Enterprise value is an important term to understand in stock investing. Many investors are familiar with market capitalization when considering how big a company is, its size relative to the industry it participates in, and the value of its stock.

Enterprise value, on the other hand, is often used in valuing a company for merger and acquisition purposes. It paints a much broader picture of how a company is structured, but it's an often overlooked calculation.

What is enterprise value?

Market cap is frequently used to determine how big a company is. Calculating the market cap is simple: Multiply the share price by the total number of shares outstanding (the number of shares of common stock a company has issued to investors).

Enterprise value takes the calculation a step further and includes total cash and debt in the market cap formula. This can help an investor determine the true value of a business compared to other firms in the same industry and with similar capital structures (that is, how a firm uses equity versus debt when it needs to raise cash). It can also show a company's overall financial health compared to its competitors.

How to calculate enterprise value

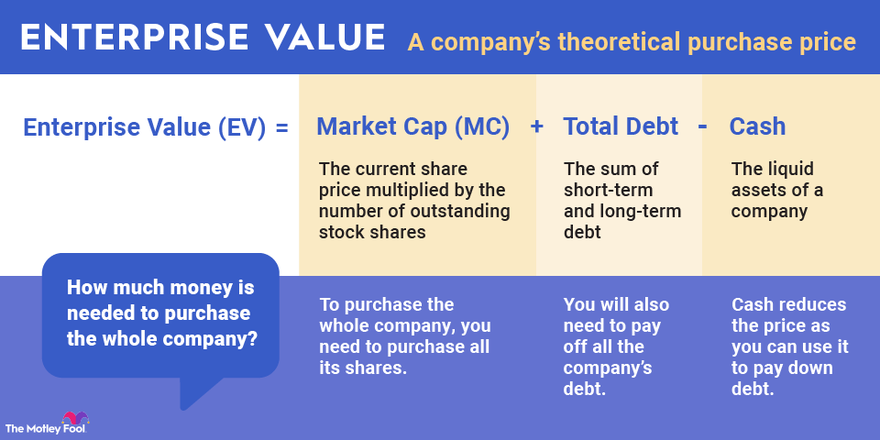

The formula for calculating enterprise value (EV) is as follows:

- EV = MC + Total Debt-Cash

MC is market cap (the current share price multiplied by total shares outstanding). Total debt includes both short- and long-term debt and borrowings. Cash is all liquidity available to a company, including short-term cash equivalents but excluding long-term marketable securities.

Here is an example of how to calculate enterprise value using Tesla (TSLA -5.59%). Based on the company's share price on Sept. 20, 2021, and number of shares outstanding at the end of the second quarter of 2021, Tesla's market cap stood at $730 billion. At the end of the second quarter, the company reported total debt of $9.4 billion and cash and equivalents of $16.2 billion. Tesla's enterprise value can be calculated as follows:

- EV = $730 billion + $9.4 billion-$16.2 billion = $723 billion

Importance of enterprise value

Enterprise value is used when a company is being acquired because the acquiring firm will need to assume the debt of its targeted purchase. But it also gets to add the cash to its own balance sheet, which is why you add debt but subtract cash in the calculation.

For investors, though, enterprise value is a great tool in determining the actual size of a company, along with factoring in how the business has made use of debt. For example, some high-growth tech stocks may look overpriced when you only use market cap. But when you factor in that they have little to no debt and subtract a large balance of cash, the enterprise value may show a drastically different valuation than basic market cap.

Enterprise value vs. market cap

Enterprise value becomes useful since it can reveal the true value of a company based on how it has funded its operations over the years. For example, when comparing GM (GM -0.91%) and Ford's (F -3.01%) market caps of $71 billion and $51 billion, respectively, to Tesla's $730 billion, there would seem to be an incredibly wide disconnect between these U.S. automakers' valuations, especially considering that Tesla sells far fewer vehicles than its two older peers. However, when you add GM and Ford's substantial debt, it reveals the automakers aren't quite as relatively small as they appear on the surface.

| Company | Market Cap | Total Debt | Total Cash | Enterprise Value |

|---|---|---|---|---|

| Tesla (NASDAQ:TSLA) | $730 billion | $9.4 billion | $16 billion | $723 billion |

| GM (NYSE:GM) | $71 billion | $111 billion (including $94 billion from GM Financial financing services) | $23 billion | $159 billion |

| Ford (NYSE:F) | $51 billion | $162 billion (including $138 billion from Ford Credit financing services) | $25 billion | $188 billion |

There's still a big disparity between the legacy automakers' enterprise values and that of Tesla. However, GM and Ford aren't growth companies, they have lower gross profit margins on products and services sold than Tesla, and they have sizable burdens of debt. This, at least in part, can help explain why some tech growth companies trade for such high premiums compared to their older competitors.

Limitations of using enterprise value

When determining a good stock to buy, EV works best when comparing two companies at similar stages in their business cycle. GM and Ford are both value stocks and are better compared to each other using enterprise value when determining which is a better buy.

But when comparing a young company that's still in growth mode, EV will have limited usefulness in determining how "cheap" it is relative to older peers since younger companies tend to have stronger growth and far less debt.

Comparing companies from two different industries is also problematic for the EV method. For example, a software company may have little need to take on debt for the purchase of property and equipment. By contrast, an energy company's cost on property and equipment tends to be very high. Thus, debt financing is often a necessary ingredient when cooking up a growth strategy.

Related investing topics

How to use enterprise value

Despite its limitations, enterprise value is a great way to determine the true size and worth of a business. It can also reveal potential risks if a company has primarily funded its operations with debt and if its indebtedness relative to cash on hand is far greater than its peers within the same industry.

When determining how profitable a firm is, EV can shed more light on a firm's ability to generate earnings relative to the assets and liabilities it has on its balance sheet versus just using market cap or share price in basic earnings per share calculations.

Related: Learn about fair market value.