Probate is the legal process for the distribution of a deceased person’s assets to heirs and can be a complex process. In this article, we’ll discuss what probate is, how it works -- both with and without a will -- and some of the most effective ways to avoid probate.

What is probate?

Probate is a legal process that refers to the administration of a deceased person’s estate, either with or without a will. In the probate process, the person’s assets and liabilities are evaluated, and the inheritors of the property are determined. For example, if you die without a will and are a homeowner, the probate process will determine who will inherit your home.

How probate works

Probate is always necessary after someone dies, but the process can either be simple (with a will or other documentation) or complicated (the person died without a will). We’ll cover the differences between the two in this article, but the general process involves a person’s assets and any relevant documentation being reviewed by a probate court.

It’s worth noting that there are some assets that can pass to beneficiaries outside of the probate process. For example, life insurance proceeds can be paid to a named beneficiary, as can retirement accounts. If you own a home in a specific manner, such as joint tenants with right of survivorship (JTWROS), and the other owner is still alive, the home won’t need to be part of probate.

Probate with a will

When someone dies with a legal will, the process is typically much easier than the alternative. A will typically names an executor, or the person responsible for carrying out the deceased person’s wishes. This is usually a financial advisor, but it doesn’t have to be.

The executor will file the will with a probate court, which will then verify the authenticity of the will and legally appoint the executor to carry out the will’s instructions. The executor’s responsibilities include locating assets, settling any debts owed by the deceased, filing personal and estate tax returns as needed, and, finally, distributing assets to the beneficiaries.

The general steps of probate with a will are:

- The probate court Is informed of the death, typically by being presented with a copy of the death certificate.

- The will is validated to make sure it is legally signed and dated.

- The executor is formally appointed. Unless there’s a good reason, this is usually the person named in the will.

- The executor informs beneficiaries and creditors of the death and settles debts (including funeral costs and taxes) using money from the estate.

- The value of the estate is determined, which involves inventorying, appraising, and adding values to arrive at the estimated total estate value.

- Assets are distributed to beneficiaries.

Probate without a will

If someone dies without a will (this is technically known as dying intestate) or with a will that is invalid for one reason or another, the process can be a little more complicated and time-consuming. If the deceased person has no assets to distribute or owes more than their estate is worth, this isn’t much of an issue, but it can be in cases where there is substantial property to distribute.

In these cases, the probate process involves a court-appointed executor, which is usually the surviving spouse or nearest living relative, if there is one. Then the property is verified and debts are settled. Once this part of the process is done, the estate is distributed in accordance with state laws.

In most states, when someone dies without a will, property is distributed among a surviving spouse and the deceased person’s children. If no heirs in these categories exist, the executor will try to locate other legal heirs. These could include surviving parents, siblings, aunts, uncles, nieces, and nephews, just to name a few. If there are no legal heirs to be found, assets are transferred to the state.

As an example, in South Carolina the intestate succession laws are as follows:

- If you die with children and no spouse, the children inherit everything in equal shares.

- If you die with a spouse and no children, your spouse inherits everything.

- If you die with both a spouse and children, the spouse inherits half of the property in question, and the children split the rest.

- If you have neither a spouse or children, but your parent(s) are still alive, the parents inherit everything.

- If you have no spouse, children, or living parents, but you have siblings, they split everything in equal shares.

Beyond spouses, children, living parents, or siblings, it can get a little more complicated. And while the exact laws vary from state to state, they typically have a similar structure to what is listed above.

To be clear, the probate process without a will can take much longer than if there is a legal will in place, and this is especially true if survivors start fighting over the assets in the estate. Neither is typically quick, but one of the biggest reasons to have a will in place is to make sure your assets go where you want them to in a timely manner.

Just to give you a rough idea of what to expect, with a will (and no major snags), probate typically takes six to nine months. Without a will, it isn’t unusual for the probate process to drag on for years.

