When Bill Gates and Paul Allen co-founded Redmond, Washington-based Microsoft (MSFT -0.66%) on April 4, 1975, they aimed to write a BASIC interpreter for the Altair 8800 to make it easier for personal computing hobbyists of the day to make better use of the breakthrough machine.

Today, Microsoft ranks third on Forbes' list of most powerful brands and employs more than 144,000 people around the globe. Its products include PC operating systems (Windows), video games (Xbox), software development tools (Visual Studio), laptops and tablets (Surface), search (Bing), productivity suites (Office), social media (LinkedIn), and a robust public cloud platform (Azure). Combined, they helped Microsoft generate $39.2 billion in net profit and $38.3 billion in free cash flow on $125.84 billion in fiscal 2019 revenue.

Microsoft has come a long way in the four decades since its founding. And yet CEO Satya Nadella -- handpicked to be CEO by Gates and Nadella's predecessor, Steve Ballmer, at the occasion of Ballmer's retirement -- has always wanted to win well. He's wanted to see Microsoft become a world leader in environmental, social, and governance (ESG) -- an investing strategy employed by investors seeking to align their portfolio with their values -- since day one. From the letter:

Many companies aspire to change the world. But very few have all the elements required: talent, resources, and perseverance. Microsoft has proven that it has all three in abundance. And as the new CEO, I can't ask for a better foundation. Let's build on this foundation together.

So far, so good. In recent years the company has racked up numerous spots on ESG-related lists, including Ethisphere's World's Most Ethical Companies, Fortune's World's Most Admired Companiess, Glassdoor's Best Places to Work, and Forbes' America's Best Large Employers.

There's good reason for these accolades and high rankings. For years, Microsoft has put out a detailed sustainability report that uses the Global Reporting Initiative (GRI) Sustainability Reporting Standards, as well as the United Nations' approved disclosures for reporting on human rights and progress as defined under the UN Global Compact. Does that commitment to transparency make Microsoft a responsible investment? Let's turn to our 10-question ESG framework for the answer.

1. Does the company treat its employees well?

Yes. Three of the nine factors listed in its sustainability report that Microsoft says affects its business relate to how well the company treats employees: accessibility, ethical business practices, and human capital. Humane and respectful treatment of employees is a core value of the company.

Microsoft ranked 34th on Glassdoor's 2021 Best Places to Work while subsidiary LinkedIn ranked sixth. Overall, Microsoft is an elite employer that treats its employees very well. This finding is supported by the tenure ratio, calculated as the total years the top three officers have spent at the company divided by its total years in business. Microsoft has been in business for 44 years. At 1.58 out of a maximum of 3, Microsoft's top officers -- Nadella, President Brad Smith, and Chief Financial Officer Amy Hood -- have spent an average of more than 22 years at the company. Microsoft has a history of retaining people and promoting them into leadership. Nadella is just one example.

Areas for improvement: As the diversity section below shows, Microsoft would likely rank higher on ESG lists were it not for well-known and ongoing issues with gender discrimination. Nadella's team still has work to do in this area.

2. Is the company a good steward of the environment?

Yes. Environmental leadership is at the center of three -- and perhaps more interestingly, two of the top three -- of Microsoft's nine nonfinancial material factors affecting its business:

- Applying technology for environmental and social good

- Climate change and energy

- Responsible sourcing and device lifecycle impacts

Data centers are potentially one of the world's great polluters because of their relentless need for electric power to push and pull data from around the globe at a blistering pace. This same process creates heat inside the servers doing the processing, which creates demand for power from cooling mechanisms. This unvirtuous circle can lead to extraordinary levels of power consumption.

How is Microsoft fighting back? Since 2014, the company's operations have been 100% powered by renewables, landing it on the Carbon Disclosure Project's A list.

Just the sheer scale of Microsoft's data center ambitions shows how important its efforts to go green have been and continue to be. There are already 54 global regions in 140 countries where Microsoft has at least one data center serving the local population.

Expanded infrastructure is helping the Azure business unit grow quickly, with fiscal Q4 revenue from Azure up 64% over the past year. And yet Microsoft is committing to growing responsibly. One year ago, the company kicked off a long-term research effort called Project Natick, aimed at testing the viability of 100% sustainable data centers submerged off the coasts of major population centers.

