FF&E stands for fixtures, furniture, and equipment. These are assets contained inside of a commercial building that are not part of the building itself and are not permanently attached but have tangible value and are used in the day-to-day operations of a business that occupies a commercial building. Office furniture is a common example. (We'll get into more examples of FF&E in a bit.)

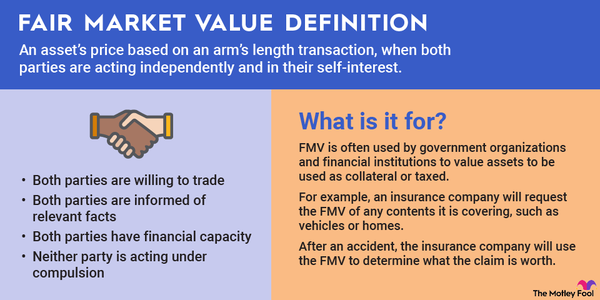

There are a few reasons why FF&E is an important concept to know in real estate. For one thing, if you're buying or selling an existing business, the fixtures, furniture, and equipment owned by the business are important components of the business's fair value. The same concept also applies in cases of business liquidation, such as in bankruptcy.

Why is FF&E important?

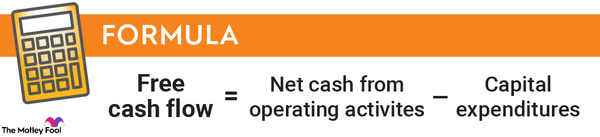

If you're a business owner or a commercial property landlord, FF&E is an important concept for accounting and tax purposes, as items included in FF&E have depreciation calculated in a different way than the property itself and therefore also have an impact on a business's book value. For example, the IRS considers computing equipment to have a useful lifespan of five years while an office building that houses the computers would be depreciated according to a 39-year schedule. FF&E deductions can help boost your qualified business expense each year, in turn lowering your income tax.

So, let's say you buy a $1,000 computer for business use. Assuming you use straight-line depreciation for this expense, you could get a $200 depreciation expense deduction on your tax return each year for five years. Similar depreciation deductions can be obtained for the rest of your FF&E.

Examples of FF&E

While it wouldn't be practical to list everything that could possibly be considered FF&E on a business's balance sheet (there is a wide range of items that could be included), here are some of the most common examples:

- Furniture: Tables, chairs, lamps, bookcases, sofas, and more.

- Electronic equipment: Computers are a very common example, as is stereo equipment, point-of-sale (POS) terminals, speakers, and other electronics. Security systems are often considered to be FF&E as well.

- Decorative items: Art, photographs, or other objects on the walls.

- Lighting: Lamps and lighting fixtures (even if they are technically attached to the building).

- Other business equipment that isn't a product for sale: For example, in a fitness center, gym equipment such as weights and cardio machines would be included. In a lending business, an object such as a currency counter could be considered FF&E. In a dry cleaning business, rotating clothing racks are an asset type likely included in FF&E.

As a general rule, items considered in FF&E calculations are tangible assets that:

- Are easy to remove from the building.

- Have a useful life of one year or more.

- Aren't products that a business would typically sell.

In the next section, we'll look at a few examples of things that are generally not included in FF&E, but most things that qualify meet these three basic criteria.

What is not included in FF&E?

It's just as important to know what items are not included in FF&E calculations. Just to name a few common asset types that aren't considered FF&E:

- Immovable building components: Any fixed asset that would damage the functionality of the building if removed is typically not included in FF&E. Just to name a couple of examples: toilets, faucets, and HVAC units are typically not included in FF&E and are considered to be part of the business itself. Doors and windows are also examples in this category.

- Office supplies: To be included in FF&E, an asset needs to have an expected lifespan of one year or more. So, things like paper, pens, markers, and other office supplies aren't considered to be FF&E, even though you might think of these as business "equipment."

- Consumables: Any food, drink, or paper products aren't included in FF&E.

- Built-in furniture: If a building has built-in desks, bookcases, or other non-removable furniture incorporated into its design, it is not part of the building's FF&E.

- Intangible assets: This should go without saying, but in order to be considered FF&E, an asset must be a tangible piece of equipment.

It's also important to mention that FF&E is a different concept from inventory. For example, let's say you were looking to buy an existing restaurant business. The tables, chairs, POS terminals, and furniture in the back office would be included in the business's FF&E assets. On the other hand, any items that the business would typically sell (say, the bottles of liquor in the bar's stockroom) would not be counted as FF&E and would be accounted for separately as part of the business's current inventory.

The bottom line

To sum it up, items located within a commercial building that are used in a business's day-to-day operations are considered to be FF&E if they aren't part of the building itself, can be reasonably expected to last for more than a year, and are used in the general operations of a business. This is an important concept to know for both accounting reasons for determining depreciation expense and for business valuation.