Dating apps aren't just a clever way to look for love. They're also a great business opportunity.

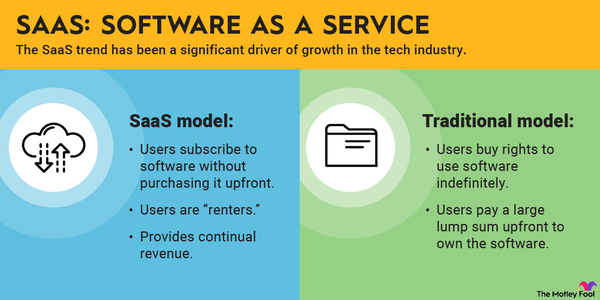

Dating app companies benefit from a number of built-in competitive advantages, including network effects and scalability. In many ways, dating apps are tech stocks with strengths that mirror those of social media companies. A successful app can deliver substantial profit margins.

There are only a handful of dating app stocks that are publicly traded, but that's not a bad thing for investors, especially since each one offers a different way to get exposure to the industry. The chart below shows three of the best dating companies you can invest in today.

Top dating app stocks

| Companies | Market Cap | Description |

|---|---|---|

| Match Group (NASDAQ:MTCH) | $31.8 billion | Industry leader and owner of Tinder, Hinge, OkCupid, and Match.com. |

| Bumble (NASDAQ:BMBL) | $4.8 billion | Owner of female-first dating app Bumble. |

| Hello Group (NASDAQ:MOMO) | $2 billion | China's leading online dating company and owner of Tantan, known as China's Tinder. |

Match Group

Match Group is biggest and oldest online dating company. It owns the most brands, adding them as part of a "roll-up" strategy to grow well beyond its roots as Match.com.

Today the company has about 45 different online dating brands focused on different demographics, including age, ethnicity, sexual orientation, and world regions.

Match was founded at the dawn of the internet in 1995 as Match.com. The business really took off with mobile technology and Tinder, the swipe-based app it developed. Smartphones offered a new level of access to online dating apps, and Tinder grew rapidly through the 2010s, propelling Match's growth. Tinder is now central to the business, driving more than half of the company's revenue and serving as a business model template for other subscription-based swipe apps. More recently, Match acquired Hinge, an app that's more focused on relationships than hookups.

The stickiness of Match Group's products and their scalability helped the company deliver adjusted operating margins of roughly 30% in 2021. It's managed to maintain its strong growth rate, with revenue up 25% last year even as the company faced some headwinds from the COVID-19 pandemic due to social distancing protocols and masking requirements.

Bumble

Bumble, the creation of former Tinder marketing executive Whitney Wolfe Herd, went public in early 2021 and has benefited from the success of Match Group. Bumble is similar to Tinder in that users swipe left or right on prospective matches. However, a key difference is that only women can make the first move. Because of that, the app is often preferred by women, and men tend to be less aggressive than on other online dating platforms.

Investors sent Bumble's stock soaring in its initial public offering (IPO) during the peak of the growth tech stock boom, but it's since fallen below its IPO price, which seems to have more to do with compressing valuations among tech stocks than the company's performance. Bumble grew rapidly through the first nine months of 2021, with revenue up 34% and adjusted EBITDA margins around 20% (although it's not profitable on a GAAP basis).

In February 2022, Bumble acquired Fruitz, a fast-growing European dating app focused on Gen Z. That gives it three apps, including Bumble and Badoo, a dating app founded in 2006 and which is still a market leader in Europe and Latin America. The acquisition of Fruitz shows that the company may be trying to grow through a similar roll-up strategy as Match.

Hello Group

China blocks most U.S. social media apps, so it's not surprising that popular online dating apps such as Tinder and Bumble are also banned there. That has opened the door for Hello Group, which is something of a hybrid between social media and online dating.

Hello's two biggest apps are Momo, a social media and video entertainment app often used for online dating, and Tantan, which is essentially a copy of Tinder and uses the same swipe-based features.

Like other Chinese tech companies, Hello Group (which changed its name from Momo in 2021) has been squeezed by the Chinese government, and regulatory pressure remains a risk for investors. In 2019, Tantan was removed from multiple app stores, and the company suspended news feed posts from both Momo and Tantan for a month over concerns that the content was attracting scrutiny from the government.

The incident cooled off investor expectations for Hello, and the pandemic also led to the business grinding to a halt and reporting flat revenue through the first three quarters of 2021. Momo's user growth has slowed, and its live-streaming and video entertainment business appears to be losing users to rival platforms such as Bilibili (BILI -2.0%) that are still seeing strong growth.

Momo's growth rate could bounce back when pandemic restrictions lift in China, but recent results have not been encouraging.

Related investing topics

Are online dating stocks right for you?

Although there are only a handful of online dating app companies available for investors, the sector is worthy of attention since there is still a lot of growth left and the market is expected to keep expanding. Meanwhile, new technologies such as virtual reality headsets and the metaverse could add another dimension to dating app stocks and unlock more potential value. As the success of companies such as Match shows, dating apps can drive both strong growth and profitability, which is a rare combination in the tech industry.

Of the companies above, Match is the most obvious place to start investing since it's been the industry leader since online dating began. Its ownership of Tinder and diversification with dozens of other brands give investors exposure to almost every corner of the dating industry. However, Bumble has the potential to be the next Match, and its namesake app is the most popular in the U.S. after Tinder. Finally, Momo could make a recovery in China once the world's most populous country reopens.

With plenty of innovation and expansion ahead in online dating, it's not too late to invest in this exciting growth industry.