Required minimum distributions, or RMDs, are mandatory withdrawals from pre-tax retirement accounts, such as 401(k)s or IRAs.

Money invested in pre-tax retirement accounts may have been deposited decades ago. Consequently, it hasn’t been taxed over the period you’ve kept it.

RMDs exist to ensure that the IRS collects the tax revenue associated with your retirement money prior to your death. As such, RMDs are calculated between your early 70s and the expected remainder of your lifespan.

Let’s briefly break down what an RMD is, review the accounts that usually come with an RMD requirement, perform a simple RMD calculation, and consider how RMDs may affect your annual tax returns.

What is an RMD?

RMDs are mandatory retirement account withdrawals that take effect well after most people actually retire.

You’ll need to take your first RMDs from any pre-tax retirement accounts by April 1 of the year after you turn 73. (Prior to the passage of the Secure Act 2.0 in late 2022, RMDs began the year after you turned 72.) From then on, you’ll need to take all future RMDs by Dec. 31 each year going forward.

For example, say you turned 72 in 2022. You still had to take your first RMD by April 1, 2023, and you’d need to take your next RMD by Dec. 31, 2023. Your deadline for RMDs in subsequent years will be Dec. 31.

But if you turned 72 in 2023, you can delay by an additional year. You won't have to take your first RMD until April 1, 2025. You'd then need to take your next RMD by Dec. 31, 2025, and your deadline will be Dec. 31 for all subsequent years. Under the Secure Act 2.0 rules, the RMD age will increase to 75 in 2033.

The amount you’d need to take out from your account -- so that it’s taxed as ordinary income -- is based on your life expectancy. The IRS provides a table from which you can calculate your current year’s RMD using your account balance at the end of the previous calendar year.

The IRS table used to calculate your RMD is subject to legislative change, so be sure you’re using the most recently updated table before withdrawing any money.

RMDs by account

This isn’t an exhaustive list, but these are some of the more common accounts that have RMD mandates:

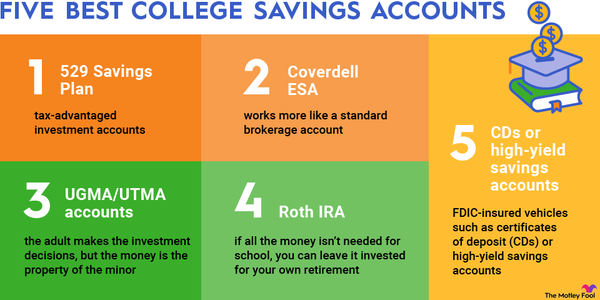

- 401(k)s or 403(b)s: Assuming you have a pre-tax retirement account, you’ll be required to remove a certain percentage of your employer-sponsored plan every year after you turn 73. (The Secure Act, which passed in early 2020, increased the RMD age from 70 1/2 to 72. The Secure Act 2.0 increased the age again from 72 to 73 in late 2022.) Starting in 2024, however, Roth-designated accounts will no longer have RMDs.

- Inherited IRAs: Pre-tax retirement accounts left to you by deceased loved ones also come with required annual distributions. You’ll likely roll the account into an inherited IRA, which has a complex set of rules for distribution based upon your relationship to the original owner. Inherited IRAs have become even more complicated to manage since the passage of the Secure Act. Consult with a qualified tax advisor to decode your particular scenario.

- Traditional IRAs: Traditional IRAs are also subject to RMDs once you reach age 73 (previously 72). Note that we’re referring to IRAs with pre-tax balances, or those containing money that has yet to be taxed. We are not referring to Roth IRAs since these accounts contain money that’s been taxed already and don’t have RMDs.

For certain accounts, such as IRAs, your total RMD amount is the aggregate of all RMDs for all pre-tax retirement accounts. You could withdraw the entire amount from a single account, although this may be difficult to track if your accounts are spread across multiple brokerages.

For inherited IRAs, this is possible as long as you’ve inherited the IRA from the same person.

