Do you want to support companies working toward sustainable solutions for climate change? Consider sustainable investing. The term sustainable investing is often used interchangeably with ESG investing, socially responsible investing, or impact investing. Without a defined scope for sustainable investing, investors can decide what sustainable investing means for them.

According to a 2021 Morgan Stanley survey, 79% of investors and 99% of millennials were interested in sustainable investing, and 88% of millennial respondents showed interest in investments that can influence climate change. While climate change remains a top focus, interest in public health, small business, and social justice is also surging.

Sustainable investing is about more than doing good. It is a wealth-building strategy on the rise because it brings results. According to Morningstar, 56% of ESG funds outperformed their peers in 2021.

What is sustainable investing?

What is sustainable investing?

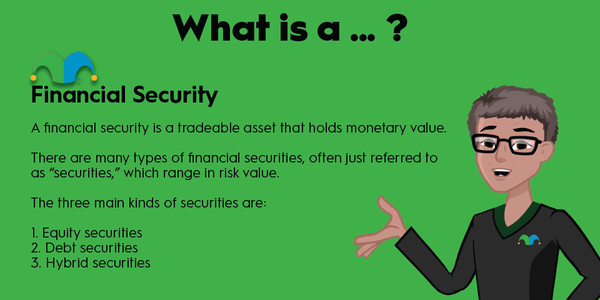

Sustainable investing takes care of people and the planet to create a better future while building long-term wealth. It is a term used interchangeably with ESG investing. ESG considers a company’s environmental, social, and governance values. Sustainable investors choose priorities or objectives to use as filters in selecting investment opportunities.

One definition of sustainability from the Oxford English dictionary, the “avoidance of depletion of natural resources to maintain ecological balance,” may lead investors to focus on companies providing solutions to climate change and renewable energy. Others may consider social responsibility and good governance as essential pillars of sustainability.

Becoming a sustainable investor does not change good investment practices. These investors still evaluate technical metrics such as a company’s debt-to-equity ratio, price-to-earnings ratio, and historical performance. Sustainable investors use sustainability as one more metric to evaluate a company’s performance and risk profile.

ESG ratings are one tool to gain insight into a company’s sustainability priorities. The most common ESG rating frameworks are MSCI and Sustainalytics ESG Rating. These third-party certifications score companies on performance factors related to environmental, social, and governance issues.

MSCI uses a 10.0 scale by which companies receive a composite score based on the three areas of sustainable investing. A score of AAA is the highest rating, awarded only to companies that demonstrate strong commitment to all three values of environmental stewardship, social responsibility, and good governance. Companies with an AAA rating earn a score between 8.571 and 10.0 using MSCI’s criteria.

A company’s ESG reporting can also give investor’s greater insight into sustainability priorities and potential risks. These reports provide detailed information about sustainable initiatives. ESG reporting is not yet standardized, so look for companies using the TCFD, GRI, UNPRI, or SASB reporting standards for greatest transparency and accountability.

How fast is sustainable investing growing?

How fast is sustainable investing growing?

Sustainable investing is on the rise. In 2021, sustainable mutual funds and exchange-traded funds (ETFs) rose by 53% to $2.7 trillion. According to Bloomberg, ESG assets are poised to reach $41 trillion by the end of the year. According to BNP Paribas’s 2021 report, 47% of institutional investors believe ESG will be central to their work in two years.

The number of ESG funds is also rapidly increasing. According to Morningstar, 73 new ESG funds were established in 2020, and 121 new ESG funds were established by the end of 2021, up from only 319 ESG funds in 2019. That is a total ESG fund increase of 67% in two years.

The reasons for the growing popularity in sustainable investing? According to the 2021 BNP Paribas survey, 45% of respondents rated improved long-term returns as their motivation for ESG investing; 59% noted brand and reputation, and 39% cited decreased investment risk as a reason for ESG investment.

