A convertible bond is a type of debt security that allows investors to exchange their bonds for a specific number of common shares. Convertible bonds can be a good addition to a diversified portfolio, but they come with unique terminology and calculations. Here, we’ll define convertible bonds and explain the different types, as well as the pros and cons of owning them. We’ll also answer some frequently asked questions about convertible bonds.

Understanding convertible bonds

Understanding convertible bonds

Convertible bonds are fixed income securities that can be converted into common stock shares. (Sometimes they’re just called “convertibles.”) This conversion can take place at the discretion of the investor, i.e., the bondholder, or it may be mandatory. Conversion can happen at various times over the bond’s life.

Convertibles provide an interesting option to bondholders if the corporation’s equity shares significantly increase in price.

A convertible bond’s conversion price is specified in the bond’s indenture agreement, which is released at bond origination. The conversion price is the price at which an investor can convert their bond into stock shares. It’s typically set higher than the current equity share price.

A convertible bond’s conversion ratio is the number of stock shares an investor will receive should they choose to convert their bond. A bond with a face value of $1,000 and a conversion price of $20 has a conversion ratio of 50, meaning it could be exchanged for 50 stock shares.

Types of convertible bonds

Types of convertible bonds

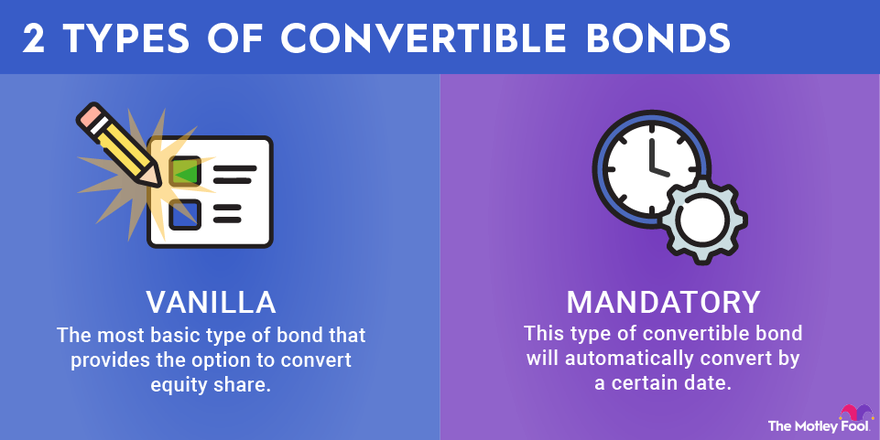

There are a few different types of convertible bonds to review, including the vanilla convertible bond and the mandatory convertible bond.

- A vanilla convertible bond is a standard convertible bond. An investor can either hold the bond to maturity and receive the bond’s face value, or they can convert it to equity shares and benefit from a rise in the issuer’s stock price. Vanilla convertible bonds offer a lower yield to investors because they also provide the option, but not the obligation, to convert to equity shares.

- A mandatory convertible bond functions as advertised: An investor’s bonds will automatically convert by a certain date specified in the bond’s indenture agreement. With mandatory convertibles, the investor earns a higher return prior to mandatory conversion. After conversion, returns could be higher or lower, depending on the issuer’s equity performance.

Pros and cons

Pros and cons of convertible bonds

Owning convertible bonds comes with various advantages and disadvantages. Here are the basic pros and cons:

Pros of convertible bonds

- Optionality: Given uncertain bond and equity prices, many investors like the idea of being in control. If equity prices rise past the conversion price, an investor holding a convertible bond can exchange their bonds for common shares and earn a profit.

- Guaranteed income: Although it may not be a tremendous amount of income, convertible bonds do provide guaranteed income nonetheless. In volatile equity markets, guaranteed income streams are all the more valuable.

- Higher upside than corporate bonds: Even though convertible bonds will offer a lower yield than corporates at bond origination, they have the potential to more than make up for the difference upon conversion to common shares.

- Protection from issuer default: If the bond hasn’t yet been converted, a convertible bondholder will be paid before common stockholders if the issuer defaults. Priority in liquidation can be an important feature in the event of unexpected financial trouble.

