Whether you're looking for income now or building your wealth for a financial goal, dividend stocks can make for ideal investments. Taken a step further, dividend growth stocks, companies that have made it a stated goal to consistently and regularly increase their dividend payments, can deliver dependable income and market-beating returns.

The Dividend Achievers, a trademarked property owned by the Nasdaq, is a collection of high-quality companies that have a track record of at least 10 straight years of dividend growth. The companies on this list have established themselves as leaders in their industry with strong competitive advantages that have resulted in years of cash flow growth. The best of the best will go on to join the Dividend Aristocrats, companies that have grown enough to be included in the S&P 500 index and have also increased their dividends every year for at least 25 years.

There are several exchange-traded funds (ETFs) that track various versions of the Dividend Achievers index and are offered by well-known investment managers such as Invesco (IVZ -0.07%) and Vanguard.

Dividend Achievers list

With almost 300 stocks on the Dividend Achievers list, this article won't delve into every single company. Instead of a data dump, here are five top Nasdaq Dividend Achievers that all offer something compelling to different investors:

1. American Water Works

The largest publicly traded water company in the U.S., American Water Works (AWK 0.16%) is both a clean water utility and wastewater utility services provider. It's also been in business for a very long time, with a corporate history that extends back to the 1880s, and currently providing services to 14 million people in 24 states.

American Water Works has also made for a pretty great investment. Since the beginning of 2010, investors have enjoyed almost 800% in total returns. The dividend has grown 187% over that time, driving a large portion of investors' gains.

2. Brookfield Infrastructure

Another business that's delivered great long-term returns by providing boring and easily overlooked services, Brookfield Infrastructure (BIP -1.33%) owns and operates telecommunications, utility, energy, water, and transportation infrastructure assets around the world. Investors have also done very well with this wonderful business, which has steadily grown on the need for more and more worldwide infrastructure.

Since the start of 2010, Brookfield Infrastructure's share price is up 444%. But its generous dividend and steady, regular payout growth has delivered 853% in total returns.

Brookfield Infrastructure's cash dividend was reduced 10% in early 2020 when it spun out Brookfield Infrastructure Corporation (BIPC -0.47%), but BIP shareholders received a tax-free distribution of BIPC shares equal to the cash dividend reduction. It returned to cash dividend growth in the next quarter, and the total distributions growth streak remains intact.

3. Costco Wholesale

Another long-term market beater, Costco Wholesale (COST -0.12%) has become the go-to retailer for both businesses and families looking to stock up on large quantities of goods at bargain prices. The company's secret? Actually delivering on its low price promise.

The company sells products as cheaply as possible while counting on membership fees for most of its profits. It's a deal customers love: Costco regularly reports renewal rates near or even above 90%.

The business model has also paid off for shareholders. Costco investors have enjoyed 1,090% in total returns since 2010, with dividend growth doing a lot of the heavy lifting.

As a bonus, the company pays out a special dividend every so often when it has a banner financial period or ends up with a much larger amount of cash on the books than it really needs. It paid out by far its biggest-ever special dividend in late 2020, rewarding investors with a whopping $10 per share extra payout on top of its regular $0.79 per share quarterly base dividend, which it increased 13% in 2021.

4. JM Smucker

Investors looking for stability and reliability across any market environment (and prioritizing a safe dividend above the highest returns) might want to give Smucker (SJM -2.84%) a long, hard look. The company, best known for its brands such as Folgers coffee, Jif peanut butter, and, of course, Smucker's jams and jellies, has rewarded investors with annual dividend growth every year since 2002. It raised the payout 485% over that period and 183% since 2010.

Its returns haven't been nearly as high as the three prior companies, however. Total returns are 152% since 2010. But for investors who prioritize a higher floor over a higher ceiling, Smucker's 3% dividend yield and strong cash flows might be ideal. Smucker's cash payout ratio -- the percentage of cash flows it uses to pay the dividend -- has been below 60% every year for nine straight years.

