Real estate syndication isn’t exactly a well-known type of investment, but it has emerged as an interesting opportunity for investors who want to capitalize on the high return potential of real estate but don’t necessarily want to directly become property owners. In this article, we’ll take a closer look at real estate syndication, its pros and cons, and what investors should know before deciding if it is right for them.

What is real estate syndication?

Real estate syndication involves a group of investors who collectively raise capital to purchase commercial real estate or build a new property. For example, most people couldn’t simply decide to finance and construct a large hotel all by themselves, but a syndicate of a few dozen investors might be able to raise enough capital to do so. In practice, real estate syndication typically pairs developers and knowledgeable real estate professionals with investors who are looking to put capital to work.

Over the years, real estate syndication has significantly evolved. For most of modern history, real estate syndicates either had to raise money through private solicitations or register the offering with the SEC to raise funds from the public. However, thanks to the JOBS Act of 2012, the rules were relaxed and now allow real estate syndication opportunities to raise capital from anyone who meets the definition of an “accredited investor.” For individuals, this typically means an annual income of more than $200,000 for at least two consecutive years ($300,000 for couples) or a $1 million net worth (excluding a primary residence).

As a result of this new rule, real estate syndication deals are now commonly crowdfunded from accredited investors. The term “real estate crowdfunding” is a common form of real estate syndication.

Who is involved in real estate syndication?

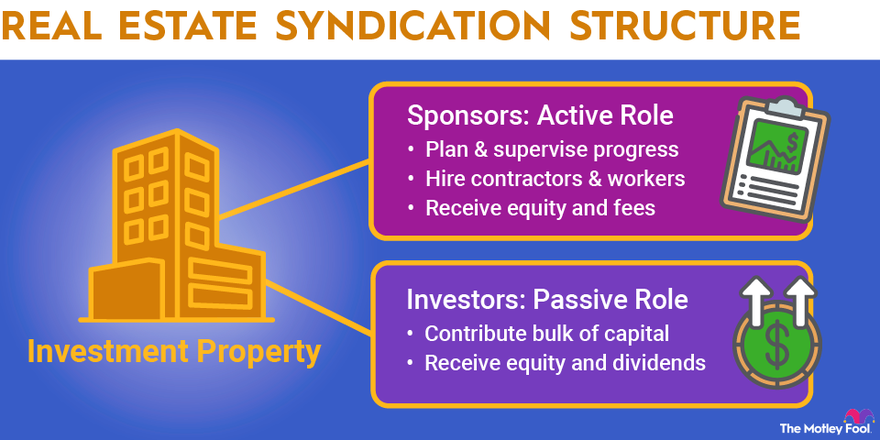

There are two main parties involved in real estate syndication -- the sponsor and the investors.

The sponsor, also known as the general partner, is the individual or company that identifies, plans, and oversees the investment. The sponsor arranges for the purchase of the real estate asset, hires contractors and other workers, supervises progress, and makes capital decisions for the project. The sponsor is also responsible for distributing any income or profits from the deal to the proper places.

The investors in a syndicated real estate deal are also known as limited partners and take a passive role in the investment. In a nutshell, the investors typically contribute the bulk of the capital required for the deal. In most cases, the sponsor will commit their own money and obtain loans to fund a substantial portion, with the rest of the capital coming from accredited investors.

In modern real estate syndication, there is often another involved party -- the crowdfunding platform. Since it’s easier than ever to solicit investments from the public, many sponsors choose to list their investment opportunities on crowdfunding platforms (CrowdStreet is one popular example). The platform acts as a middleman between sponsors and investors and collects a fee for raising capital and dealing with regulatory requirements.

Pros and cons of investing in syndicated real estate investments

There’s no such thing as a perfect type of investment for everyone, so here are some of the pros and cons of investing in syndicated real estate deals.

Pros of real estate syndication

High return potential: This is perhaps the No. 1 reason to invest in syndicated real estate deals. There is a lot of money to be made from commercial real estate investments that work out well. CrowdStreet keeps a record of all of the realized (sold) properties that have raised capital through its platform. Of 115 realized investments, the average has produced a 17.7% internal rate of return (IRR) for investors, a stellar annualized return history.

Access to unique real estate investments: As previously mentioned, most people couldn’t simply fund the construction of a hotel. And, even if you could afford it, would you really know what to do? Real estate syndication gives investors without extensive real estate development or management backgrounds the ability to participate in new investment opportunities.

Portfolio diversification: This can be an especially large benefit in turbulent markets and in rough economic times. Single-asset real estate returns aren’t strongly correlated with the stock market, and their prices don’t fluctuate on a daily basis like stocks, so investing in real estate syndication can give a nice element of diversification to an investment strategy.

