A real estate capitalization rate, or cap rate, is a popular metric to estimate the rate of return on an investment property. Real estate investors use cap rates to determine if a property investment is worthwhile compared to other opportunities. It compares a property's net operating income, or NOI, to its value.

Here's a closer look at the cap rate and its importance to real estate investors.

What is the cap rate?

What is the cap rate?

The commercial real estate transaction market works differently than the residential real estate sales market. In residential, the market values homes predominantly through comparable sales or comps. In commercial real estate, investors are seeking a return on their investment. The primary form of that return is the income the property can generate and distribute to investors. The cap rate helps investors measure this return.

The cap rate is a valuation metric investors use to determine if a property is an attractive investment. It's like a price-to-earnings (PE) ratio for stocks. However, it's a percentage, so it's even more similar to a stock's free cash flow yield or dividend yield. The cap rate helps investors determine if a real estate investment is worthwhile compared to other potential investments based on the income it can produce relative to the investment value.

Like valuation metrics for stocks, the cap rate isn't a perfect measure of value. It only provides a snapshot of valuation based on a property's net operating income (NOI) over the past year or what it could produce after completing a value-add strategy. It doesn't consider future revenue or expense growth. It also doesn't factor in other items that could impact a property's value, such as needed repairs or location. Because of that, it shouldn't be the sole tool investors use to make an investment decision.

What is the cap rate formula?

What is the cap rate formula?

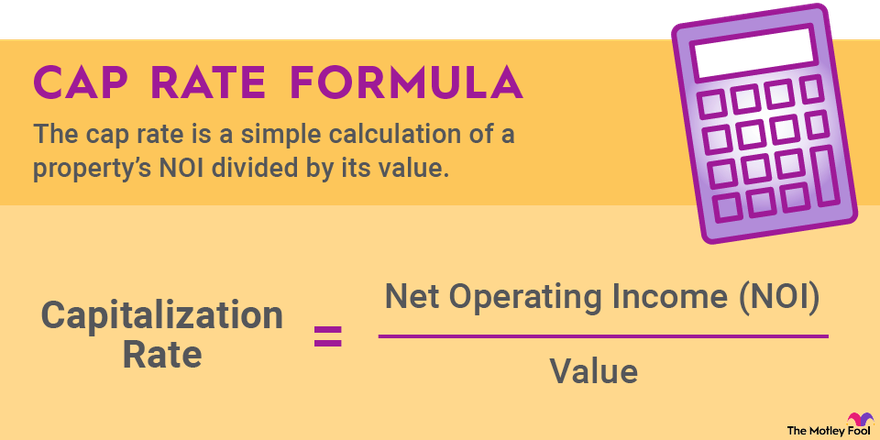

The cap rate is a simple calculation of a property's NOI divided by its value (either sales price, purchase price, or appraised value). NOI is a measurement of an investment property's profitability. It subtracts all operating expenses from the revenue a property generates.

The formula for calculating cap rate is:

Capitalization rate = Net operating income (NOI) / Value

For example, a single-family rental property is currently on the market with a list price of $450,000. The property has generated $22,500 of NOI over the past year. Using the cap rate formula, we can determine that this investment property is selling for a cap rate of 5% (22,500 / 450,000 = 5%).

The cap rate shows an investor the return they can expect from an investment and how long it will take for an asset to pay for itself. With a 5% cap rate, the investor can expect a 5% annual return and that the investment will pay for itself in 20 years. An investor can then compare that cap rate to other potential property investments.

How to interpret the capitalization rate

How to interpret the capitalization rate

The cap rate helps measure the return of an investment property compared to other opportunities. As a general rule of thumb, a higher cap rate implies that an investment property offers a higher return than a similar investment. However, it also often suggests this investment carries more risk.

Cap rates vary significantly by property type, quality, and market. The cap rates on multifamily and industrial investments are lower than on office and retail properties. Cap rates also tend to be lower on Class A properties compared to Class B or C. Likewise, commercial properties in primary markets tend to have lower cap rates than those in secondary and tertiary markets.

For example, a recently built, well-located multifamily property in a fast-growing market like Atlanta will have a significantly lower cap rate than an older office property in a declining market like Binghamton, New York. That's because investors are willing to pay more for the NOI of the Class A multifamily property in a primary market since income will likely rise at an above-average rate due to strong occupancy rates and increasing rents. On the other hand, the NOI generated by the Class C office property in the tertiary market could decline due to a lack of tenant demand and higher potential maintenance expenses.

Many other factors can impact cap rates, including interest rates, the macroeconomic outlook, and investor demand. Because of that, the definition of a good cap rate can change as those outside factors shift.

According to the Commercial Market Insights Report by the National Association of Realtors in January 2023, the national average cap rates by property type were as follows:

| Property Type | Cap rate | |

|---|---|---|

| Multifamily | 4.9% | |

| Office | 6.9% | |

| Industrial | 6.2% | |

| Retail | 6.7% |

Given those national average cap rates, investors could expect to pay a lower cap rate for a higher-quality property in a primary city.

Why is the cap rate important?

Why is the cap rate important?

Beginners in real estate investing need to understand cap rates. They are the basic valuation metric for commercial real estate that showcases the return an investor can expect to earn on a potential property investment. It can help investors quickly compare property investments by looking at the income each property generates relative to its value.

The cap rate can help investors spot a potentially attractive investment opportunity. It can also flag potentially higher-risk investments.

However, the cap rate doesn't always tell the whole story, which is why investors need to do more research than simply looking at this metric. For example, they need to ensure the seller hasn't inflated NOI by deferring maintenance since that would increase future costs, impacting NOI.

The cap rate is a good starting point for evaluating a potential real estate investment opportunity. Investors should use it along with other valuation metrics and complete additional due diligence to help inform their investment decision.

Related investing topics

Cap Rate FAQs

What is a good cap rate in real estate?

There is no official definition of a good or bad cap rate in real estate because several factors can impact one property's cap rate compared to another. Further, cap rates can change as interest rates, macroeconomic conditions, and investor sentiment shift. However, as of January 2023, the average nationwide cap rates by property types were 4.9% for multifamily, 6.9% for office, 6.2% for industrial, and 6.7% for retail. Those are a benchmark for a good cap rate.

Is it better to have a higher or lower cap rate?

It's generally better to have a lower cap rate than a higher one. A lower cap rate implies that the property is more valuable and less risky due to type, class, and market. While a higher cap rate offers investors a higher return, that property investment typically has a higher risk profile.

Why do sellers want a low cap rate?

Sellers want to maximize the value of the property they are selling. Because commercial real estate uses cap rates to value properties instead of comparable sales, a low cap rate means they're obtaining a high value for the property they're selling.