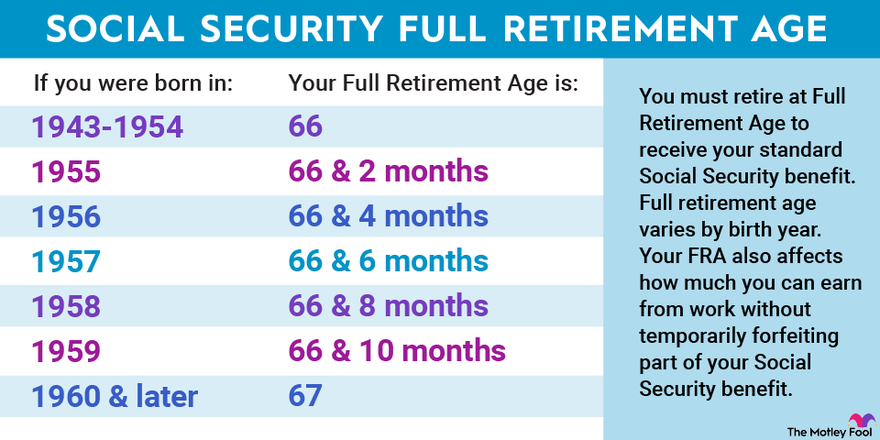

Full retirement age (FRA) is the age at which you can claim your standard Social Security benefit, or your primary insurance amount (PIA), from Social Security. Your PIA is the standard amount you can expect to receive based on your inflation-adjusted average wages earned throughout your career. Full retirement age is 66 for those born in 1954 and 67 for those born in 1960 or later -- it varies depending on your birth year.

It is important to know your full retirement age, as it affects when you can claim Social Security without reducing your benefits, the amount of delayed retirement credits you can earn in order to raise your benefits, and how much you can earn from working while receiving Social Security without forfeiting any of your benefits.

Social Security full retirement age chart

Social Security full retirement age chart

The chart below shows the full retirement age for people born at different times.

How does full retirement age affect your Social Security benefits?

How does full retirement age affect your Social Security benefits?

If you claim your benefits at full retirement age, you will receive your standard Social Security benefit amount. If you claim prior to FRA, you will be subject to early filing penalties that reduce your benefit by the following amounts:

- 5/9 of 1% for each of the first 36 months before FRA

- 5/12 of 1% for each subsequent month before FRA

This amounts to a 6.7% annual reduction for each of the first three years and an additional 5% reduction for each following year before FRA. If you claim benefits at 62 with an FRA of 67, you will face a full 30% reduction in benefits.

By contrast, if you claim benefits after FRA, you receive delayed retirement credits valued at 2/3 of 1% per month. This results in an 8% annual increase to your monthly benefit. Delayed retirement credits can be earned until age 70, after which time there is no financial benefit to delaying your claim. Delayed retirement credits cannot be earned if you are claiming either spousal or survivor benefits.

Working after full retirement age

Working after full retirement age

Retirees may work while collecting Social Security benefits, but those younger than their FRA will be subject to the retirement earnings test (RET).

Under this test, if your earnings exceed a certain limit (which changes annually), you will temporarily forfeit some or all of your benefits. Once you reach full retirement age, your benefit is recalculated and you may receive most of that money back.

Other key questions about full retirement age

Other key questions about full retirement age

There are a few other key things you may need to know about full retirement age.

1. Do survivor benefits increase after full retirement age?

If you are the surviving spouse who is claiming benefits based on your deceased partner's work record, there is no benefit to waiting until after FRA to claim your benefits. You do not earn delayed retirement credits, so your benefit will not increase.

However, if you are the higher-earning spouse, delaying your claim for benefits until after FRA can result in your widow(er) receiving more monthly income, as your widowed partner will receive the higher of the two monthly benefits you were each receiving.

2. Are Social Security benefits taxable at full retirement age?

Your age does not have an impact on whether you will owe tax on Social Security benefits. Depending on your earnings, you may pay federal taxes on Social Security benefits regardless of the age at which you claim.

Social Security benefits are taxed on amounts exceeding the "provisional income" limit set by the IRS. To calculate your provisional income, add up all non-Social Security sources of income, including nontaxable income such as municipal bond interest, and include half of your annual Social Security income.

Single filers earning provisional income between $25,000 and $34,000 and married joint filers earning between $32,000 and $44,000 will owe income taxes on 50% of their Social Security benefits. For single filers with provisional income above $34,000 and married filers above $44,000, up to 85% of Social Security benefits will be taxable.

3. Is your full retirement age affected by where you live?

Your FRA is not affected by where you live. Most Social Security rules, including those that determine benefit amount and claiming age, are set by federal law. However, some states do tax Social Security benefits, so where you live can affect tax levels on your retirement income. But again, the age at which you claim benefits won't affect your tax rate -- your income is the key factor.

Working after full retirement age FAQ

Can I work after full retirement age?

You can work after full retirement age and earn as much as you'd like without the amount of your Social Security benefits being affected at all.

How much can I earn if I work after my full retirement age?

If you continue to work after reaching full retirement age, you may work and earn as much as you'd like. You will not be subject to the retirement earnings test, and your Social Security benefits will not be affected.

If you work prior to FRA, you may forfeit part of your benefits if you earn above annual thresholds. However, your benefit amount will be recalculated at full retirement age to account for most of those forfeited funds.

Does working after full retirement age increase Social Security benefits?

Working after full retirement age could increase your Social Security benefits. Your benefits are based on average wages over your 35 highest-earning years (adjusted for inflation).

Even after you've reached full retirement age, and even if you've already claimed benefits, the Social Security Administration continues to recalculate your average annual wage to account for new income. If your earnings after FRA are higher than previous years and raise your average wage for your 35 top-earning years, your benefits could rise accordingly.

Related retirement topics

Expert Advice

Jialu Streeter, PhD,

The Motley Fool: Because of the COVID-19 pandemic, many Americans now fear they won’t be able to retire. What is your advice for someone who may be worried about retiring because of recent financial setbacks?

Streeter:

- First, I would suggest the person and their family have a thorough review of all their assets and debt, including home equity, mortgages, student loans (including their children’s if they have co-signed), retirement plan balances, and other checking and savings accounts.

- Second, it’s important to understand the implications of retirement age on the Social Security benefits. For some people who are in good health and can afford to delay Social Security, it might be better for them to delay in order to receive higher benefits for the rest of their lives. Third, the person or family need to have an honest conversation about their envisioned retirement style. E.g., will they travel much? Will they dine out or cook at home?

- Lastly, the longevity risk. Whether they will outlive their wealth. People need to put all these points together in order to see whether they are on track of a retirement life that they had planned for.

The Motley Fool: In 2019, the average retirement account savings for American households was $65,000 with the average American under 35 having $13,000 saved for retirement. Why do you think this average is so much lower than what experts typically expect Americans to have?

Streeter: Only about half of American adults have access to workplace retirement plans such as a 401(k). Second, people are going to school for longer and start saving for retirement later. Third, many people just follow the “default” rate of retirement savings which is lower.

The Motley Fool: There are no hard and fast rules about when to retire or how much we should have saved, but what three pieces of advice would you give someone who is just starting their first retirement savings account?

Streeter:

- Start saving early.

- Save more than the default rate.

- Max out on the retirement contribution if you expect that your retirement income will be lower than your current income, and of course, if it doesn’t interfere with your other financial goals.