Investing your money can make your future bright, but how you invest your money matters, too. If you've been looking for something with a lot of potential upside but without a lot of work involved, a growth fund might be for you.

What is a growth fund?

What is a growth fund?

A growth fund is a mutual fund or exchange-traded fund (ETF) that's made up entirely of growth stocks. These are stocks that are gaining at faster-than-average rates and are expected to continue to do so into the future. Often, these are tech-driven stocks, or stocks that are involved in cutting-edge industries, like biotechnology, but they may also simply be innovators in their own spaces.

Growth funds are generally grouped by size: Small-cap, mid-cap, and large-cap. Choosing a market capitalization category can act as a proxy for choosing your risk level. Small-cap growth stocks and their growth funds are by far the most risky; large-cap stocks (and their funds) are the least risky. All growth stocks carry more risk than other types of stocks, however.

Growth vs. blend funds

Growth funds vs. blend funds

Growth funds are funds made up exclusively of growth stocks, giving them enormous potential. There's also a great deal of risk with growth funds since there's nothing to really balance them out, which explains why a lot of people generally steer clear of growth stocks and growth funds.

However, if you're interested in growth funds but want to temper the risk some, blend funds can help you do that. Instead of being all growth stocks, blend funds balance growth stocks with value stocks, which can help to keep your portfolio more balanced. Both carry different types of risk, but having your money spread across many different kinds of companies can also help protect it against loss.

Who invests in them?

Who invests in a growth fund?

Growth funds are really for anyone who has money to lose and is looking to earn a substantial gain without doing a ton of legwork. The stocks are already pre-selected by professional investors, meaning you only have to look at individual funds and the limited stocks included when choosing your investment.

These investments can be quite volatile, so people who buy growth funds are usually people who are at a stable point with their investments -- perhaps with a firm base in some fairly conservative assets -- but aren't close to retirement yet. It can take five to 10 years to really see how a growth stock plays out, so you need a long time horizon to fully assess these investments.

Related investing topics

Pros and cons

Growth fund pros and cons

Like other types of funds, the pros and cons of growth funds depend on your perspective. Issues to consider include:

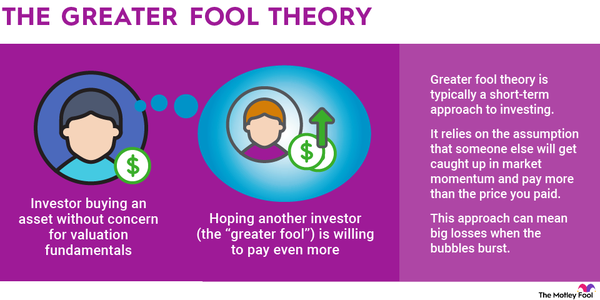

- Volatility. Growth funds are much more volatile than many other types of funds. For investors who are looking for high-risk, high-reward investments, growth stocks absolutely fit the bill. But the risk of an investment in them is often unacceptable to people who are approaching retirement or who simply want to protect their income.

- Low to no dividend payouts. If you're looking for an investment that will provide a trickle of income, growth funds aren't it. Growth stocks tend to be companies that will take every last cent and roll it back into the company, often into research and development to help the company grow faster. However, if you're OK with waiting for the return to come as a massive growth in stock prices once the company's product hits, the dividends won't really matter.

- Long-time horizons. Again, growth stocks tend to be really young companies that may need many, many years to deliver on their promises. This means that you have to buy and hold growth stocks and growth funds, making them less than ideal for someone who is seeking a quick gain in their portfolio's value. Growth funds are best for people who are perfectly comfortable with high risk over the long term, which is a pretty narrow group of investors.