5. Mastercard

Some of the best dividend growth stocks are easy to miss when their yield is low. Mastercard (MA -0.08%) is an excellent example: In its entire history as a public company, the dividend yield has never been as high as 1%.

But the low yield isn't because management has been stingy. Since 2012, when the company made regular dividend increases a priority, Mastercard's dividend has been increased an incredible 3,170%, helping juice investor returns to the tune of 878% since. Going back to the beginning of 2010, when Mastercard was paying a dividend but not aggressively increasing it, shareholders have enjoyed a simply incredible 1,330% in total returns.

A growing global middle class, a massive opportunity in person-to-person and business-to-business transactions, and the fact that the vast majority of the world's consumer spending is still cash-based paint a wonderful picture for Mastercard's next decade, too. With a minuscule payout ratio of 20%, the dividend is secure, and there's a lot of room to expand the payout much, much higher.

Dividend Achievers' dividend yield

Here is the dividend yield of the five Dividend Achievers described above. This compares to a dividend yield of 1.8% for the S&P 500 at the end of the same period.

| Company | Dividend Yield* |

|---|---|

| American Water Works (NYSE:AWK) | 1.6% |

| Brookfield Infrastructure Partners (NYSE:BIP) | 3.4% |

| Costco Wholesale (NASDAQ:COST) | 0.6% |

| Smucker (NYSE:SJM) | 2.96% |

| Mastercard (NYSE:MA) | 0.53% |

Source: YCharts. *As of March 2, 2022, based on trailing 12-month regular dividend payments.

High-yield Dividend Achievers list

Most Dividend Achievers stocks don't pay very high dividend yields, with the index averaging around or even below 2% yield in recent years. Investors looking for more yield might be better served with one of the NASDAQ US Dividend Achievers 50 Index stocks. This index is composed of 50 Dividend Achievers stocks that offer high yields as well as consistent dividend growth.

Here are five of the top High-yield Dividend Achievers and their dividend yields (dividend yields as of March 3, 2022):

3M Co: 3.3% yield

Industrial manufacturing giant 3M (MMM -0.66%) makes more than 60,000 products across a wide variety of industries and applications. It's also increased its dividend payments every single year for 63 years, one of the longest streaks of any Dividend Aristocrat or Dividend Achiever.

Since 2015, 3M has increased its dividend by 45%. Its cash payout ratio is generally below 60%, with the occasional spike due to opportunistic spending to strengthen the business. With one of the longest dividend growth streaks and a strong, profitable business, 3M is an attractive high-yield growth stock for anyone looking for a secure and above-average payout.

Verizon Communications: 4.7% yield

Telecommunications and media giant Verizon Communications (VZ -0.68%) hasn't exactly been a barn-burner of an investment in recent years. Shareholders have seen the stock significantly trail the broader market over the past few years, earning 22% in total returns -- all from dividends as the stock price actually fell -- from 2017-2021.

But there could be brighter days ahead for the company. Its business is on very solid footing, and, unlike AT&T (T -1.37%), which is likely to lower its dividend in 2022 as it divests and spins off some holdings, Verizon's balance sheet is more manageable and its dividend is secure, with a payout ratio below 60% the past several years. It's not likely to grow quickly -- the dividend has only been raised 10.8% over the past five years -- but with a well-above-average dividend yield of 4.7%, it's ideal for investors looking for dependable income today.

Chevron: 4.5% yield

The COVID-19 pandemic brutalized the oil and gas industry, but integrated oil and gas giant Chevron (CVX 1.04%) was able to ride out the worst of it on the strength of a very strong balance sheet and its resilient, integrated operations. The company maintained its dividend during the worst days of 2020 and was able to return to increasing it in 2021.

In 2020, Chevron paid $9.7 billion in dividends while earning $10.6 billion in operating cash, leaving it with an $8 billion shortfall to cover capital expenditures, the lifeblood of its future cash flows. As a result, the company took on more debt to balance its spending that year. However, 2021 was a bounce-back year and then some. Chevron's operating cash flow almost tripled to $29.2 billion, while dividend and capital expenditure costs were about the same as the prior year.