3. Does the company promote diversity and inclusion?

No. At first blush, Microsoft looks like a model corporate citizen that gets accolades for diversity, inclusion, belonging, and sustainability (DIBS) and representing areas of focus for companies aiming to operate humanely and responsibly.

The Human Rights Campaign scored Microsoft a perfect 100 in both 2018 and 2019 on its Corporate Equality Index. Thomson Reuters ranks Microsoft 16th on its Diversity and Inclusion Index. And, of course, there are the Glassdoor rankings.

Microsoft is working for these rankings. In July 2018, the company hired IBM's (IBM -0.35%) former Chief Diversity Officer, Lindsay-Rae McIntyre, to the same role. Microsoft issued a press release announcing her appointment in February 2018, noting she'll report directly to Chief People Officer Kathleen Hogan.

In a Forbes article McIntyre explains the company's DIBS practice, including how, as of 2016, Microsoft now ties executive compensation to diversity and inclusion goals.

In 2016, we tied executive compensation to internal diversity and inclusion goals to hold leaders accountable for improving representation at all levels, which includes retention strategies...we are encouraging our employees to be intentional, engaged, and accountable owners of the culture by incorporating an inclusion goal into our performance review process at all levels.

Programmatic efforts include unconscious bias training, expanded parental leave (a benefit highly valued by The Motley Fool), and a program called Dialogues Across Differences for teaching employees how to have conversations about cultural perspectives.

And yet, Microsoft isn't without scars in the social component. The company has faced lawsuits from multiple former female employees alleging gender discrimination. More troubling are allegations of sexual harassment and misconduct that surfaced in 2019. Add to that the 2020 resignation of Bill Gates from the board of directors after the board hired a law firm to investigate an affair he had with a Microsoft employee, and it's impossible to score Microsoft highly when it comes to D&I. Bloomberg appears to agree: Microsoft isn't on the company's Gender-Equality Index.

Areas for improvement: Tools that make it easier for employees to report diversity and inclusion violations would not only make it easier for victims to report but for HR to respond systematically and track progress. Reporting on progress in this area (or a lack thereof) in the annual sustainability report is a must.

4. Does the company have ethical corporate governance principles?

Yes. Microsoft checks all the important boxes for a shareholder-friendly board that practices ethical principles. From the company's most recent proxy statement.

It's worth noting that Microsoft pays for performance that rewards all stakeholders. Executive pay includes cash incentives that are 50% tied to pre-determined financial metrics such as revenue growth and gross margin, and 50% to qualitative factors that include D&I, corporate citizenship, and customer satisfaction scores, among other factors. Performance stock awards are tied to the measurable financial performance of Microsoft's different product lines.

5. Do the company's business model and its investments promote ESG principles?

Yes. Microsoft sells desktop and mobile software, usually via subscription and delivered via the cloud, to billions of people around the globe. Its financial reporting is organized into three segments:

- Productivity and Business Processes for selling tools such as Excel and Word under the Office brand name, for selling the Dynamics business intelligence software suite, and for selling LinkedIn's services for connecting professionals with opportunities.

- Intelligent Cloud for selling access to the Azure public cloud and the tools developers use to create and support modern, cloud-hosted software.

