Although bonds tend to be pretty safe investments, nothing in the world is guaranteed. And bond defaults aren't great for anybody. Read on to learn more about bond defaults and how they affect you as an investor.

What is a bond default?

What is a bond default?

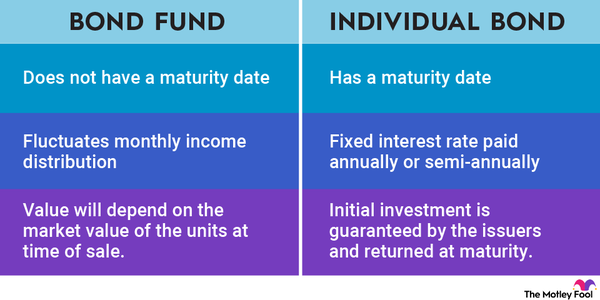

Bonds are a type of loan that an investor makes to a company. In return, the company pays back the principal, as well as interest. The interest can be paid when the bond matures, while the bond is held, or both.

When a bond defaults, it's due to at least one payment not being met. So, although a bond default sounds pretty terrifying, it could simply be a failure of a company to make a single interest payment, which it later catches up, or it could be as severe as the company failing to pay for bonds at maturity.

Bonds

How are bonds rated?

How are bonds rated?

When you buy bonds, you'll see that they each have a grade or a rating, which helps an investor understand the risk level for the bond. A bond with a higher bond rating is less likely to default but may pay less interest; one with a lower rating generally will offer better returns but be at greater risk of default.

Independent firms like Standard & Poor's (S&P), Fitch Ratings, and Moody's are among the companies that grade bonds. Each has its own system and standards, although they often align fairly closely. Bonds can experience grade changes over time, as well, which is certainly something an investor should monitor. An improvement in the grade is great, but a downgrade is not.

Signs of bond default risk

Signs of bond default risk

Knowing for sure that your bond is going to default would take a crystal ball, but there are a few signs that a bond may be getting close to a default.

- Low interest coverage ratios. The interest coverage ratio is an estimate of a company's ability to pay interest on a debt. You'll want to look at the interest coverage ratio compared to other companies in the same industry. If your company is trending higher than others, there may be a risk of default.

- Cash flow problems. Money to make the interest payments has to come from somewhere, and that's typically the cash flow. If the company is experiencing shrinking cash flow -- or worse, negative cash flow -- it may be in serious trouble.

- A declining bond rating. If the bond's rating starts to drop with no plan from the company to correct the conditions causing the drop, it's not a good thing. Sometimes, a company can recover from a fallen bond rating, but many will eventually file for bankruptcy.

Related investing topics

How to protect against bond defaults

How to protect against bond defaults

A bond default is obviously not a great thing for an investor and may cause you to lose a substantial amount of money. Even though bondholders are paid before stockholders in a bankruptcy proceeding, bond investors don't have priority and may still not come out great.

But you can protect against bond defaults by choosing bonds with great care. The safest bonds have high credit ratings across the board and tend to be issued by municipalities rather than companies. So, if you're looking at two different AA bonds, and one is to help fund a company, and the other is to pay for a bridge in Miami, the bridge is always the safer bet.

You can protect yourself even more by paying close attention to the bond and how the issuer is behaving. Monitor earnings, watch the news for signs of trouble, and keep a close eye on how those ratings are moving. If they're holding steady or increasing, all is well. If they're starting to slip, it's time to consider selling.