The technology sector has played a leading role in powering the market's gains over the past couple of decades. New hardware, software, and services have driven changes in business and everyday life. Tech's ability to shape and influence almost every industry under the sun means the sector remains one of the best starting places for investors seeking big gains.

8 Cheap tech stocks to watch in 2024

8 Cheap tech stocks to watch in 2024

After a brutal sell-off that began at the end of 2021, even some high-flying growth stocks might be considered a great long-term deal right now. And for many older and slower-growing tech stocks, valuations are attractive. Here are eight "cheap" tech stocks that could deliver strong returns over the long term:

1. Lumen Technologies

1. Lumen Technologies

CenturyLink changed its name in late 2020 to Lumen Technologies as part of a broader effort to refocus its business and has been making progress under its new banner. Share prices increased 28% in 2021 but fell sharply last year and have continued to struggle in 2023 due to pains stemming from its business transformation. However, the stock remains cheaply valued (just 2.5 times trailing-12-month free cash flow in mid-2023 and offers attractive characteristics for investors seeking big dividend payments.

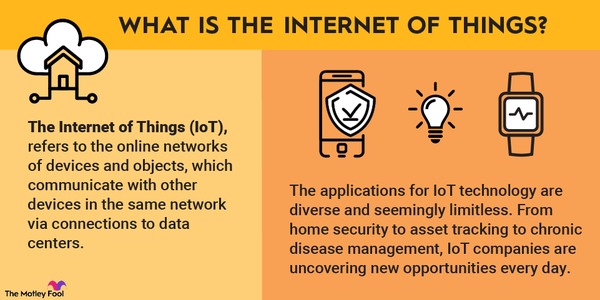

Lumen is pivoting its core business from copper-based broadband services to high-performance fiber lines, which have a stronger demand outlook in the age of next-gen internet technologies. The company is also leveraging its position in enterprise internet services to explore growth opportunities in edge computing, cybersecurity, and collaboration software. This deep-value stock could deliver big gains if the company's turnaround effort succeeds.

2. Applied Materials

2. Applied Materials

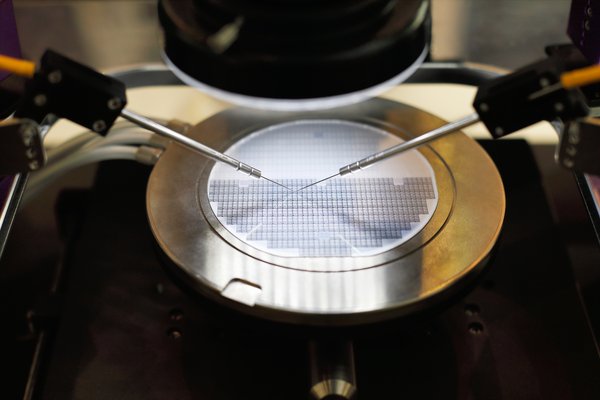

Applied Materials provides the equipment needed to manufacture semiconductors. Many chip companies are cyclical, with revenue and profits ebbing and flowing with consumer and business demand. However, Applied Materials is a much more stable growth business model. New chip fabrication plants and expansions take years of planning, and their equipment requires ongoing service -- a source of revenue for Applied, as well.

The company should be able to continue growth in conjunction with the overall microchip manufacturing industry and increasing demand for network-connected industrial equipment, electric vehicles, and artificial intelligence (AI) technologies. A push is also being made around the globe to diversify and localize the semiconductor supply chain. Governments are allocating billions of dollars to promote new manufacturing capabilities at home. This bodes well for Applied Materials. The company consistently generates high operating profit margins and returns all of its free cash flow to shareholders via a dividend and share repurchases. The stock trades for just 18 times trailing-12-month free cash flow.

3. Alphabet

3. Alphabet

One of the FAANG stocks (large tech companies with big competitive advantages), Alphabet has gone from high-flying internet search technologist to value-stock status. Alphabet's Google search business is facing some intense pressures due to a slowdown in the overall digital advertising industry, but the company is still generating operating profit margins in the 25% range. It uses its profits to fund even higher-growth businesses such as YouTube and Google Cloud, as well as emerging technologies such as its self-driving car start-up Waymo.

Alphabet also had one of the largest cash and short-term investment (net of debt) balances of any public company at more than $100 billion as of early 2023. When paired with its strong product suite and long-term expansion potential, there's a lot to like about Alphabet -- especially with shares trading at 19.5 times one-year forward expected earnings.

4. ATT

4. AT&T

AT&T's big vision to build a multimedia empire capable of complementing its telecommunications business didn't turn out as planned. In 2021, the company spun off its DirecTV satellite-television business. The following year, the telecom giant spun off the Time Warner division that it had paid $85 billion to acquire, resulting in a merger that created Warner Bros. Discovery (WBD 0.97%). Although the move reduced cash-generating capabilities and resulted in a dividend cut, the company is now leaner and more efficient and still offers a great dividend profile.

