Emerging market funds are investment funds that focus on developing countries. These nations are undergoing an economic transition that often results in higher growth than developed countries. Investors can sometimes earn higher returns by investing in an emerging market fund.

Understanding emerging market funds

Understanding emerging market funds

An emerging market fund is typically an exchange-traded fund (ETF) or mutual fund that invests the majority of its assets in securities (debt or equity) from countries classified as developing or emerging market economies. Those countries include:

- Americas region: Brazil, Chile, Colombia, Mexico, and Peru.

- Europe, Middle East, and Africa (EMEA): Egypt, Russia, South Africa, and Turkey.

- Asia: China, India, Indonesia, Malaysia, Pakistan, Philippines, and Thailand.

EMF types

Emerging market fund types

Investors have a growing number of emerging market fund options. They typically fall into the following investment approaches:

- Actively managed funds: Experienced investment managers select stocks they believe can deliver superior performance.

- Indexed funds: These passively managed funds aim to deliver returns that match an emerging market index.

- Regional or country-specific funds: These funds, which can be active or passively managed, focus on a specific emerging market region (e.g., Americas, Middle East/Africa, or Asia) or a specific emerging market county (e.g., China or India).

- Thematic-focused funds: These funds focus on a specific investment theme within emerging markets. Examples of thematic emerging market funds include those focused on small-cap stocks, high-dividend stocks, or internet stocks within a particular country or across emerging markets.

Emerging market funds typically focus on investing in the equities of emerging market companies or debt from those companies or countries.

Potential benefits

Potential emerging market investing benefits

Investing in emerging market funds has several advantages. These include:

- Diversification: Adding some international exposure can help an investor build a more diversified portfolio. That can help reduce their overall volatility and risk. Meanwhile, emerging market funds have built-in diversification benefits because many hold several investments.

- Opportunity: According to the International Monetary Fund, emerging and developing countries accounted for almost 80% of global economic growth in recent years, so investing in an emerging market fund can potentially increase an investor’s returns. The stocks in the funds could grow their revenue and earnings faster than those in developed markets and produce higher returns than the S&P 500, for example, which is the 500 biggest publicly traded companies in the U.S.

- Valuation: Fewer investors focus on emerging markets. Fund managers focused on those markets can often identify potential opportunities where companies in an emerging market trade at a low valuation compared to their growth prospects, allowing those stocks to generate even higher returns over the long term.

Related investing topics

Examples

Emerging market fund examples

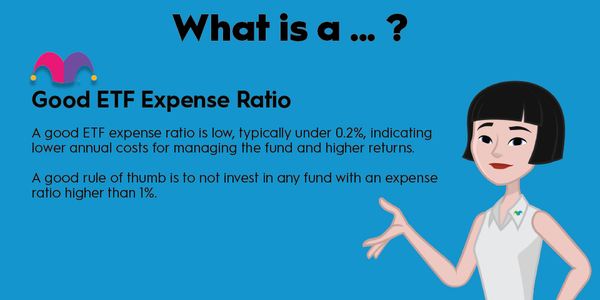

Many ETFs provide investors with the opportunity to invest in emerging markets. The Vanguard FTSE Emerging Market ETF (VWO 0.86%) is one of the biggest. It had almost $72 billion in total assets under management (AUM) as of mid-2023. The passively managed fund aims to deliver returns that closely match the FTSE Emerging Markets All Cap China A Inclusion index. The fund had more than 5,000 holdings across all emerging markets. It charges investors a very low ETF expense ratio (0.08%) to add some emerging market exposure to their portfolio.

The WisdomTree Emerging Markets High Dividend Fund (DEM 0.12%) is a thematic fund focused on investing in emerging market stocks with high dividend yields. The fund held more than 400 stocks in mid-2023 across several emerging markets. Although the fund had a relatively higher ETF expense ratio (0.63%), it paid a high dividend yield (around 7% in mid-2023 compared to 1.5% for the S&P 500), making it a potentially attractive option for income-seeking investors who want to add some international diversification to their portfolios.