Money market funds are mutual funds that invest in short-term, low-risk securities such as certificates of deposit, municipal bonds, and U.S. Treasury bonds. Read on to learn more about these funds and how they can be part of your portfolio.

Understanding money market funds

Understanding money market funds

One of the surest signs of an impending recession is an inverted yield curve, which occurs when short-term interest rates are higher than long-term rates. Recessions often prompt investors to look for safe havens for their money, and there aren't many investments safer than money market funds that invest in low-risk, short-term securities such as certificates of deposit, municipal bonds, and U.S. Treasury bonds.

A money market fund is a type of mutual fund, which means it makes investments in securities for a group of investors who buy shares in the fund. The fund is managed professionally and designed to generate income for its investors through dividends.

Gains on investments in money market funds are generally minimal, about on par with bank savings accounts. When inflation is rising, and short-term interest rates are higher than long-term rates, however, an investment in a money market fund can be a smart and safe way to increase your portfolio's value in the short term.

Types

Types of money market funds

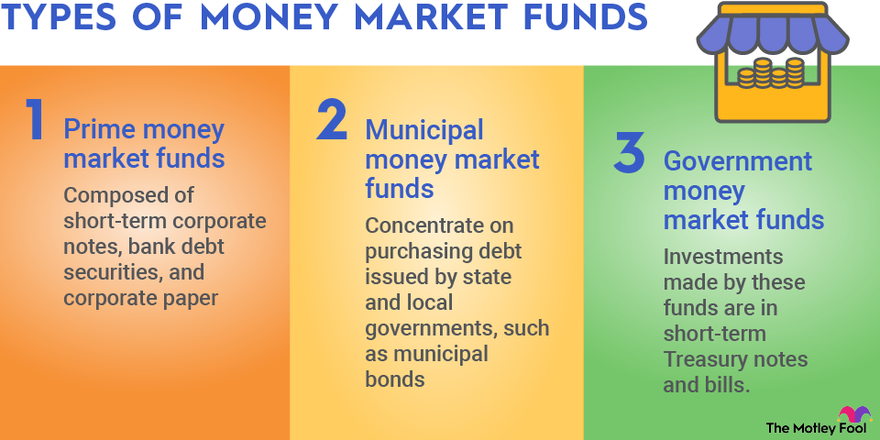

There are three main types of money market funds:

- Prime money market funds: These funds are generally the riskiest types of money market funds -- yet they’re still considered extremely safe. Generally, they’re composed of short-term corporate notes, bank debt securities, and corporate paper, which consists of low-risk, short-term debt issued by companies with excellent credit ratings.

- Municipal money market funds: These funds concentrate on purchasing debt issued by state and local governments, such as municipal bonds. Municipal money market funds are also considered extraordinarily safe, as the odds of default are very slim. Returns on investments in state and local government debt are frequently exempt from federal taxes.

- Government money market funds: Almost all of the investments made by these funds are in short-term Treasury notes and bills. Because they’re backed by the federal government, they’re considered to be the safest form of short-term government debt.

Pros and cons

Pros and cons of money market funds

As with any other investment, there are pros and cons of money market funds. Advantages include:

- Stability: Because of their short duration, money market funds are among the most stable and least volatile investments in an investor’s portfolio.

- Liquidity: Investors usually can retrieve funds from a money market fund within a day.

- Security: Federal regulations require money market funds to invest in short-term, low-risk investments.

- Short terms: Because of their short windows, interest rate changes aren’t as likely to affect money market fund investments.

- Diversification: Money market funds generally hold multiple types of short-term debt.

- Tax advantages: Many securities held by money market funds can be exempt from federal or state taxes.

- Potential downsides include:

- Returns: Because of their conservative investments and short terms, money market fund investments typically offer lower returns than more volatile opportunities, such as stocks and bonds.

- Insurance: Amounts invested in money market funds are not insured by the Federal Deposit Insurance Corp., although the risk of default is quite low.

Related investing topics

General tips

General money market fund tips

Like any other investment, money market funds should only be one part of a balanced portfolio that includes longer-term investments with the potential for greater profits, such as stocks and bonds. Investors should be aware of interest rate trends and projections to ensure they’re not missing short-term opportunities.

Investors should also be aware of the expense ratios for a money market fund. High expense ratios can cut into investor profits, especially in a low-interest rate environment. The expense ratio for the typical mutual fund declined to 0.12% in 2021, meaning you’ll pay $12 annually for every $10,000 invested in a fund.

It’s important to research a money market fund before investing. The best source is generally a prospectus that outlines the fund’s strategy, past performance, management, and financial information. The prospectus will also offer valuable information about any expenses and fees.

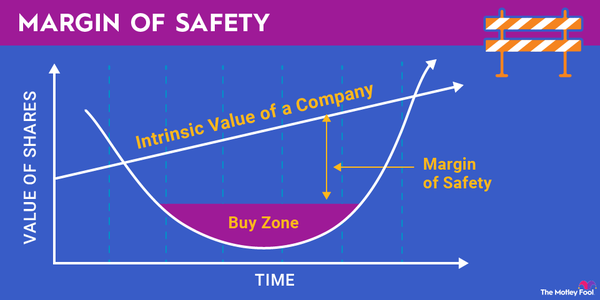

There’s a place for money market funds in a number of portfolios, especially for investors who need a low-risk, short-term place to park money. But smart investors will follow a long-term, buy-and-hold strategy that focuses on companies with strong financial fundamentals, competitive advantages, and a bright future.