Calculating a return on investment (ROI) helps real estate investors gauge whether a property investment is worthwhile. It allows them to compare one property's potential return to a similar investment, making it an important tool real estate investors can use to make money in the sector.

Here's how to understand and calculate ROI to see if a real estate investment is worth the risk and effort. ROI can help investors determine if real estate investing is right for them.

Understanding real estate return on investment (ROI)

Once you know the basics of real estate investing, ROI helps guide you to making money in the sector.

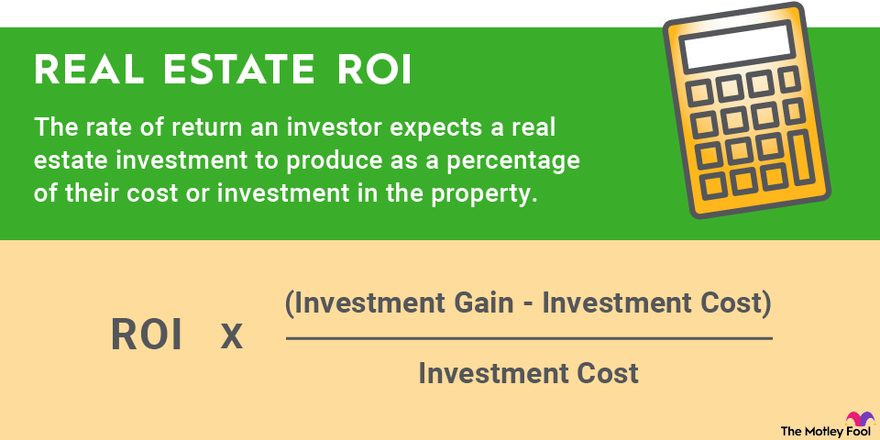

The basic definition of ROI in real estate is the rate of return an investor expects a real estate investment to produce as a percentage of their cost or investment in the property. The return percentage allows investors to compare various real estate investment options to determine the best opportunity.

ROI is one of several profitability measurements in real estate investing. Other profitability metrics are capitalization rate, internal rate of return (IRR), and cash-on-cash returns. Investors should use several profitability metrics to help determine whether a real estate investment is worthwhile.

How to calculate ROI on real estate

In its simplest form, the formula for calculating ROI in real estate is:

ROI = (Investment Gain - Investment Cost) / Investment Cost

There are two primary methods of calculating ROI using this formula: the cost method and the out-of-pocket method.

Calculating ROI using the cost method

For example, a house flipper buys a property for $500,000 in cash. They spend another $100,000 on repairs and improvements, giving them a total cost of $600,000. Upon completion, they sell the renovated house for $750,000. Here's the ROI for this property using the cost method:

ROI: ($750,000 – $600,000) / $600,000 = 25%

Investors can also use a simple ROI formula to calculate the returns on a rental property. For example, an investor bought a rental property for $500,000 in cash. It generates $35,000 in yearly rental income and has $10,000 in annual costs. Here's the ROI using the cost method:

ROI: ($35,000 - $10,000) / $500,000 = 5%

Calculating ROI using the out-of-pocket method

Many real estate investors prefer to use the out-of-pocket method because it showcases a higher ROI. It calculates the return based on the equity invested in a property.

We'll use the same numbers from the above example. However, instead of paying for the property in cash, we'll assume the investor purchased it with a loan. They invest $50,000 as a down payment, putting their total equity investment at $150,000. Here's the ROI for this property using the out-of-pocket method:

ROI: ($750,000 - $600,000) / $150,000 = 100%

We can also calculate the ROI of a rental property financed with a mortgage. For example, an investor puts $100,000 down on a rental property. It generates $35,000 in annual rental income. Meanwhile, the total costs (including mortgage interest) are $20,000. Here's this property's ROI using the out-of-pocket method:

ROI: ($35,000 - $20,000) / $100,000 = 15%

Those higher returns show the power of leverage to boost returns in real estate investing.

What's a good ROI in real estate?

There isn't a set standard for what makes a good ROI in real estate. It depends on several factors, including property type, interest rates, real estate inflation rates, property risk profile, investment type, leverage, and investor preference.

For example, ground-up developments and value-add projects like a fix-and-flip investment should have a much higher return than a stabilized rental property investment. That's the investor's reward for taking on the additional risk and work associated with this type of real estate investment.

However, a good benchmark is to compare a potential real estate investment's return with other investments. For example, the average stock market return over the last 50 years has been 9.4%. Meanwhile, real estate investment trusts (REITs) have historically performed better than stocks over the long term. An investor would need to earn a total return (income plus price appreciation) above what they could make in the stock market to justify a real estate investment's risk and time commitment. Otherwise, buying an index fund or a REIT ETF would make better sense.

For more income-focused investments, good return benchmarks are the average capitalization rate of similar property types or the rate an investor can earn on risk-free U.S. Treasury bonds. In 2023, cap rates for common property types ranged from 4.9% for multifamily to 6.9% for office. Meanwhile, treasury yields were between 4% and 5%. As such, a good income yield would be above those key benchmarks.

Is investing in real estate right for you?

Real estate investing can earn high returns due in part to the use of leverage. Because of that, they can make great investments.

However, investors need to measure the ROI they can earn on a property investment compared to alternatives to see if it's worthwhile. The return must be high enough compared to a common benchmark or another property to justify the risk (including the associated leverage) and the work (including managing contractors, tenants, and competing repairs).

For some investors, even a high return might not be worth it if they have time constraints and can't manage a property. Because of that, real estate investing isn't for everyone since there are many great alternatives, including investing in REITs.