ESG funds have performed, and investors are seeing lower risks and greater long-term returns. In 2021, two-thirds of ESG funds outperformed the market. The S&P 500 ESG index outperformed the standard S&P 500 index on the past one-, five-, and 10-year reporting periods. And, according to Morningstar, more than half of ESG funds outperformed their peers in the past three- and five-year periods.

What is the future of sustainable investing? Green bond issuance topped $500 billion in 2021 and is projected to reach $1 trillion by the end of this year. According to Bloomberg projections, ESG assets could reach $53 trillion by 2025. ESG assets would then account for more than a third of the global assets under management. With these trends, ESG and sustainability are mainstream investment considerations.

Challenges to sustainable investment growth include the need for consistent, relevant reporting frameworks, and improved alignment of materiality with performance. Public and regulatory engagement can also have a significant impact on growth. The 2021 Morgan Stanley survey notes that performance concerns remain the biggest barrier to sustainable investments despite above-market returns.

Investors looking to sustainable investing growth areas can consider cleantech and renewable energy. Consider stocks such as Brookfield Renewable (BEP -0.18%) (BEPC -0.47%), NextEra Energy (NEE -1.25%), and Tesla (TSLA 12.0%). These companies have all shown a dedication to renewable energy and climate-forward technologies, along with high five-year returns and strong financial management.

Related Investing Topics

How to invest with sustainability in mind

How to invest with sustainability in mind

Ready to build a portfolio that promotes sustainability and long-term growth? Here’s what to keep in mind:

Set sustainability objectives

Building a sustainable portfolio should not be a financial trade-off. For that reason, you’ll want to set both financial and sustainability benchmarks. A conservative financial objective may be to earn market-level returns over the next 10 years.

A simple sustainable objective may be to keep a percentage of your portfolio invested in AAA-rated ESG funds. Other sustainable objectives could include investing a portion of a portfolio in renewable energy or emerging climate tech. You can also choose an exclusionary principle, avoiding stocks in fossil fuels, weapons, or companies without climate initiatives.

Define asset allocations

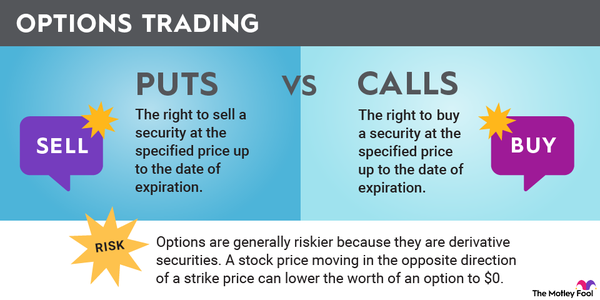

Successful investors will always diversify their portfolios to mitigate risk. Sustainable investing is no different. Asset allocation means choosing the percentage of different asset classes, such as stocks and bonds, within your portfolio. Risk tolerance and investment timeline will be deciding factors.

A medium-risk, long-term asset allocation could be 70% stocks and 30% bonds. Investors can choose between large-cap, medium-cap, and small-cap stocks, emerging markets, international securities, REITs, fixed-income securities such as government bonds, and money market investments to build asset diversity. For the sustainable investor, focus on assets with ESG priorities or ratings.

Research options

With hundreds of ESG stocks, bonds, and funds to choose from, you’ll want to find investment opportunities with sustainable financial returns. To evaluate investment options, you’ll want to look at debt-to-equity ratio, price-to-earnings ratio, and historical performance, as well as ESG reports and ratings. You can choose companies that have strong financial performances and focus on the sustainability criteria you set in step one.

One of the simplest ways to start investing sustainably is with ESG mutual funds, or ESG ETFs. Funds offer built-in diversification and clear reporting. Investors may choose to prioritize socially responsible funds, ESG funds, or impact funds. There are also a number of stocks taking on climate change.

Invest for the long term

With a sustainable investment portfolio, the basic principles remain the same. Diversify, buy and hold, invest new money regularly, and focus on long-term returns. Building a sustainable portfolio has the potential to bring consistent, long-term financial growth while supporting impact targets and a sustainable future.