Companies split their stock for a variety of reasons and in a variety of ways. Here's what you need to know about stock splits, how the process works, why it can have a positive or negative impact on a company's market value, and other important details.

Stock splits explained

A stock split is a multiplying or dividing of a company's outstanding share count that doesn't change its overall market value or capitalization. For example, if a company doubles its share count by giving investors one additional share of stock for every share they own, each shareholder will own twice as many shares of stock. However, the overall value of all outstanding shares won't change since no additional capital will have been paid into the company.

What is a forward stock split?

What is a forward stock split?

The most common type of stock split is a forward split, which means a company increases its share count by issuing new shares to existing investors. For example, a 3-for-1 forward split means that if you owned 10 shares of company XYZ before it split, you'd own 30 shares after the split took effect. However, the overall value of your investment wouldn't change (at least in theory). So a forward split results in more outstanding shares but a lower price for each share, with no net gain or loss in the company's overall market value.

What are reverse stock splits?

What are reverse stock splits?

There's another type of stock split, known as a reverse split, that works in the opposite way. Shares owned by existing investors are replaced with a proportionally smaller number of shares.

For example, a 1-for-3 reverse split is one that replaces every three shares owned by a company's investors with a single share of stock. So, if you owned 30 shares of a company's stock before such a reverse split went into effect, you'd own 10 shares afterward. It's important to know that a reverse stock split generally (but not always) happens for a negative reason such as after a big decline in a stock's price.

Stock split ratios

Stock split ratios

A stock split ratio tells you the number of new shares that will be created after a forward stock split, or by how much the share count will be divided in a reverse stock split. For example, a 3-for-1 stock split means that two shares will be created for every one currently in existence, for a total of three after the split.

It's also important to note that the stock split ratio can tell you whether you're looking at a forward or reverse stock split. Simply put, if the first number is larger (as in "3-for-1"), it is a forward split. If the first number is the smaller of the two, it is a reverse split.

Why do stocks split?

Why do stocks split?

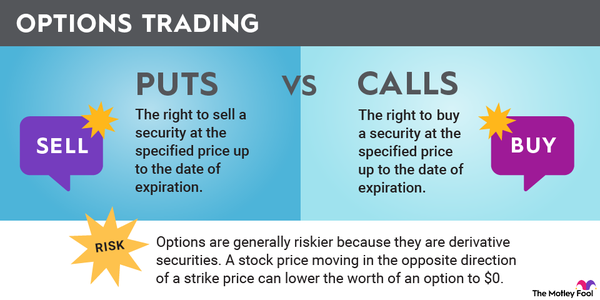

The main benefit of a stock split is to make a company's shares cheaper for small investors to buy. Many companies (specifically their boards of directors) have split their stock periodically throughout their history in order to maintain a desirable share price. It's important to note that derivative investments such as options will, in turn, become more affordable as well after a stock split.

To be clear, a stock split doesn't have any effect on the overall value of your investment, at least in theory. In the real world, the circumstances surrounding the split can certainly move a stock higher or lower.

For example, when a company decides to split its shares in order to make shares more affordable, it can have a positive effect. This opens the stock to an entirely new subset of the investing public (namely, those who previously couldn't afford even a single share), which can cause a spike in demand that pushes the stock higher. If your broker allows you to trade fractional shares, this isn't a concern, but, for many investors, high-dollar stocks are inaccessible. Stock splits also can convey management's confidence in a stock price, which can trickle down to investors.

What should you expect when stocks split?

What should you expect when stocks split?

There are three key dates investors need to know when it comes to stock splits. They are (in chronological order):

- Announcement date: First, the company will publicly announce the plans for the split, as well as pertinent details investors need to know. This information generally includes the split ratio and when it will happen, including the dates I describe in the next two bullet points.

- Record date: This is an important date when it comes to accounting, but it isn't terribly important for investors to know. The record date is when existing shareholders need to own the stock in order to be eligible to receive new shares created by a stock split. However, if you buy or sell shares between the record date and the effective date, the right to the new shares transfers.

- Effective date: The date when the new shares show up in investors' brokerage accounts and the shares trade on a split-adjusted basis.

This may sound complicated, but it's quite simple in real-world situations. On the morning of the effective date of a stock split, the increased number of shares will appear in your account, and the share price should be adjusted accordingly.

Stock split examples

Stock split examples

Here are some stock split examples from recent history:

- Alphabet (GOOG -0.11%L) (GOOG -0.11%) announced a 20-for-1 stock split, their first in eight years, with an effective date of July 15, 2022.

- Nvidia (NVDA 1.58%) announced a 4-for-1 stock split in mid-2021, with an effective date of July 20, 2021.

- Tesla (TSLA -2.78%) announced a 5-for-1 stock split along with its second-quarter 2020 earnings report, with an effective date of Aug. 31, 2020.

- The Trade Desk (TTD 1.04%) announced a 10-for-1 stock split in 2021 after years of stellar stock performance, with an effective date of June 17, 2021.

Related investing topics

The bottom line on stock splits

To sum it up, a stock split doesn't affect the overall market capitalization of a company all by itself. Rather, it is simply a change in the share count or structure of a company's stock. If you like a stock, buy before or after a stock split -- there's no need to buy shares before a split happens.

However, while a split itself doesn't affect the value of a stock, the circumstances surrounding the stock split, as well as the split-adjusted stock price, can certainly be a positive or negative catalyst.