Calculating your RMD

Say you’ve saved up $200,000 for retirement in a company-sponsored plan, such as a 401(k). You also turned 72 in 2022.

For your first RMD -- and the first one only -- you had until April 1, 2023, to remove the calculated amount from your account without incurring any penalty.

Every subsequent RMD must occur by Dec. 31 of the year in question. The second RMD must occur by Dec. 31, 2023.

For your first RMD, you would have divided $200,000 by your distribution factor (or life expectancy, as calculated by the IRS) of 17.2 to arrive at $11,627. You’d have until April 1, 2023 to withdraw at least $11,627 from your retirement account.

For your second RMD in 2023, you’ll need to divide your 2022 end-of-year account balance by your distribution factor at age 73, which is 16.4.

Even if you decided to take your first RMD on April 1, 2023, you’ll still need to take your second RMD by Dec. 31 of the same year.

It’s entirely possible that you’ll choose to take two RMDs in the year following your 72nd or 73rd birthday. You’ll need to consider a number of personal factors, including your total income for both years.

RMDs and tax planning

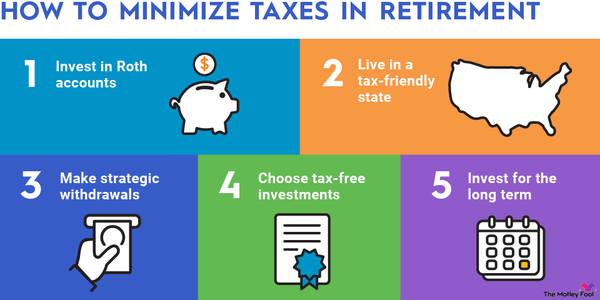

RMDs can be particularly pesky because they’re taxed at your highest ordinary tax rate upon withdrawal.

There isn’t any special tax treatment for RMDs -- unlike with dividends or capital gains -- so you’ll need to be extra careful in planning around RMDs.

Taking the required minimum distribution is mandatory and unavoidable, but taking beyond the minimum can make sense if you’re in an otherwise low-income year. Purposely liquidating big portions of your pre-tax retirement savings can be a tax-saving move if you don’t have enough total income to “fill up” the lower tax brackets.

On the flip side, if you’re a high-income earner (whether active or passive), it’s possible that taking too much from pre-tax retirement accounts can push your income into a higher tax bracket, leading to higher-than-necessary tax costs. Having too much income in retirement can also lead to greater taxation of Social Security, as well as increased Medicare premiums.

RMDs and penalties

If you failed to take your RMD on time in 2022 or previous tax years, you’ll be liable for a penalty of 50% of the amount you were supposed to withdraw. But the Secure Act 2.0 reduces that penalty to 25% beginning in 2023. The penalty drops to 10% for IRA owners who fail to take an RMD but correct their mistake in a timely manner.

This penalty would be levied in addition to the taxes you’ll owe on the missed RMD. Depending on your total tax picture, you may also owe interest. In other words, failing to take your RMD has major consequences.

Following the earlier example, failure to withdraw $11,627 in the first year you were responsible for RMDs would have resulted in a $5,813 penalty for 2022. But in 2023, the penalty would be half that, or $2,906.

It’s truly in your best interest to take all RMDs when they’re due and to consider them as a fixed piece of your tax planning process.

Related Investing Topics

Managing RMDs

RMDs are unavoidable, although you can manage around them if you’re diligent with your tax planning. Careful tax projections can help you determine if it’s a good year to withdraw more than your RMD amount, or if it’s better to simply take the minimum distribution.

The most important aspect of RMDs is that you take them when it’s time. Failure to do so can result in very costly penalties that can have the effect of undoing a portion of your retirement savings. For any saver, this is something worth avoiding.

As with any financial decision, you’ll need to consider your entire financial picture before making a planning decision involving RMDs since it’s rarely a good idea to look at any single account in isolation. If you devote a small amount of time to learning, you’ll have a solid handle on RMDs and how to work with them in the future.