When most investors begin their hunt for a new stock, it starts and ends with a large-cap name valued at more than $10 billion.

Although there are many good reasons to own large-cap stocks, it's also a good idea to seek out small-cap stocks -- those with $300 million to $2 billion in market cap. As a group, these companies are much smaller than their larger-cap counterparts, so they have greater growth potential. Under the right circumstances, small caps are a good bet to outperform their larger peers.

Small-cap stocks have the potential to maximize returns

Small-cap stocks have the potential to maximize returns

The best reason to invest in small-cap stocks is their greater potential to deliver outsized returns compared to larger companies. For instance, it's considerably easier for a $1 billion company to become a $10 billion one than it is for a $100 billion company to grow to $1 trillion. In fact, some of the biggest companies in the world once traded in the small-cap range, such as Amazon (AMZN 1.49%) and Netflix (NFLX -0.08%). If you had bought and held these stocks when they were small, you would have seen your initial investment appreciate more than 100 times.

Small-cap stocks tend to have higher growth rates. Again, it's easier for a smaller company to double its revenue; mature companies tend to see slowing revenue growth. However, small caps are also more likely to be unprofitable. This makes them more volatile than large caps because they are more vulnerable to recessions, market crashes, and other shocks. For example, during the 2020 crash, when the COVID-19 pandemic hit the U.S., small-cap stocks fell more than their large-cap peers.

Additionally, small-cap stocks are followed by fewer investors and Wall Street analysts, so they often have bigger swings on news such as earnings reports.

How small-cap stocks can outperform large-cap stocks

How small-cap stocks can outperform large-cap stocks

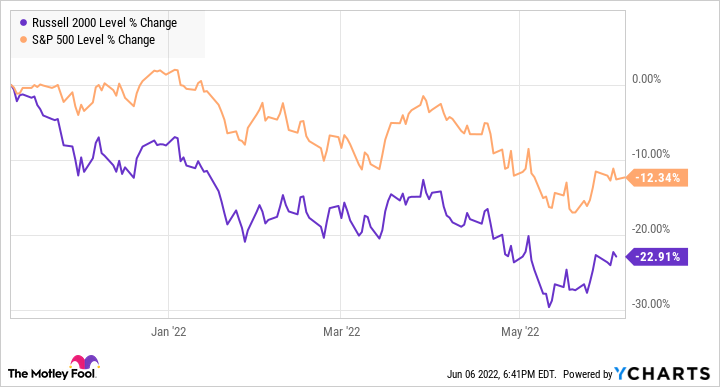

Due to their higher volatility, small-cap stocks tend to outperform during young bull markets when stocks are quickly moving higher. For example, since the Russell 2000, which tracks the performance of small-cap stocks, bottomed out on March 18, 2020, it's outperformed the much larger S&P 500 by a significant margin, as the chart below shows.

However, you'll notice that since the bear market in the Russell 2000 began on Nov. 8 2021, the small-cap index has underperformed its large-cap peer, showing how volatility swings both ways.

It's also worth noting that in the heady days of the bull market following the 2008-2009 financial crisis, the Russell 2000 outperformed the S&P 500 by a wide margin. The chart below shows the first year of that bull market.

In fact, the Russell 2000 would outperform the S&P 500 for most of the decade after the financial crisis. Smaller companies also benefit from such accommodative monetary policies as low interest rates, which make it easier for them to borrow to expand or keep their businesses afloat during tough times. Similarly, fiscal stimulus programs are also beneficial for small-cap stocks since they're generally more sensitive to consumer spending and market sentiment.

On average, small-caps have an advantage when the U.S. economy is in recovery mode. When the economy is rebounding, unemployment rates are quickly going down, and businesses are seeing strong earnings growth, making it a great time to invest in small-cap stocks.

Of course, small-cap stocks don't always outperform. Just as these stocks have more upside potential, there's also substantial downside risk since they're less likely to be profitable and can more easily be pushed into bankruptcy. That makes small-cap stocks riskier than so-called blue chips. But with greater risk comes greater potential for reward.

A number of high-growth stocks skyrocketed in 2020 and 2021 before collapsing in 2022 as investor sentiment shifted and became more cautious, and many of those stocks were revealed to be overvalued. One example is Blink Charging (BLNK 0.44%), a provider of electric vehicle charging equipment and services. Blink is one of several EV stocks that skyrocketed during the pandemic before collapsing in recent months as investors sold unprofitable stocks. Although Blink is growing rapidly, the company is still unprofitable and its losses are expanding. Blink is down about two-thirds from its early 2021 peak.

In a bear market, investors often lose patience for these kinds of stocks, and small caps tend to underperform because more of them are unprofitable.

January Effect

When will small caps recover?

When will small caps recover?

Nobody knows for sure when small caps will recover from the current bear market. After all, timing the market is almost impossible, and the beginning of a recovery is based on things that are unknowable, including how much the Fed raises interest rates, how long high inflation lasts, and how the overall economy performs in such an uncertain environment.

However, we do know that small caps are likely to hit bottom before their large-cap peers. Because it's a riskier sector, small caps tend to both peak and trough before large caps in the stock market cycle. We saw that in March 2020 when small caps hit bottom before large caps, and more recently when the Russell 2000 peaked in Nov. 2021, two months before the S&P 500 peaked.

While no one knows when the market will turn, it's a good bet that small caps will jump before larger stocks do and they'll gain faster in the recovery.

Related investing topics

Be smart when investing in small-cap stocks

There are no absolute rules in investing. Although small caps historically outperform large-cap stocks, that doesn't necessarily mean your portfolio should consist only of small companies. As always, a healthy balance of different types of stocks is the key.

You can also look to index funds and mutual funds to make diversification easier. It's also important to focus on quality rather than just market cap -- it's much better to own a high-quality, large-cap stock than a low-quality, small-cap share.

Still, scaling up your exposure to small-cap stocks as a group is a tried-and-true way to increase your returns. If you can buy some of the top small-cap stocks early in a bull market, you're likely to outperform the market over the coming years and into the long term.