- Diversification benefit: Hybrid securities such as convertibles (as well as preferred stocks) offer an added diversification benefit to a portfolio of standard stock and bond investments.

Cons of convertible bonds

- Low yields: Relative to other corporate bonds, convertible bonds will offer a lower yield along with a conversion option. If the issuer’s stock price never reaches the conversion price, the investor may instead hold the bond until maturity at a lower yield.

- Increased portfolio complexity: Retail investors may not have the inclination to add hybrid securities to a basic portfolio. If keeping things simple is a priority, convertible bonds may not be a good option.

- Riskier than corporate bonds: Should the issuer enter bankruptcy, convertible bondholders will be paid back after most other classes of debt, including corporates.

- High correlation to equity markets. Intermediate price movements within convertible bond security markets are highly correlated to stock prices, which may remove some of the advertised diversification benefit. Convertibles trading at or near their conversion price will display higher volatility.

- Less liquid than other bond classes: Convertible bonds may trade in markets with greater bid-ask spreads, and as a result, less liquidity. Selling large blocks of convertible securities may be difficult to do without receiving a lower price for certain tranches.

Example

Example

Say an investor were to purchase a convertible bond with a face value of $1,000 and a coupon rate of 2%. As long as the investor holds the bond, they’ll receive a coupon payment of $20 annually, or $10 semi-annually. The investor, while guaranteed a modest stream of income, is likely to have purchased the bond not for the interest payments but for a potential rise in the issuer’s equity share price.

Imagine that, at the same time, the investor is also able to convert the bond to equity shares at a conversion price of $15. This implies a conversion ratio of 66.67 ($1,000/$15). In other words, if the investor chooses to convert the bond to equity shares, they’d receive 66 shares (plus a fraction) in exchange.

It will only make sense for the investor to convert the bond to stock shares if the market price of the issuer’s equity exceeds the conversion price. If the price is less than the conversion price, converting the bond will result in a loss; above the conversion price, the investor will see unrealized profit. Unless the bond is a mandatory convertible bond, there is no guarantee that the investor will ever convert the bond.

Related investing topics

The bottom line on convertible bonds

Convertible bonds are unique securities that can play a role in an investor’s diversified portfolio. Convertibles are usually appealing to investors who are willing to accept lower returns in the short run in the hope of striking it big down the line. From a company’s perspective, convertible bond issuances are a way of lowering its cost of debt in a tax-efficient manner.

As with any investment, there is a risk of loss with convertible bonds. Before investing, be sure to understand what you’re signing up for, and realize that losses are possible. If the risks are worth the rewards in your scenario, convertible bonds might be worth a second look.

Convertible Bonds FAQs

What is a forced conversion?

A forced conversion happens when a bond issuer mandates conversion of its hybrid securities. This is more likely to happen if the issuer’s equity price hasn’t yet reached its conversion price. After all, most convertible bondholders would convert on their own if the conversion price had been met.

A forced conversion can throw off your plans and expectations as a convertible bondholder, so it’s vital to know if forced conversions are permitted in the bond’s indenture agreement.

Can you lose money on convertible bonds?

Absolutely. This can happen in a variety of ways, but the most direct way would be if the issuing company were to declare bankruptcy or enter involuntary liquidation. Convertible bondholders will recover their investment after corporate bondholders but before common stockholders.

Next, convertible bond prices will move with stock price and/or interest rate movements. Prices can be volatile, and convertible bonds trade in relatively illiquid markets.

Like with most stock and bond investments, principal is at risk if any one of a variety of events take place.

Who can issue convertible bonds?

Any company looking to finance operations through debt can theoretically issue convertible bonds. Convertibles allow a company to pay a lower rate of interest on its debt and still receive tax-deductible debt financing.

Start-ups that have yet to meaningfully increase their revenue -- and also have yet to develop a strong credit rating -- might be ideal candidates to issue convertible bonds. Issuing convertibles offers investors an opportunity to participate in big upside should the company take off in the future.