A bond fund is an investment vehicle that pools capital from multiple investors to buy a portfolio of bonds or other debt instruments. Bond funds are often a more efficient way for individual investors to gain exposure to the asset class than buying individual securities, with the added value of better diversification.

There are many different considerations when investing in bond funds, from the type of bond fund to choose, to the pros and cons of buying bond funds versus buying individual bonds. You’ll also need to understand how to compare the performance of bond funds. This article will cover everything you need to know.

Understanding bond funds

Understanding bond funds

A bond fund is similar to a stock mutual fund. Instead of buying stocks, however, the fund manager buys bonds or other debt instruments to meet the fund’s objective.

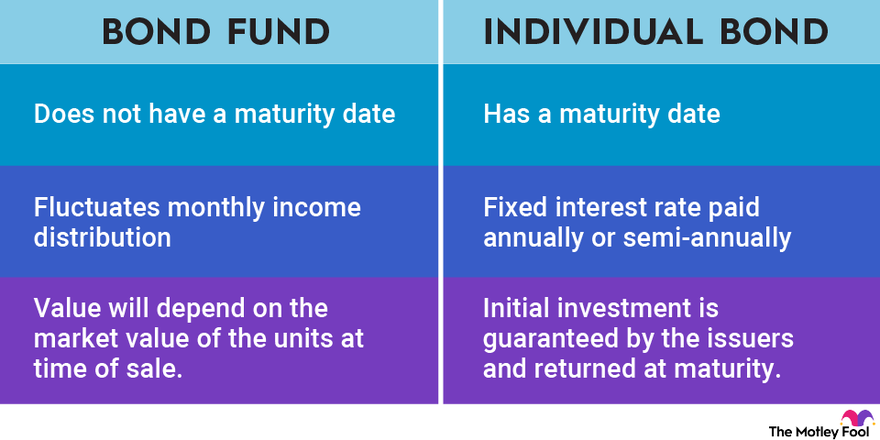

Fund managers will rarely hold bonds until maturity. Instead, they’ll buy and sell bonds more frequently to maintain maturities within the bounds outlined by the bond fund. If a bond fund aims to invest in government Treasury bonds maturing in seven to 10 years, the manager will sell bonds maturing sooner to maintain an average maturity in the portfolio between seven and 10 years.

Bond funds pay out interest to their shareholders. Payments are typically made monthly, but they can fluctuate from month to month based on the bonds in the fund portfolio.

To pay for the fund manager and other operating costs of the bond fund, investors have to pay some fees. Most bond funds charge an expense ratio, a fee based on the amount of assets invested with the fund. Some will charge a sales fee or redemption fee paid at the time of purchase or sale, respectively. Some charge a flat annual fee.

Types

Types of bond funds

There are bond funds for just about any type of bond you might want. Types range from the safest government bonds to the riskiest junk bonds, which offer relatively high yields.

Here are the main types of bond funds you’ll find:

- U.S. Treasury funds: These funds come in short-, medium-, and long-term styles. Short-term funds are usually classified as holding Treasuries that mature in one to five years, medium-term funds mature in five to 10 years, and long-term funds hold government bonds maturing in more than 10 years. Treasury funds may also invest in Treasury Inflation-Protected Securities, or TIPS.

- Municipal bond funds: Some funds invest in municipal bonds, also called munis. One special characteristic of municipal bonds is that the interest is exempt from federal tax. On top of that, many states also exempt the interest paid by bonds sold by municipalities in that state. So you might buy a municipal bond fund that only invests in munis from your state.

- Corporate bond funds: Many companies issue bonds as an alternative to selling stock to fund their growth. Corporate bond funds will invest in those bonds. Some may stick to corporations with a threshold credit rating. A higher credit rating comes with a lower interest rate, but the risk of losing principal is less. Some bond funds specialize in junk bonds, or bonds issued by corporations with low credit ratings. These have higher coupon rates, but they also come with more risk.

- Emerging market funds: Emerging market bond funds invest in bonds issued by governments and government-owned entities in emerging markets.

- Global funds: Global funds invest in bonds issued by governments and government-owned entities in developed markets outside of the United States. Both global funds and emerging market funds can provide geographic diversification for investors.

- Mortgage-backed securities funds: A mortgage-backed security, or MBS, is created by packaging illiquid mortgages into a single security. These securities are supported by the mortgages behind them and are packaged based on the credit attached to the individual loans. They can offer better interest rates than government bonds with more safety than corporate bonds since most people will do a whole lot before they default on their home mortgage.

You can also invest in a multi-asset class fund, which will invest across various types of bonds. This can be useful for gaining general exposure to the bond market at a low cost.

Pros and cons

Pros and cons of bond funds

| Pros | Cons |

|---|---|

| You can invest in lots of different bonds at once to spread out your risk. | Management fees and sales fees. |

| Bond funds are typically easier to buy and sell than individual bonds. | Less predictable future market value. |

| Monthly income. | No control over capital gains and cost basis. |

| Low minimum investment. | |

| Automatically reinvest interest payments. |

Measuring performance

Measuring bond fund performance

There are several important performance measurements for bond fund investors to keep in mind when comparing various funds and assessing their portfolio.

First, there’s the net asset value, or NAV. Net asset value is the value of the entire portfolio of bonds divided by the number of shares of the mutual fund. This is what determines the price of a bond fund. Ideally, the NAV for your funds increases over time.

But bonds also pay out interest on a regular basis, so you’ll also want to consider the yield of a bond fund. Most funds display the 30-day annualized yield for their portfolio, which is the average yield of all bonds it holds over the past 30 days. That yield may increase or decrease based on the market.

Importantly, some bonds’ interest payments are exempt from federal taxation and others are exempt from state taxes; some may be exempt from both. As such, you may want to calculate the tax-equivalent yield, which considers the required yield if the taxable gains were equivalent to the tax-free yield. This will vary depending on the investor’s state and income.

Putting it all together, you can calculate the total return of a bond fund. Total return considers interest payments and changes in NAV over a set period. This is the best measure of bond fund performance, especially since they’re often used for income generation and not capital appreciation.

Related investing topics

The bottom line on bond funds

Investors looking to add bonds to diversify their portfolio will do well with a bond fund. Not only is buying a bond fund easier than buying a portfolio of individual bonds, but it’s often less expensive when you factor in the commissions and costs associated with buying individual securities. The ability to buy a bond fund and keep your assets there without having to reinvest once your bonds reach maturity also makes it the simplest route to bond investing for most individuals.

FAQs

Bond Fund FAQs

What’s the difference between bonds and bond funds?

A bond is an individual security backed by a single entity such as a government or company. When you buy a bond, you’re lending money to the issuer at a fixed interest rate described by the bond. Therefore, you’re locking in an interest rate and hoping a single entity won’t default. A bond fund pools investor money to buy a large diversified group of bonds, often from multiple entities, reducing risk.

How are bond ETFs different from bond funds?

A bond ETF typically seeks to track a certain index by buying bonds with the same characteristics as those tracked by the index. A bond fund may be actively managed, with a manager seeking the best bonds available within the fund’s mandated criteria. An ETF, or exchange-traded fund, is traded on an exchange, similar to a stock. Shares trade hands throughout the trading day, and every seller needs a buyer. Conversely, bond funds trade hands at the end of the trading day after determining the NAV. The mutual fund company will issue or retire shares as needed, so liquidity isn’t a concern for individual investors.

What does fixed income investment mean?

A fixed income investment is a financial instrument or security that pays a fixed rate until maturity. Bonds are an example of a fixed income investment because the coupon rate on an individual bond never changes regardless of other economic factors like inflation.