Value investors want to buy stocks for less than they're worth. If you could buy $100 bills for $80, wouldn't you do so as often as possible?

With the S&P 500 index down about 15% as of August 2022, the current market presents an opportunity for value investors. When the overall stock market drops, even high-quality companies with strong fundamentals see share prices fall. Plus, value stock companies tend to be well-established and less volatile compared to growth stock companies.

Here's an overview of value stocks, including some excellent beginner-friendly value stocks, and some key concepts and metrics that value investors should know.

3 best value stocks for beginners

3 best value stocks for beginners

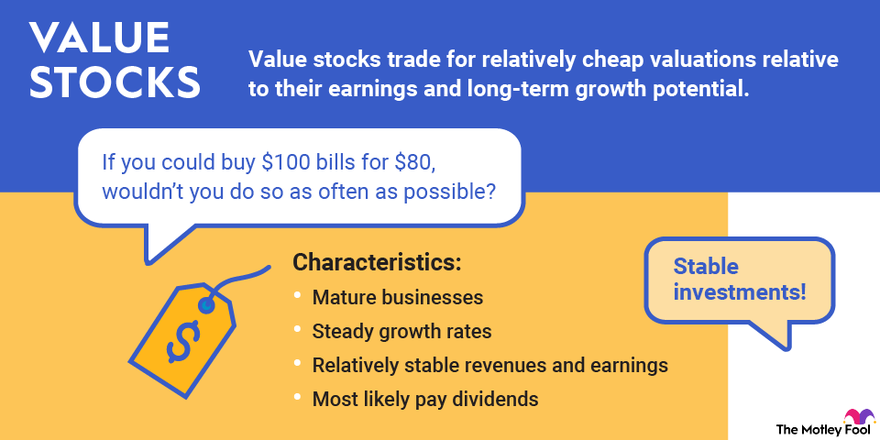

Value stocks are publicly traded companies trading for relatively cheap valuations relative to their earnings and long-term growth potential.

Let's take a look at three excellent value stocks: Berkshire Hathaway (BRK.A -0.59%) (BRK.B -0.74%), Procter & Gamble (PG 0.08%), and Target (TGT -0.67%). Then we'll dive into some of the metrics that can help you find the best value stock investments.

- Berkshire Hathaway: Since CEO Warren Buffett took over in 1964, Berkshire Hathaway has grown into a conglomerate with more than 60 wholly owned businesses and a massive stock portfolio with more than four dozen different positions. Berkshire has steadily increased its book value and earnings power over time -- and it operates under the same business model that has led the stock to almost double the annualized return of the S&P 500 index for more than 55 years.

Buffett and his business partner, Charlie Munger, have long kept large cash reserves to deploy when they spot opportunity as part of their value investing strategy. In his annual letter to shareholders released in February 2022, Buffett wrote that Berkshire Hathaway held $144 billion in cash and cash equivalents. But Buffett apparently spotted value investing opportunities soon after. He later revealed at Berkshire’s annual shareholder meeting that the company bought $40 billion worth of stocks in the three weeks after the shareholder letter went out. - Procter & Gamble: Consumer products manufacturer Procter & Gamble is the company behind such brands as Gillette, Tide, Downy, Crest, Febreze, and Bounty, but there are dozens more in its product portfolio. Through the success of its many brands, Procter & Gamble has been able to steadily add to its revenue over time and has become one of the most reliable dividend stocks in the market. The company is just one of 44 stocks to reach the coveted Dividend King status, having boosted its dividend for 65 consecutive years.

P&G is a classic example of a recession-resistant stock since demand for its products holds steady throughout stock market cycles. The consumer staples giant continues to post impressive growth. In fiscal 2022, P&G increased organic sales by 7%, and it held or expanded its market share in 36 of 50 competitive niches. Although management expects sales growth to slow in fiscal 2023, the company’s size, stability, and diversity of products make it a solid play for tough times. - Target: Big-box retailer Target has a cult-like following that continues to grow, fueled in part by the popularity of its in-house brands. Sales of Target-owned brands soared by 18% in 2021 to more than $30 billion. Like other retailers, the company’s online sales have surged since the beginning of the pandemic. But Target’s unique digital model -- where 95% of sales, including online orders, are fulfilled by stores -- gives it an edge over competitors and allows it to reduce costs and maximize speed.

As of mid-2022, Target had a price-to-earnings ratio of around 14, making it cheap compared to rivals Walmart (WMT -0.35%) and Costco (COST -1.78%), which respectively trade for about 28 times and 42 times their earnings.

Another perk for value investors: Target is also a Dividend King, having boosted its dividend for 50 consecutive years.

What are value stocks?

What are value stocks?

