Investment banking refers to a broad range of financial services that mostly involve raising capital and providing advice for corporations, governments, and high-net-worth individuals. Transactions involving the capital markets are often complex and full of regulatory hurdles to navigate, so corporations and other organizations often hire investment banks to help facilitate them.

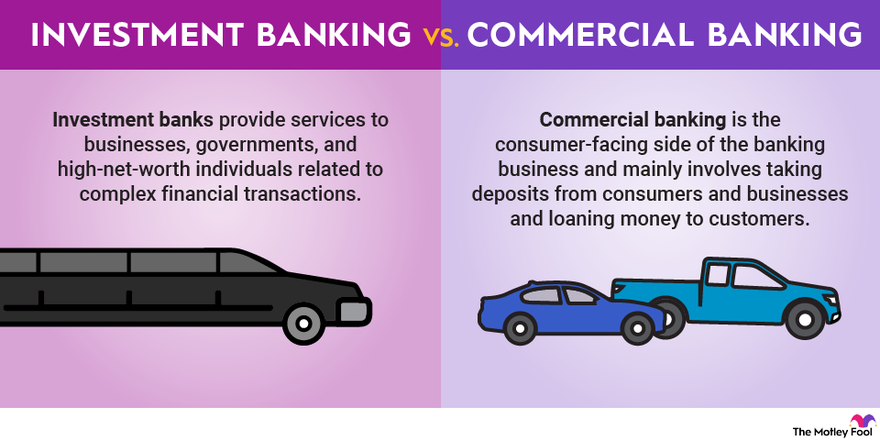

Investment banking is very different from consumer, or commercial banking, which is what most people think of as “banking,” so as investors, it’s important to understand the distinction.

Understanding investment banking

Investment banking is a broad term that refers to several different services that can be performed by financial institutions. Most investment banking activities fall into one of two categories: mergers and acquisitions (M&A) and corporate financing.

On the M&A side, investment banks advise corporations when it comes to acquiring other businesses or merging with them. Although the exact services provided can vary, investment bankers can provide valuation calculations, assist with negotiations, and provide “fairness opinions” on a transaction.

With corporate financing, businesses have two main ways of raising capital. They can take on debt, such as through a bond offering, or they can issue equity, either in the form of an initial public offering (IPO) or a secondary offering. In both cases, investment banks help facilitate the process.

For example, when a company decides to go public through an IPO, investment bankers act as an intermediary between the company and investors to sell its initial set of shares (a process known as underwriting). Investment bankers will determine the initial offering price, ensure that the IPO is compliant with all regulatory requirements, and purchase the shares from the company to sell to the public.

In addition, investment banks often have other activities:

- Trading: Investment banks often have trading divisions that buy and sell securities and derivatives, both for clients and for the firm’s own accounts.

- Investment research and analysts: Many investment banks produce investment research for their clients. If you’ve ever heard that an analyst “upgraded” a stock, or raised their price target, that likely came from an investment bank.

- Lending: Although lending is typically the realm of commercial banks, investment banks often have some lending operations.

- Asset management: Investment banks often advise corporations and high-net-worth individuals how to invest their capital. Some of the largest investment banks have hundreds of billions or even trillions of dollars of client assets under management.

Investment banking vs. commercial banking

There are two main types of banking. Commercial banking is what most people associate with the term “banking.” This is the consumer-facing side of the banking business and mainly involves taking deposits from consumers and businesses and loaning money to customers, hoping to profit from the interest earned on loans. Other types of banking activities that typically fall in the realm of commercial banking include foreign exchange services, merchant services, retail brokerage services, and financial advisory businesses.

Investment banking has little to do with typical savings and loan activities. As previously noted, investment banks provide services to businesses, governments, and high-net-worth individuals related to complex financial transactions.

Many banks engage in both commercial and investment banking activities. The four largest U.S. banks -- JPMorgan Chase (JPM 1.94%), Bank of America (BAC 2.06%), Wells Fargo (WFC 1.24%), and Citigroup (C 3.06%) -- all have investment banking operations in addition to their consumer-facing banking activities.

It’s rare these days for a bank to be a pure investment bank. Even the investment banking leaders, such as Goldman Sachs (GS 3.3%) and Morgan Stanley (MS 1.58%), have been classified as “bank holding companies” since the 2007-09 financial crisis and now engage in commercial banking to some extent.

For the most part, investment banks make their money from fees. For example, when a corporation hires investment bankers to advise on a merger, they pay an advisory fee. The same is true for underwriting, asset management, and most other investment banking activities. This is a sharp contrast to commercial banking, where the primary source of revenue is from interest.

How is investment banking regulated?

In the United States, investment banks are regulated by the Securities and Exchange Commission, or SEC. Since the SEC oversees the securities industry, and virtually all investment banking activities are related to the securities industry in one way or another, the SEC has oversight of the investment banking business.

Example of investment banking

As a real-world example, student housing developer (and publicly traded company) American Campus Communities agreed to be acquired by Blackstone Funds, which would take the company private. American Campus Communities hired BofA Securities (the investment banking arm of Bank of America) as well as KeyBanc Capital Markets (KEY 0.07%) to advise it on the deal terms, while Blackstone hired Wells Fargo Securities, J.P. Morgan Securities, and TSB Capital Advisors.

This brings up an important point. In larger transactions, it’s very common for corporations to hire more than one investment bank for advice. One may be designated as lead advisor, which was the case with BofA Securities in the example above, but it isn’t always the case.

Related investment topics

The bottom line

Investment banking is the side of the banking business that deals with capital markets and related transactions. It is generally the corporate-facing side of the banking industry, as opposed to the consumer-facing side.

Investment banking FAQs

What do investment bankers do?

Investment bankers perform a variety of services for their clients. They underwrite equity and debt offerings; provide advice on mergers, acquisitions, and restructurings; and often perform securities research. Some investment bankers deal directly with corporations, governments, or high-net-worth clients and help to manage their assets and investments.

What are the big four investment banks?

Goldman Sachs is the largest investment bank in terms of global M&A advisory activity, followed by Morgan Stanley, JPMorgan Chase, and Bank of America. By market capitalization, JPMorgan Chase is the largest bank that has substantial investment banking operations.

What are IPOs and how are they related to investment banking?

When a company decides to go public through an IPO, it can’t just call the New York Stock Exchange or Nasdaq and list its shares. It relies on investment bankers to underwrite the IPO, provide advice on the transaction, and handle the capital raised through the offering. In fact, underwriting IPOs can be a major revenue center for investment banks.