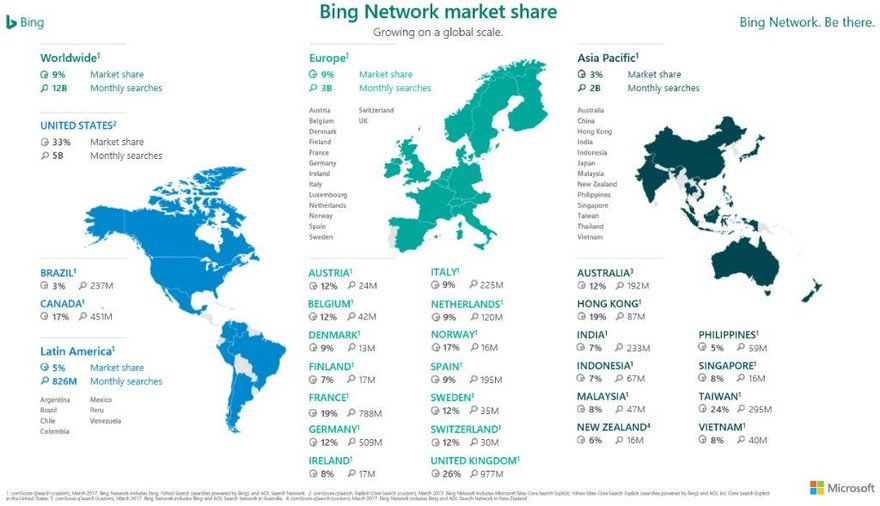

- More Personal Computing for selling Windows licenses to PC makers, for selling the Surface line of products, for selling the Xbox and associated gaming products, and for all business related to the Bing search engine.

To support all these products Microsoft is increasing the capital expenditures in the area of its cloud offerings. ESG-minded investors should like this trend. Long term, Microsoft is aggressively pushing to be fully reliant on renewables.

6. Does the company have a healthy balance sheet?

Yes. Microsoft is one of only two U.S.-based companies with a AAA credit rating. This is likely a function of its large net cash position, recurring revenue, tremendous FCF generation, and product relevance.

Critics will rightly point out that Microsoft carries more than $58 billion in debt so it's not like the company is free of obligations. And yet it's worth looking at where that capital has gone. Much of it was used to make greener corporate buildings and construct modern, energy-efficient data centers.

7. Can the company generate organic revenue growth supported by long-term tailwinds?

Yes. Microsoft either leads or is a serious contender in most of the markets in which it competes. Even Bing, the search engine that badly trails Google, is still a common option for online advertising.

8. Is the management team focused on driving long-term profitable growth?

Yes. Nadella is playing a long game, and with Azure, he and his team are playing to win at a scale not seen since Windows 95 revolutionized how we came to see and use PCs. And you know what? He's been thinking this way since his first day on the job. From his letter to employees:

I believe over the next decade computing will become even more ubiquitous and intelligence will become ambient. The coevolution of software and new hardware form factors will intermediate and digitize — many of the things we do and experience in business, life and our world. This will be made possible by an ever-growing network of connected devices, incredible computing capacity from the cloud, insights from big data, and intelligence from machine learning. This is a software-powered world.

Indeed it is, and Microsoft is profiting handsomely as a result.

10. Does the company have a medium- or lower-risk profile?

Yes. Microsoft checks just one box on the list of risk factors that inhibit potential ESG Compounders, and that's largely due to its size and global reach. Burdensome regulation is a potential problem for all multinational corporations. And yet the problem is greater for Microsoft thanks to General Data Protection Regulation (GDPR), which requires companies operating in the European Union to give people control of their data and ensure it not be transferred or sold to other parties outside the EU. The legislation has since given rise to a global discussion in which countries are debating how and whether to implement their own data privacy protections.

There's also the long shadow of U.S. vs. Microsoft, the 1998-2001 antitrust trial that still follows the company in press coverage. The stories appear to have had one practical effect on the business: Nadella's Microsoft is more humble, more collaborative, and increasingly proving to be a powerful force for good.

Consider the company's contributions to open source, software that's professionally built by skilled developers and then let loose into the world for anyone to use — free of charge. At the time of its $7.5 billion deal for GitHub, Microsoft was the single largest contributor to the site, backing more than 2 million open source projects. Helping developers do more with technology is a wonderful and industry-specific way to do good in the world, and it may help to explain why -- just nine months into the acquisition -- GitHub's installed base of developers using the platform had ballooned by 28.6%. Microsoft is winning over the audiences it most needs.

Microsoft is an ESG top performer

While Microsoft isn't perfect, a nine out of 10 on The Motley Fool's ESG Compounder Checklist is a sterling result. Should efforts to improve the company's diversity and inclusion practices continue to improve, it may not be long before we see Microsoft stick the landing alongside Accenture (ACN 0.19%), which scores a perfect 10. Keep this company on your ESG shortlist if you don't already own shares.