Most stocks are classified as either value stocks or growth stocks. Generally speaking, a value stock trades for a cheaper price than its financial performance and fundamentals suggest it’s worth. A growth stock is a stock in a company expected to deliver above-average returns compared to its industry peers or the overall stock market.

If you could buy $100 bills for $80, wouldn't you do so as often as possible?

Some stocks have both attributes or fit in with average valuations or growth rates, so whether to call them value stocks depends on the number of pertinent characteristics they possess. Value stocks generally have the following characteristics:

- They typically are mature businesses.

- They have steady (but not spectacular) growth rates.

- They report relatively stable revenues and earnings.

- Most value stocks pay dividends, although this isn't a set-in-stone rule.

Some stocks easily fit into one category or the other. For example, package delivery giant FedEx (FDX -0.4%) is clearly a value stock that’s fallen out of favor with Wall Street due to some short-term challenges. Fast-moving Tesla (TSLA -5.59%) is an obvious example of a growth stock.

On the other hand, some stocks can fit into either category. For example, there's a case to be made either way for tech giants Apple (AAPL -2.19%) and Microsoft (MSFT -1.96%).

Regardless of the category of a stock, economic downturns present an opportunity for a value investor. The goal of value investing is to scoop up shares at a discount, and the best time to do so is when the entire stock market is on sale.

What to look for

How to find value stocks to invest in

The point of value investing is to find companies trading at a discount to their intrinsic value, with the idea that they'll be likely to outperform the overall stock market over time. However, finding stocks that are undervalued is easier said than done.

That said, here are three of the best metrics to keep in your toolkit as you search for a bargain:

- P/E ratio: This is the best-known stock valuation metric -- and for a good reason. The price-to-earnings, or P/E, ratio can be a very useful tool for comparing valuations of companies in the same industry. To calculate it, simply divide a company's stock price by its past 12 months of earnings.

- PEG ratio: This is similar to the P/E ratio but adjusts to level the playing field between companies that might be growing at slightly different rates (thus, PEG, or price-to-earnings-to-growth, ratio). By dividing a company's P/E ratio by its annualized earnings growth rate, you get a more apples-to-apples comparison between different businesses.

- Price-to-book (P/B) ratio: Think of the book value as what would theoretically be left if a company stopped operations and sold all its assets. Calculating a company's share price as a multiple of its book value can help identify undervalued opportunities, and many value investors specifically look for opportunities to buy stocks trading for less than their book value.

Value investors

Value investors

Long-term investors can generally be classified into one of three groups:

- Value investors try to find stocks trading for less than their intrinsic value by applying fundamental analysis.

- Growth investors try to find stocks with the best long-term growth potential relative to their current valuations.

- Investors who take a blended approach do a little of each.

Warren Buffett is perhaps the best-known value investor of all time. From the point when he took control of Berkshire Hathaway in 1964 to the end of 2021, the S&P 500 has generated a total return of 30,209%. Berkshire's total return during the same period has been a staggering 3,641,613% (that's not a typo).

Although he isn't as well-known as Buffett, Benjamin Graham is often referred to as the father of modern value investing. His books, The Intelligent Investor and Securities Analysis, are must-reads for serious value investors. Graham also was Buffett's mentor.

Related investing topics

The power of value stocks

Don't underestimate the power of value stocks

While they might not be quite as thrilling as their growth stock counterparts, it's important to realize that value stocks can have just as much long-term potential as growth stocks, if not more. After all, a $1,000 investment in Berkshire Hathaway at the beginning of 1965 would be worth more than $28 million today. Finding companies that trade for less than they are truly worth is a time-tested investment style that can pay off tremendously.

Value Stock FAQs

What is a value stock?

A value stock is one that trades for a cheaper price than its financial performance and fundamentals suggest it’s worth.

What are value stocks vs growth stocks?

Value investing and growth investing are two different investing styles. Usually, value stocks present an opportunity to buy shares below their actual value, and growth stocks exhibit above-average revenue and earnings growth potential. Wall Street likes to neatly categorize stocks as either growth or value stocks. The truth is a bit more complicated since some stocks have elements of both value and growth. Nevertheless, there are important differences between growth and value stocks, and many investors prefer one style of investing over the other.

What are value stock ETFs?

An exchange-traded fund (ETF) that invests in value stocks uses specific criteria to find companies whose intrinsic values substantially exceed the market values implied by their stock prices. By investing in a wide range of undervalued companies, value stock ETFs confer instant portfolio diversification. Buying shares in a value stock ETF can be a safe and easy way to invest in companies in cyclical industries.

How do I start value investing?

Value investing requires a lot of research. You'll have to do your homework by going through many out-of-favor stocks to measure a company's intrinsic value and comparing that to its current stock price. Often, you'll have to look at dozens of companies before you find a single one that's a true value stock.