AT&T is back to focusing on telecommunications services, and it's likely in the early stages of benefiting from focusing on driving growth for its 5G and fiber-internet businesses. Mobile connectivity and high-performance internet are increasingly central to business and everyday life, and it's likely that digital connectivity will become even more important through the next decade and beyond. Even after cutting its dividend, AT&T stock boasts almost a 7% yield, and shares are in deep-value territory, trading at just 6.5 times next year's expected earnings.

5. IBM

5. IBM

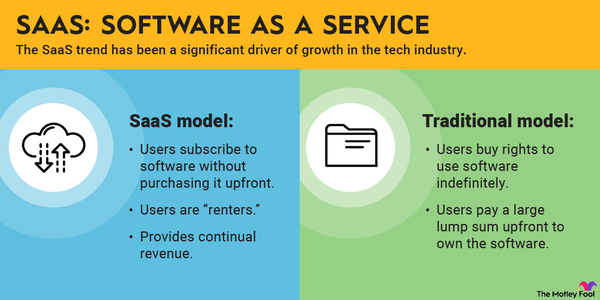

IBM, a longtime tech giant, has been in need of some major transformation in recent years. But it is indeed transforming. It is focusing its operations on cloud and hybrid-cloud computing and spun off a big chunk of its legacy operation via Kyndryl Holdings (KD -0.3%) in late 2021. The new IBM has returned to growth mode and reported a mid-single-digit-percentage sales increase to kick off 2023. It expects it can sustain a mid- to high single-digit revenue expansion rate over the next few years while still maintaining a high level of profitability.

IBM also pays a lucrative dividend, one it expects to be able to maintain now that it's refocusing on higher-profit cloud services. With shares sporting a dividend yield and a low P/E ratio (13.5 times on a one-year forward expected earnings basis and the company's opportunities for gradual growth in emerging computing services, IBM could be a great buy for value-seeking technology investors.

6. Meta Platforms

6. Meta Platforms

Meta Platforms, the rebranded parent organization of Facebook, Instagram, and WhatsApp, has taken a hit as Apple (AAPL -0.57%) and other digital advertisers changed how apps can track user activity on the internet. As a result, Meta traded for just 17.5 times earnings estimates for next year as of mid-2023. The social media titan is undervalued compared to many other big names in the tech sector, and there's a good chance it could outperform the market over the long term if it can adapt its operations.

Meta is also investing heavily in AI, and these initiatives could make its developers and platforms more efficient and create improved performance for its core advertising business. As a more long-term growth initiative, the tech giant is also betting big on the metaverse and virtual reality. The company thinks virtual worlds present massive growth opportunities and is willing to play the long game in developing related technologies and platforms. With billions of users around the globe, Meta can tap into the long-term growth of digital ads and use profits to foster growth in the metaverse, as well as in other areas such as e-commerce.

7. Qualcomm

7. Qualcomm

Almost every smartphone on the planet contains some sort of Qualcomm chip, and as mobility expands to encompass other devices (cars, smart-home devices, industrial equipment, etc.), Qualcomm is finding new avenues for growth. Yet, largely due to a widespread belief that Apple will eventually completely part ways with Qualcomm and use its own mobile chips for the iPhone and iPad, Qualcomm trades for less than many of its semiconductor industry peers.

In the spring of 2023, Qualcomm stock was valued at just 17 times trailing-12-month free cash flow. But, in the next few years, the company thinks it will experience a lot more growth from new mobility chip designs. Along the way, shareholders get treated to a modest dividend yield and share repurchases to sweeten the deal.

8. Broadcom

8. Broadcom

Broadcom is another value stock within the semiconductor industry, trading at only 17 times trailing-12-month free cash flow in spring 2023. A giant in developing mobile circuitry and networking equipment, this is a slow-but-steady growth firm that gets a significant discount compared to some of its peers due to a large debt burden.

However, Broadcom has used debt to acquire complementary software services, and the business is a cash cow. It generates more than enough (operating profit margins of above 40%) to service interest payments, gradually pay down debt, and provide a solid dividend for shareholders. Semiconductors and related computing hardware and software are a secular growth trend, making Broadcom a solid technology value stock pick for the long haul.

Related investing topics

What to look for in tech stocks

What to look for in tech stocks

Investors are generally well-served by keeping an eye on tech companies' sales and earnings growth, as well as valuation metrics such as price-to-sales and price-to-earnings ratios. There are many other useful stock metrics you can and should consider. For example, it's helpful to keep an eye on each company's number of active users or its customer count, plus how much per-user or per-client sales and profit a business is generating.

The technology sector encompasses a vast array of companies providing a wide range of disparate products and services. There's no reliable one-size-fits-all approach for evaluating stocks in the space, but charting business momentum and keeping intrinsic value in mind can make it easier to identify winners.