Cons of real estate syndication

Illiquidity: Syndicated real estate investments are perhaps the least liquid way to invest in real estate. With a real estate investment trust, or REIT, you can simply sell your shares whenever you want. If you own an investment property, it may take a few weeks or months, but you can choose to sell it. A syndicated real estate deal is typically illiquid for the entire holding period.

Performance is tied to a single asset: One of the advantages of investing in REITs is that the company owns many different properties. If one of them performed poorly, it wouldn’t make much of a difference. In syndicated deals, your money is typically tied to one asset, and if it doesn’t perform up to expectations, it can result in large losses.

Not all deals work out: In the pros section, it was mentioned that syndicated real estate investments can produce excellent returns, as evidenced by the 17.7% annualized average return on one popular platform. However, a wide range of outcomes is possible. In fact, of those 115 realized investments, five produced annualized returns of more than 50%; six of the deals lost 100% of investors’ money. To be sure, the risk/reward can still make a lot of sense, but this is especially worth keeping in mind if you’re investing in one syndicated real estate deal.

Inconsistent income: Many syndicated real estate investments have some component of passive investment income, but there are caveats. For one thing, the income doesn’t usually start right away, especially if it’s a development or renovation project. Plus, there’s no guarantee that you’ll get any income at all. If you do, it may vary considerably from year to year. Syndicated real estate investments are generally not the best fit for income-seeking investors.

Must be an accredited investor (usually): To invest in single-asset real estate syndication deals through a crowdfunding portal, you’ll need to be an accredited investor. An exception is when a sponsor is raising funds privately, but, for obvious reasons, private syndication opportunities can be tough to find (and have not been vetted by any reputable third party).

How to invest in real estate syndication opportunities

There’s no single answer to this question, but, for most investors, the easiest way is through a real estate crowdfunding portal such as CrowdStreet or Realty Mogul. Most single-asset syndication deals (as opposed to investment funds that buy several properties) are restricted to accredited investors. As previously noted, individuals need to satisfy one of two criteria:

- Annual income of at least $200,000 ($300,000 for a couple) for the past two years, with a reasonable expectation of the same in the current year.

- Net worth of $1 million, excluding the value of your primary residence.

Although it’s not a fail-safe method of screening investors, the purpose of the accredited investor requirement is to limit “riskier” investments to people who either have the financial knowledge to assess the risk/reward dynamics or who can afford to absorb a loss if the investment goes badly.

Related Investing Topics

The bottom line

Real estate syndication can be an excellent investment opportunity for accredited investors who want to diversify their portfolio into real estate investments but don’t necessarily want the work involved with owning properties directly. However, just like any other investment type, real estate syndication has its pros and cons, so it’s important to know what you’re getting into before writing any checks.

FAQs

REIT vs. syndication: What’s the difference?

A real estate investment trust, or REIT, is an investment vehicle that pools investors’ money to acquire a portfolio of real estate assets. For example, a REIT may own 100 office buildings or a portfolio of hotels. REITs are also income-oriented investments -- it’s common for 90% or more of a REIT’s properties to be leased at any given time.

On the other hand, real estate syndication typically involves a single asset, and there’s usually some sort of value-adding component to it. Many real estate syndication deals involve the development of new properties or renovations of existing properties, or maybe there’s an opportunity to reposition or refinance the property to make it more profitable than under the previous ownership.

What are the three phases of real estate syndication?

Real estate syndication typically occurs in three phases: origination, operation, and liquidation.

The origination phase occurs before the investment has officially started. This involves the sponsors identifying the asset or opportunity, negotiating a purchase price, performing due diligence, and finding investors. This phase ends when the deal is closed and all investor capital has been committed.

The operation phase takes place while the syndication deal is an active investment. Things like construction, renovations, property management, etc., take place during the operation phase. Basically, the operation phase starts when the property is acquired and consists of the sponsor carrying out the business plan.

Finally, the liquidation phase occurs when the asset is sold or refinanced, allowing investors to (hopefully) cash out with a profit.

How do real estate syndicates make money?

Real estate syndicates make money in a few different ways. The sponsor collects fee income, which typically comes in the form of an acquisition fee when the property is acquired. A fee of 1% of the property value is common. In addition, the sponsor gets a percentage of any returns generated by the investment above a specified return target. For example, a sponsor might get 20% of any annualized returns in excess of 8% produced by the property.

When it comes to the participants, or the limited partners, in a syndication deal, income comes from two main sources -- rental income and equity appreciation. Since most real estate syndication deals are for commercial properties whose goal is to generate rental income, a proportional share of any rental income is typically distributed to investors. In most syndication deals, however, equity is the main goal when it comes to investor returns.

Generally speaking, syndication deals have a targeted timeline (usually three to seven years), at which point the plan is to sell the property at a profit. Any profits from a sale (minus the sponsor’s performance fee) are distributed proportionally to investors.