Funds from operations (FFO) is a metric used to measure a company's recurring operating earnings. It's most commonly used by real estate investment trusts (REITs) to give investors a more accurate picture of their operating performance. It excludes the impact of certain items affecting a company's net income for tax purposes to more accurately reflect the income produced from business activities during a certain period.

Here's a closer look at FFO, how to calculate it, FFO variations, and why investors need to understand this metric.

Understanding FFO

Understanding FFO

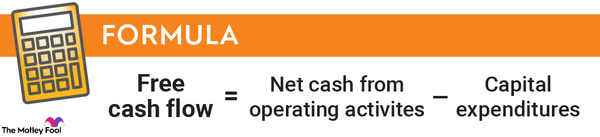

The National Association of Real Estate Investment Trusts (NAREIT) developed FFO as a non-GAAP measurement of cash generated by REITs to standardize their operating performance. It helps to measure the net cash generated by a REIT from its regular and ongoing business activities. It's a proxy for free cash flow, although it's not a replacement for that metric.

While FFO is most common in the REIT sector, companies in other industries use it. Investors will find it in sectors heavily affected by depreciation charges and asset sales. The companies will use FFO to give investors a more accurate picture of recurring income.

FFO accomplishes that by stripping out one-time items that affect the cash flow from operations that a company reports on its financial statements. It also adjusts for things that reduce reported net income that don't affect the underlying recurring cash generated by the business, such as a loss on an asset sale and depreciation.

How to calculate FFO

How to calculate FFO

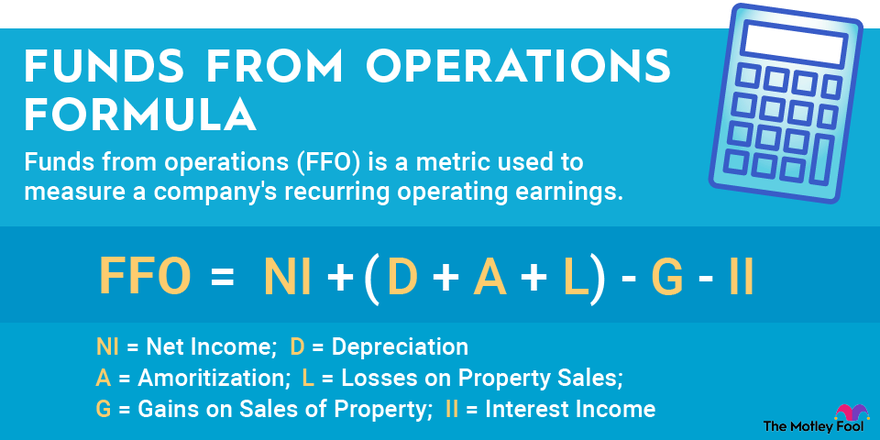

FFO is a relatively straightforward calculation. The formula is:

FFO = Net Income + (Depreciation + Amortization + Losses on Property Sales) - Gains on Sales of Property - Interest Income

Most REITs calculate FFO for their investors and feature it in their financial statements and other supplemental information. However, an investor can easily find the variables needed to calculate FFO on a company's income statement and balance sheet.

Here's an example of how to calculate FFO from a company that reported the following numbers on its income statement:

- Net income: $1 million

- Depreciation: $200,000

- Amortization: $0

- Gains on sales of properties: $400,000

- Losses on sales of properties: $0

- Interest income: $0

$1,000,000 + ($200,000 + $0 + $0) - $400,000 - $0 = $800,000

Investors can also calculate FFO on a per-share basis by dividing it by the number of outstanding shares. Using our current example, if the company had 1 million outstanding shares, its FFO would be $0.80 per share.

Why is FFO important?

Why is FFO important?

FFO helps normalize a REIT's earnings by adjusting for non-cash charges and one-time expenses that don't fully reflect its underlying earnings. The figure gives investors a better picture of the recurring cash flow a REIT produces that it can use to make dividend payments.

For example, if we used the numbers presented in the earlier example, investors might believe that the company's earnings could support a $1 million recurring dividend payment. However, a one-time gain on the sale of a property boosted net income by $400,000 in the period, while a non-cash expense (depreciation) reduced it by $200,000. After adjusting for those figures, we see that the REIT had the recurring cash to support an $800,000 regular dividend payment.

Investors also use FFO to measure a REIT's operating performance relative to other periods and other REITs. For example, if a REIT sold an asset during one period at a gain and another one during the next period at a loss, the sales could significantly affect a REIT's reported net income between the two periods. They might lead investors to believe that the REIT's operating performance has suffered dramatically. FFO helps adjust for the sales to give investors a more accurate reflection of the actual performance of the REIT's business during the periods.

Investors can also use FFO as a valuation metric similar to a price-to-earnings (PE) ratio. For example, if a REIT reported $1.00 per share of FFO and traded at $10 a share, it sells for 10 times its FFO. If another similar REIT trades at 15 times its FFO, investors could make the case that the market undervalues the REIT with a lower FFO ratio compared to the other one.

Another good use of FFO is more accurately calculating a REIT's dividend payout ratio. REITs often record significant charges for depreciation each quarter, reducing their reported net income for tax purposes. However, the REIT's recurring income is usually much higher than its reported net income. For instance, if the above example didn't include any gain on asset sales, the reported net income would have only been $600,000 in the period. However, actual recurring cash earnings were $800,000 if we add back the non-cash charge of deprecation.

That means the company could have paid $800,000 in dividends because that matched their cash flows. However, some investors might have wrongly assumed the REIT paid out more cash than it earned if they used net income instead of FFO to determine the dividend payout ratio.

Related investing topics

Adjusted FFO

Adjusted FFO

Some REITs will also report an adjusted version of FFO to provide an even more accurate reflection of their recurring income for dividend purposes. The most common is adjusted FFO (AFFO). Other variations include FFO as adjusted (FFOAA), normalized FFO, core FFO, and funds available for distribution (FAD). These metrics make adjustments for things such as straight-line rent, amortization of debt costs, share-based compensation, non-cash fair value adjustments, and some recurring capital expenses.

Investors can use the adjusted numbers to get an even more accurate reflection of a company's recurring income. They can be ideal for comparing two periods of a REIT's financial results since they attempt to strip out all non-recurring impacts.

Investors can also use the adjusted FFO metrics to calculate the dividend payout ratio more precisely. Because the metrics strive to normalize recurring income, they give investors a good picture of how much cash a company produces that it could pay to investors via dividends.

Although companies adjust FFO to provide investors with a more accurate reflection of their recurring income, these aren't standardized measures. Because of that, they're not the best for making apples-to-apples comparisons between two REITs. An investor should use FFO or ensure that both companies make the same adjustments to determine their adjusted FFO.

The bottom line on FFO

FFO is an important metric for providing investors with a more accurate reflection of a company's recurring income. It gives them more insight into a company's ability to pay and maintain its dividend. It's also a helpful valuation metric. That makes FFO a handy tool for making investment decisions.