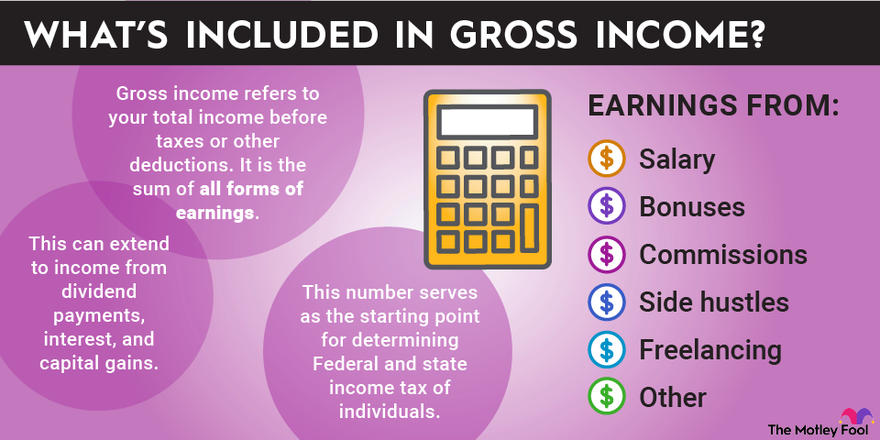

Gross income is your total compensation before taxes or other deductions. If you think of yourself as a business, your gross income is your top-line revenue.

What to include

What to include in gross income

Gross income is the sum of all money earned during a particular period of time. This includes money from your salary, bonuses, commissions, side hustles, and freelance earnings, or any other sort of income, such as Social Security. Depending on the context, this can also extend to income from dividend payments, interest, and capital gains.

The one thing you won't need to do in calculating your gross income is account for taxes. Gross income is purely a pre-tax amount, so taxes aren't relevant to the calculation.

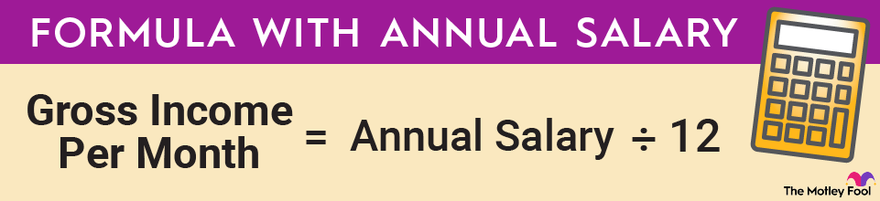

If you receive an annual salary

How to calculate gross income if you receive an annual salary

If you're paid an annual salary, the calculation is fairly easy. Again, gross income refers to the total amount you earn before taxes and other deductions, which is how an annual salary is typically expressed. Simply take the total amount of money (salary) you're paid for the year and divide it by 12.

For example, if you're paid an annual salary of $75,000 per year, the formula shows that your gross income per month is $6,250.

Many people are paid twice a month, so it's also useful to know your biweekly gross income. To find this amount, simply divide your gross income per month by 2.

Continuing with the above example, you'd divide $6,250 by 2 to arrive at $3,125 as your biweekly gross income.

If you're paid hourly

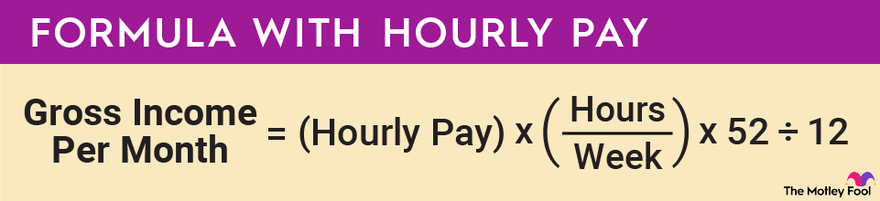

Calculating gross monthly income if you're paid hourly

For hourly employees, the calculation is a little more complicated. First, to find your annual pay, multiply your hourly wage by the number of hours you work each week and then multiply the total by 52. Now that you know your annual gross income, divide it by 12 to find the monthly amount.

(Note: If your hours vary from week to week, use your best estimate of the average number of hours you work.)

For example, if you're paid $15 per hour and work 40 hours per week, your weekly gross pay is $600. Multiplying this amount by 52 shows an annual gross income of $31,200. Finally, dividing by 12 reveals a gross income of $2,600 per month.

If you have any special circumstances, such as a certain amount of overtime hours per month or a recurring bonus or commission, you can generally add it to your gross monthly income.

The common way to do this is to determine the amount of overtime pay (or bonus or commission) you've received throughout the past year and divide it by 12. This amount would then be added to the gross monthly income you calculated from your base pay.

A note on adjusted gross income

A note on adjusted gross income

You may have heard the term adjusted gross income or AGI, which is primarily used around tax time to describe your total income less certain deductions.

Without getting too heavy into tax language, AGI refers to a number found on your annual tax return and won't usually enter into the discussion of monthly gross income as it relates to your bimonthly paychecks.

Monthly gross income is simply the amount you earn every month before taxes and other deductions. Put another way, it's the annual amount you earn divided by 12. It's merely a basic measure to help with budgeting and other run-of-the-mill financial calculations.

Adjusted Gross Income (AGI)

Be able to calculate your gross income per month

Knowing your gross monthly income is critical when it comes to formulating a budget and determining tax liabilities, retirement contributions, and other deductions. Gross monthly income also comes into play if you ever apply for a loan or submit paperwork to rent an apartment.

Finally, knowing the difference between gross monthly income and net monthly income is key. Your gross monthly income is all the money you actually earn, while your net income is the amount you can expect to actually hit your bank account every month. These amounts are very different, but they can easily get confused.

Having a handle on your monthly income is a great way to stay on top of your finances as a whole, so take the time to calculate it and know where every dollar is going.

FAQs

Gross Monthly Income FAQs

What is my gross monthly income?

Your gross monthly income is the pre-tax sum of all the money you earn in one month. This includes wages, tips, freelance earnings, and any other money you earn.

How do I calculate gross monthly income?

If you only have an annual salary amount to work with, simply take your annual salary and divide it by 12 to arrive at your gross monthly income.

Otherwise, sum up all the money you intend to earn for the year -- from all sources -- and divide that amount by 12.