"The trend is your friend."

So say the momentum traders, the action junkies, and the rocket-stock aficionados. When a stock is going up, they posit, you should buy because stocks have momentum. If they've gone up in the past, they tend to keep going up. But is that really true?

Momentum trading is the practice of trying to make money by trading stocks along with a trend. For example, if a stock is soaring after releasing a stellar earnings report, a momentum trader might try to buy shares and ride the stock's price higher. Or, for a very relevant example in the modern stock market, if a stock's price starts to rise because of a rumored short squeeze, momentum traders might buy shares with the hope that the short squeeze continues to push the price higher.

What is momentum trading?

In physics, momentum is defined as the quantity of motion of a moving body. For example, you could say that an accelerating car is "gaining momentum." This definition is also sometimes applied to non-physical situations such as investing.

Momentum trading is an investing strategy that seeks to capitalize on directional trends in a stock price. These trends can be caused by tangible events or catalysts (such as earnings reports, analyst or expert upgrades, etc.), or they can be more technical in nature. In fact, one of the core principles of technical analysis is to use patterns and indicators to detect trends other investors can't see.

Momentum trading can refer to either long-term or short-term types of stock trading. For example, the meme stock rallies we've seen in recent years are forms of short-term trading, as is trading based on a company's earnings report. But there are also momentum stocks that are clearly on longer-term uptrends. There's a solid argument to be made that Tesla (TSLA -1.92%) has been a momentum stock for years. Longer-term momentum trading is often referred to as "position trading," while intermediate-term momentum trading can be called "swing trading." Day trading is the short-term version of momentum trading.

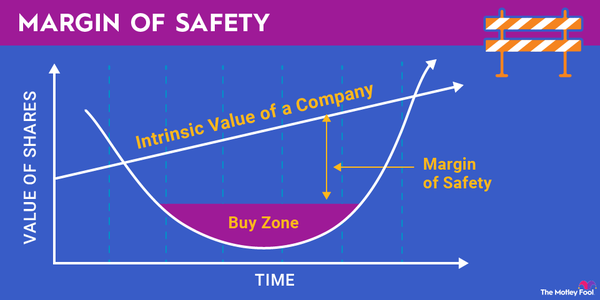

Here's a key takeaway. The goal of fundamental-driven, long-term investing is often described as "buy low, sell high." On the other hand, the goal of momentum trading is to "buy high, and sell even higher."

Momentum trading strategies

As a general rule, we take a long-term investment approach at The Motley Fool. Whether we're focusing on growth or value stocks, we typically base our decisions on fundamental analysis and the underlying business. That said, here are some popular momentum trading strategies and indicators used by traders trying to capitalize on trends.

- One popular philosophy in momentum trading is that a stock that hits a new high is likely to go even higher. So, one method of finding momentum stocks could be to run a stock screener to filter all of the stocks trading within, say, 5% of their 52-week highs.

- Day traders looking for momentum stocks often have their own criteria to help find opportunities (small companies, high volume, unusually high volatility). Some use chart patterns, a process known as technical analysis, but entire books have been written about reading stock charts. We won't go into specific chart patterns here.

- During earnings season, watching for stocks that dramatically surprise to the upside can provide momentum trading ideas. Generally following the news feeds and waiting for a sharp positive reaction from a stock on a news item also can help find momentum trading ideas.

Can you make money by momentum trading?

Well, sure. It's not uncommon for a stock to have a multiday upward move after reporting surprisingly strong earnings or for a short squeeze to last for a few days. And, if it does, there can be significant money to be made. Plus, there's something to the idea that trends tend to build on themselves.

Take earnings reports. Stocks tend to pop after issuing a solid earnings report, but this is often accompanied by a wave of analyst upgrades in the stock. Take a look at a Upstart's (UPST -1.97%) chart since reporting better-than-expected earnings. The stock soared higher by about 30% the day after, but it ended up adding another 30% on the positive momentum created by analysts and commentators over the next several weeks.

Related investing topics

Risks and drawbacks of momentum trading

In a nutshell, by using momentum trading you are counting on a certain trend to continue. However, there are absolutely no guarantees. Trend reversals happen all the time, and momentum doesn't last forever. An ideal momentum trade would involve buying a stock on the way up and selling it at (or just before) its peak. As anyone who has tried it can tell you, that is much easier said than done.

In his classic text on the advantages and disadvantages of various investing strategies, Investment Fables, Aswath Damodaran of the Stern School of Business at NYU states his doubts. After crunching the numbers, he concludes that while it's true in general that a stock that has been going up keeps going up, "timing can make the difference between success and failure" when you trade on momentum.

When a stock rockets on a better-than-expected earnings release, for example, seconds can count. Good news can spark a nearly instantaneous rise in price, and the profits go only to the quickest clickers. Gun-shy traders face a different problem. Stocks that have risen for six months straight tend to continue rising for a while, but if you wait six months to identify the "trend," you have by definition forgone all the profits to be made while the trend was forming.

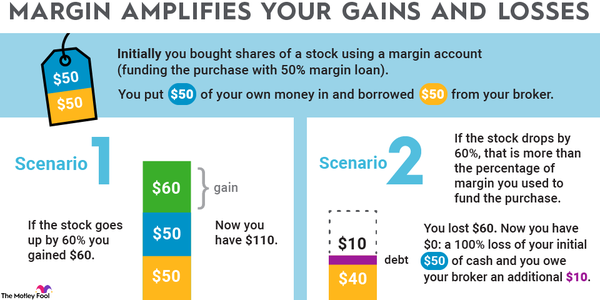

In short, momentum trading is risky. Citing statistical data, Professor Damodaran further explains that, "Momentum stocks have an average beta almost twice that of the rest of the market ... and are much more volatile."

The problem is that this process works both ways. Traders who buy a stock because it's going up may quickly turn around and abandon the stock when it stalls. At that point, a tidal wave of selling starts. Sellers, desperate to get out of the stock, will offer to sell it for progressively lower prices, forcing the price downward.

The bottom line on momentum trading is that it is a higher-risk way to put money to work in the stock market. And it's certainly a form of trading, not investing. Momentum trading can be a good way to make money when things work out, but it can quickly result in big losses if things go the other way. Invest accordingly.