With oil demand recovering and oil prices much higher than during the worst of the pandemic, Chevron has returned to dividend growth, and its payout looks very secure once again.

IBM: 5.3% yield

International Business Machines (IBM -8.25%) has one of the most impressive dividend track records out there. The company has paid a dividend every year for a century and joined the ranks of Dividend Aristocrats in 2021.

In the meantime, IBM has become a different company than it was a generation ago. In 2021, it split off its legacy managed infrastructure services business, now named Kyndryl (KD -0.45%), so it could focus on its growing cloud, hybrid cloud, and AI services business. While the newly asset-light IBM is still in the early stages of its new focus, there's reason to be optimistic due to the growing addressable market for AI and cloud services.

At the same time, there's also reason to be cautious. IBM's payout ratio spiked above 120% in late 2021 following the Kyndryl spinoff, but that was due to non-recurring expenses that should moderate. Its cash payout ratio is still under 60%, so the dividend is safe for now. But, with $44 billion in net debt, IBM's balance sheet could take priority to boosting dividends as interest rates start to rise.

Philip Morris International: 4.8% yield

An easy company for many people to hate, tobacco maker Philip Morris International (PM -2.96%) is also extremely profitable. It pays a generous dividend and has increased it every year since becoming a stand-alone company more than a decade ago. But for many investors, the fact that it makes a product that's addictive and causes cancer is enough reason to keep it out of their portfolios.

As a result, Philip Morris regularly trades for a bargain valuation compared to other stocks, making it very attractive for investors looking to capture a solid yield. In March 2022, shares regularly traded for less than 18 times trailing earnings, a 28% discount to the price-to-earnings ratio of the average S&P 500 stock. That's insanely cheap for a business that converts nearly all of its operating cash into free cash flow and has operating margins routinely above 35%.

Invest in Dividend Achievers ETFs

The top ETF that tracks the Nasdaq Dividend Achievers Index is the Invesco Dividend Achievers ETF (PFM -0.22%). The Invesco ETF tracks the full Dividend Achievers list and held 348 different stocks as of Feb. 28, 2022.

It does come at a cost, though. Its expense ratio -- the fees paid to the fund manager -- is 0.53%. At recent prices, the dividend yield was 1.8%, so a significant portion of the yield you earn goes to pay fees. Keep that in mind.

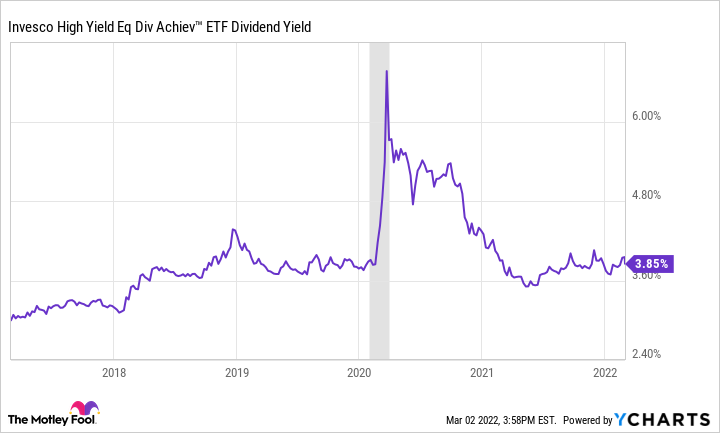

If it's higher yield you're after, the Invesco High Yield Equity Dividend Achievers ETF (PEY -0.94%) might be more appropriate. This ETF holds the 50 highest-yielding stocks on the Dividend Achievers list, with a 3.85% dividend yield as of March 2, 2022. That's much higher than the dividend yield of the S&P 500. It's similar to the yield it has paid in recent years, with the exception of the peak during the coronavirus pandemic when stock prices crashed.