The Financial Industry Regulatory Authority (FINRA) is a behind-the-scenes regulator that governs many of the interactions you have with financial institutions. Brokers, financial advisors, investment bankers, and research analysts are all regulated by the authority in one way or another.

How did FINRA come about, and how does it affect you today? We'll answer that and more below.

Understanding FINRA

FINRA governs brokers and broker-dealer firms -- government lingo for financial institutions. Any institution that you use for a brokerage account or that a business uses to go public or sell securities is governed by FINRA.

Although it acts as a governor of the industry, FINRA is a non-governmental organization. It is an independent regulatory body financial institutions must register with. The Securities and Exchange Commission (SEC) has given it the authority to discipline financial institutions with fines and other measures.

FINRA exists to protect investors in the following ways:

- Makes sure all security products have been tested and qualified: FINRA-registered brokers can only sell investment products that have been reviewed and approved by the agency.

- Makes sure securities advertisements are truthful and not misleading: You may have noticed the seemingly endless fine print in all financial advertising. FINRA sets and enforces those guidelines.

- Makes sure securities products sold to investors are suitable for their needs: Brokers who sell volatile penny stocks to retirees or expensive annuities to college students will run afoul of FINRA.

- Makes sure investors receive complete disclosure for products before investing: Potential risk and a complete rundown of historical returns must be disclosed to investors.

FINRA handles these responsibilities by enforcing its rules and educating investors, thereby affecting both sides of security transactions.

Client-facing employees of broker-dealers are required to be licensed through FINRA. This is done by passing one of its "Series" Exams. The most famous exam is the Series 7, but it is likely any representative you deal with personally has also passed at least the Series 66 and possibly several other exams. More than 600,000 people are currently registered with FINRA to be client-facing representatives of a broker-dealer.

Additionally, FINRA has 3,600 employees currently working to detect fraud and discipline wrongdoers. According to its website, FINRA processes 37 billion transactions each day to monitor U.S. markets.

On the investor education side, FINRA's website offers tools to learn how to invest, calculators for analyzing investments, and BrokerCheck, a tool you can use to check the background of every individual registered.

History of FINRA

FINRA was created in 2007 when the SEC approved the combination of the National Association of Securities Dealers (NASD) and the regulatory operations of the New York Stock Exchange (NYSE).

NASD was founded in 1939 to prevent stock exchange abuse, and it eventually founded the NASDAQ stock exchange in 1971. The NASD was the main regulatory authority for broker-dealers and spun off the NASDAQ in 2000. In 2007, the SEC approved its merger with the NYSE's regulatory operations to create FINRA.

Benefits of FINRA

The clear benefit of FINRA is that it discourages fraud among financial institutions. Giving investors confidence in both markets and institutions is beneficial to both sides. Investors have the benefit of knowing it is unlikely they will experience fraud, and, if they do, there will be discipline. Institutions have the benefit of knowing they can compete fairly with other firms, and there will be increased demand for their services.

FINRA's exams ensure that anyone licensed to sell securities to investors has more than a basic knowledge of financial products. Its enforcement branch reviews market transactions to make sure they aren't fraudulent, and its investor education website allows investors to review the histories of potential financial advisors.

Drawbacks of FINRA

There are those who think FINRA doesn't go far enough, and that financial institutions will never be fully trustworthy without a true government regulatory authority.

There are also FINRA detractors who believe the existing bureaucracy goes too far. For example, they ask why it's necessary for a financial advisor wishing to advise clients on stock investments to learn about arcane broker-dealer regulations and life insurance policy features.

As with any regulatory authority, there will always be special interests on both sides, with some people wanting more government involvement and some wanting less regulation. It's important to note that the U.S. is one of a few countries where investors can reliably work with just about anyone registered by the authority and not have to worry about fraud.

FINRA versus the SEC

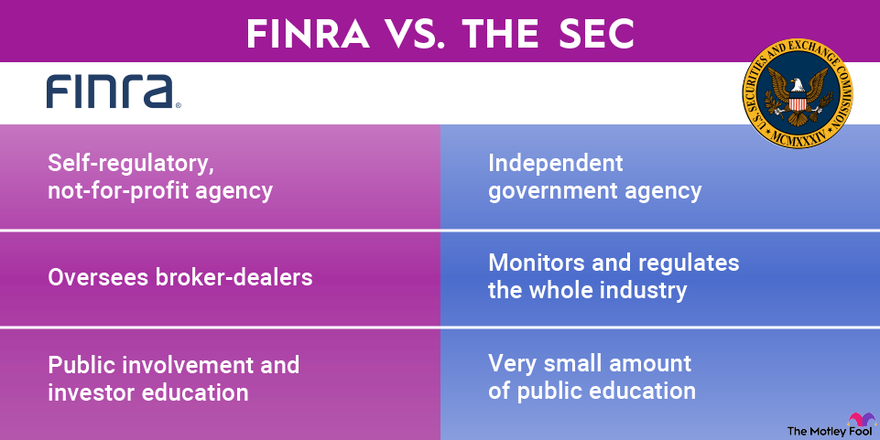

FINRA and the SEC have similar functions but are different. Here's an outline of the main differences between the two.

Type of organization

FINRA is a self-regulatory, not-for-profit agency. The SEC is an independent government agency that was formed in 1934.

Main duties

Where FINRA's main duty is to oversee broker-dealers, the SEC is charged with monitoring and regulating the entire industry. It oversees the listing of securities and regulates the filings of securities issuers.

Other responsibilities

FINRA's other responsibility is public involvement and education of investors. It does this through the tools and educational resources on its website and with BrokerCheck.

The SEC also educates investors through its Investor.gov website, but this responsibility is far down the list of everything it does to enforce security law.

Related investing topics

The bottom line

FINRA isn't an entity that you'll likely come into contact with often as an individual investor, but it's working in the background to ensure that your transactions are trustworthy. If you're working with a new broker or financial advisor, make sure to use the website to check out their background, and don't be afraid to pass anytime you suspect wrongdoing.