Related real estate topics

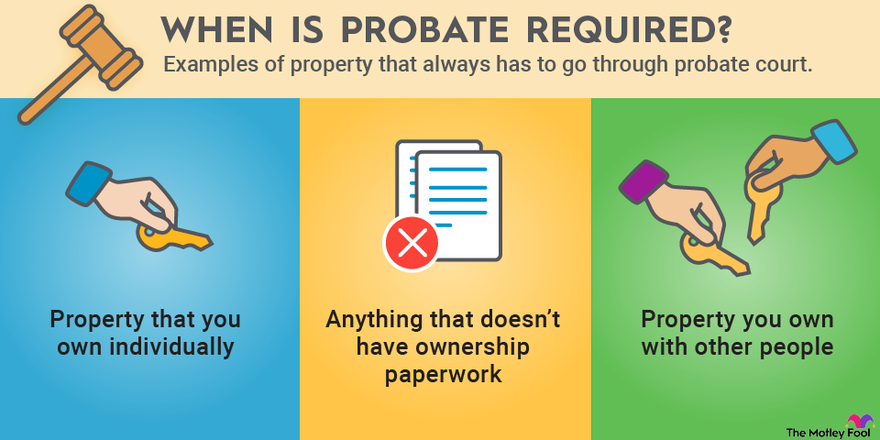

When is probate court required?

There are a few types of assets that can avoid the probate process entirely, and we’ll get to those in the next section. But first let’s go over property that always has to go through probate court.

Property that you own individually: If assets are titled in your name only, they will have to go through the probate process upon your death. For example, if your name is the only one on your vehicle’s title, it will have to go through probate court. You may be able to avoid this by adding a transfer on death (TOD) designation to a title, but the process and availability of this varies by state.

Anything that doesn’t have ownership paperwork: As an example, if you have a collection of old baseball cards, that’s the type of asset that usually doesn’t have clear ownership paperwork. Items such as furniture, clothing, and electronics also fall into this category. The best work-around is to name specific items in your will if you want them to go to specific people. This will simplify the process, but it won’t eliminate probate entirely.

Property you own with other people: If you own property or other assets jointly with another person (aside from your spouse), it will typically end up in probate. An example is if you own an investment property with a partner or if you own half of a small business with another person.

When is probate not required?

The general rule is that probate is not required when assets are owned jointly or when there is a beneficiary named. We mentioned joint homeownership earlier, but there are many other possible cases. For example, if you and your spouse have a joint checking account, ownership of the account would automatically pass to them if you were to die. If you jointly own a vehicle, the same concept would apply. The exception is if the property is titled as “tenants in common,” which means that your portion would pass to your heirs and not to the other owner.

There are other assets that don’t go through probate regardless of whether you die with a will or not. Life insurance proceeds and retirement accounts are other examples since these typically have beneficiaries as well as contingent beneficiaries named. Any accounts or assets designated as “payable on death” or “transfer on death”, also known as “POD” and “TOD,” respectively, are also not subject to probate.

It’s also worth mentioning that some of these assets can end up in probate, particularly when a beneficiary dies before the property owner and especially if any contingent beneficiaries aren’t around either. For example, if you and your spouse own your home jointly, but they die before you, the home will likely end up in probate. The same can be said if your life insurance beneficiaries predecease you.

How to avoid probate

Property in a living trust is another example of a situation when probate is not required since assets in these vehicles will pass to the named beneficiary or beneficiaries when you die. This can help avoid probate altogether on assets that would otherwise be subject to the process.

While probate can be a time-consuming process, it also isn’t cheap. According to Trust & Will, the typical cost of probate court is between 2% and 7% of the entire estate’s value. There are attorney fees, compensation for the executor, probate bond costs, court fees, and more.

Creating a trust is perhaps the most effective way to avoid probate, but it isn’t something most people can just do on their own. The best course of action is to contact a professional, such as an estate planning attorney or Certified Financial Planner® who specializes in estate planning, to help determine the best plan for your specific situation.