money from venture capital firms and other investors has poured into AI start-ups, and the industry is booming.

In this discussion on AI start-ups, we'll review some of the hottest privately held companies working on artificial intelligence today, analyze the pros and cons of investing in AI start-ups, and answer some commonly asked questions about AI start-ups.

Artificial Intelligence

Best AI start-ups to watch this year

Best AI start-ups to watch this year

1. OpenAI

1. OpenAI

As you might expect, ChatGPT owner OpenAI has received the lion's share of the attention in AI start-ups this year.

OpenAI has developed other renowned products, including its image-generating AI, DALL-E, and its success with ChatGPT and its high-profile partnership with Microsoft (MSFT -0.66%) makes it the premier AI start-up these days.

OpenAI was founded in 2015 with several co-founders, including Elon Musk, though Musk eventually left the company to work on Tesla (TSLA -1.06%) and SpaceX.

AutoGPT

Earlier in 2023, OpenAI raised $10 billion from Microsoft, strengthening the strategic partnership between the two companies and reflecting Microsoft's own confidence in ChatGPT as a product. Microsoft has incorporated its technology into a range of its products, including its Bing search engine and Azure cloud infrastructure services.

As of May 2023, OpenAI's valuation was between $27 billion and $29 billion, making it the most valuable AI start-up, largely because of the success of ChatGPT.

2. Anthropic

2. Anthropic

Anthropic is rapidly emerging as the chief start-up rival to OpenAI.

Founded in 2021 by former OpenAI researchers, Anthropic counts Google as a major investor. The Alphabet (GOOG 0.56%) (GOOGL 0.69%) subsidiary took a 10% stake earlier in 2023, and Anthopic has had multiple funding rounds this year. It was valued at $4.1 billion in March. It also counts Salesforce (CRM -0.39%) and Zoom (ZM -0.34%) as investors.

Anthropic is best known for its generative AI chatbot, Claude, which it launched in March. Unlike ChatGPT, Claude isn't publicly available. You have to ask Anthropic for permission to use it, explain the reason you want to use it, and give Anthropic your identity.

You can also use it through other apps, such as Quora's Poe.com, though it's only free for a promotional period.

According to some reviews, Claude gets better results with things like creative tasks, following instructions, and answering trivia questions.

Anthropic describes Claude as being "much less likely to produce harmful outputs, easier to converse with, and more steerable" than other AI chatbots. In other words, Claude seems designed to avoid some of the problems that have plagued ChatGPT.

3. Dataiku

3. Dataiku

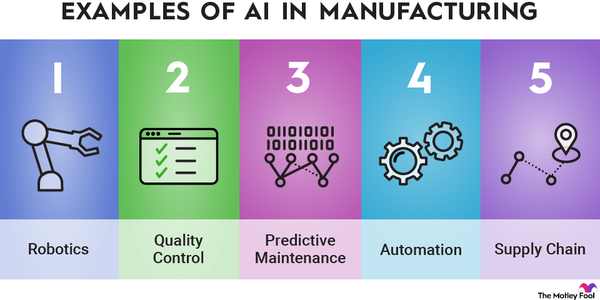

Dataiku is an artificial intelligence and machine-learning start-up founded in 2013. The company bills itself as the single platform for "Everyday AI." While OpenAI and Anthropic are both focused on generative AI, Dataiku offers a range of AI tools, including machine learning, data prep, and visualization tools.

Unsupervised Machine Learning

As opposed to the large language models that underpin technologies like ChatGPT, Dataiku is more focused on data analysis and using AI to make the process faster and more efficient.

At the end of 2022, the company was valued at $3.7 billion, down from $4.6 billion in 2021; the decline shows that AI start-ups haven't been immune from the downturn in the tech sector.

Dataiku has a wide range of customers across the business world, including GE (GE -0.69%), Sephora, and Unilever (UL 0.47%).

Supervised Machine Learning

4. Frame AI

4. Frame AI

Another fast-growing AI start-up is Frame AI, an AI-powered customer intelligence platform.

Frame AI helps companies calculate the cost of support tickets using natural language processing. By having a better sense of underlying costs, Frame AI can help companies provide better customer support and appropriately allocate customer service resources.

Frame AI was founded in 2016 and has raised $17.9 million since its founding.

5. Neatsy

5. Neatsy

One of the more unique AI start-ups out there is Neatsy, which operates in the e-commerce fashion industry and is focused on the way that shoes are sized. Shoe sizing is a particular problem in online retail, especially since processing returns is expensive and a hassle.

Neatsy has developed a three-dimensional foot scanner that uses an iPhone camera to guarantee an accurate shoe fit. It can also tell whether a user has a supinated or pronated foot roll and if special orthopedic footwear is needed.

Neatsy is still a young company, founded in 2019, and has only raised $1.4 million, but its technology shows that AI has applications well beyond the chatbots that have captivated so many users.

Related investing topics

Should you invest in AI start-ups?

Should you invest in AI start-ups?

Start-ups, by definition, are privately held, which means it's difficult for retail investors to invest in them.

However, there are ways to get exposure to AI start-ups. The easiest way is by investing in a publicly traded company that has a stake in an AI start-up. For instance, you could buy shares of Microsoft, which would give you indirect ownership of OpenAI. Similarly, you could buy stock in Alphabet to get exposure to Anthropic.

Investors should remember that start-ups tend to be riskier than publicly traded companies, and many start-ups won't succeed. However, if you find an AI start-up that looks promising, it's worth investigating if any publicly traded companies have a stake in it.

Investors looking for opportunities in artificial intelligence can also consider investing in AI stocks or AI ETFs.

AI Start-Up FAQs

What are AI start-ups?

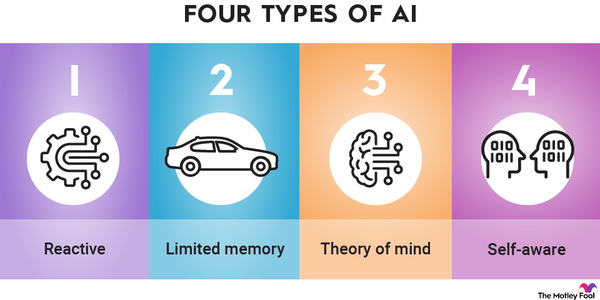

Artificial intelligence (AI) start-ups are early-stage companies that are developing AI technologies or using them in their products and generally raising money from venture capital firms. Those could include everything from natural language processing like chatbots to robotics to machine learning and more creative applications like Neatsy.

How do AI start-ups make money?

Some AI start-ups make money by selling their products to customers, but most AI start-ups are unprofitable. They raise money from venture capitalists and others to fund research, develop new products, and bring them to market.

What are the five big ideas in AI?

The five big ideas in AI are:

- Perception: Computers need to sense the world through seeing and hearing like humans do.

- Representation & Reasoning: Computers use data to construct representations to help them develop reasoning algorithms.

- Learning: Machine learning algorithms that use statistical inference from large amounts are a foundational concept in AI.

- Natural interaction: AI agents need to be able to converse in human languages and read facial expressions and emotions.

- Societal impact: AI is a powerful technology and it's important for industry leaders to consider the potential for harm, as well as the other ethical implications of their products.