An IRA, or individual retirement account, is a tax-advantaged account designed to help Americans save and invest for retirement. Many banks and brokerages offer IRAs, and they take several forms. However, while most people are familiar with the basic concept of an IRA, many don't understand how they actually work.

Here's an overview of the different types of IRAs, how IRAs work in terms of withdrawals, eligibility, and making investments, and how to open an IRA.

Different types of IRAs and how they work

All types of IRAs work in the same basic way. Money contributed to the account can be invested in a variety of stocks, bonds, ETFs, mutual funds, and other investment vehicles. These investments are tax deferred, which means that dividends and interest income received within an IRA aren't included in the owner's income each year, and taxes on any capital gains are deferred. In simple terms, as long as investments remain within an IRA, they will not result in any tax liability for the account owner.

There are two main types of IRA available to most people: traditional and Roth. In addition, there are two specialized types of IRA designed for small businesses and the self-employed.

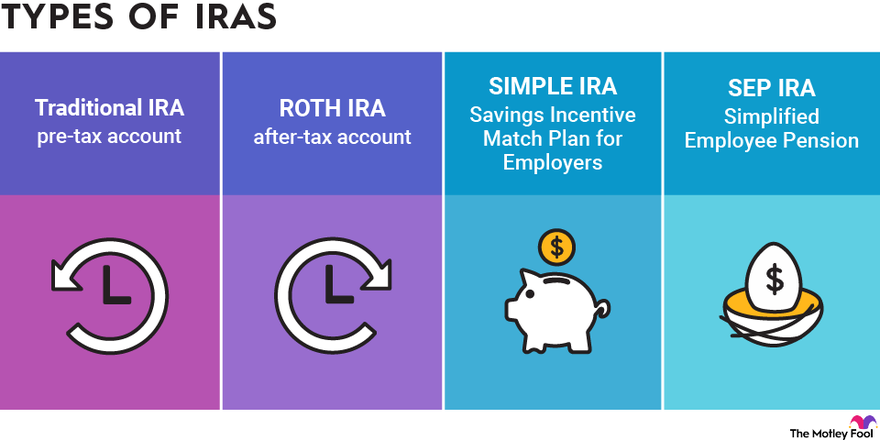

- Traditional IRA: A traditional IRA is a "pre-tax" account, meaning you may be able to deduct your contributions from your taxable income each year, up to the annual limit set by the IRS. Your investments are allowed to grow and compound on a tax-deferred basis, so you won't have to pay capital gains and dividend taxes year after year. Once you withdraw the money, it's treated as income and may be taxable.

- Roth IRA: A Roth IRA is an "after-tax" account, meaning that you don't get a tax deduction for Roth contributions. However, your investments in a Roth IRA will grow free of tax until your retirement, and any qualified withdrawals from the account will be 100% tax-free. So the biggest difference between how the two main types of IRA work is when you get the tax benefit -- now (traditional) or later (Roth).

- SIMPLE IRA: A SIMPLE (Savings Incentive Match Plan for Employers) IRA is designed to allow small businesses to offer retirement benefits to their employees. Employees can make contributions, and employers also contribute to SIMPLE IRAs on their employees' behalf. The tax structure of a SIMPLE IRA is the same as that of a traditional IRA, meaning contributions are tax deductible but withdrawals will be considered taxable income.

- SEP-IRA: SEP stands for Simplified Employee Pension. This type of IRA is designed to enable employers to set aside funds for their employees' retirements. Other than the contribution limits (more on that in the next section), the biggest difference between a SEP-IRA and a SIMPLE IRA is that SEP-IRA contributions are made only by the employer or self-employed account owner -- employees cannot contribute to their SEP-IRAs. Like SIMPLE IRAs, SEP-IRAs are treated like traditional IRAs for tax purposes.

How IRA contributions work

IRA contribution limits change over time, but for the 2023 tax year, individuals can contribute a maximum of $6,500 to their traditional or Roth IRAs. The contribution limit rises to $7,000 in 2024. If you're 50 or older, you're allowed an additional $1,000 "catch-up" contribution as well, for a total of $7,500 in 2023 or $8,000 in 2024.

It's important to realize that this limit is per person, not per account. In other words, you can have two or more IRAs, but your total contributions for any given tax year cannot exceed the applicable IRS contribution limit. For example, if you're over 50, you can contribute $5,000 to a traditional IRA and $3,000 to a Roth IRA for the 2024 tax year, assuming you're eligible to contribute to both account types.

IRA contributions can be made until the tax deadline for each year. For example, you can make 2023 IRA contributions until the 2023 tax return deadline on April 15, 2024.

SIMPLE IRAs and SEP-IRAs have somewhat higher contribution limits.

For 2023, employees are allowed to contribute as much as $15,500 to a SIMPLE IRA, and in 2024, that amount is $16,000. Employers can choose to match employee contributions up to 3% of salary or contribute a flat rate of 2% of salary for all employees regardless of the employees' contributions. Self-employed individuals with SIMPLE IRAs are considered both employee and employer for contribution purposes.

On the other hand, SEP-IRA contributions are all considered to come from the employer, who can contribute 25% of compensation, or $66,000 in 2023 and $69,000 in 2024, whichever is less. There are also catch-up contributions for SEP-IRA owners of $7,500 for both 2023 and 2024.

How IRA eligibility works

Everyone is eligible to contribute to a traditional IRA, but in order to deduct your contributions, which is the main benefit of choosing a traditional IRA, you need to meet certain requirements related to your income and your eligibility to participate in a retirement plan through your employer. If you don't have a retirement plan at work, you can contribute to an IRA. But if you or your spouse is eligible to participate in a retirement plan through an employer, you can take advantage of the traditional IRA deduction only if your income is under a certain threshold, which is determined annually by the IRS.

Unlike with a traditional IRA, not everyone can contribute to a Roth IRA. Roth IRA eligibility is income restricted, regardless of eligibility for an employer's retirement plan. The Roth IRA income limitations are also determined annually by the IRS.

SEP-IRAs and SIMPLE IRAs are not income restricted, as they are designed to be retirement plans for small employers and the self-employed. So if you meet the criteria for opening and contributing to one of these account types, it doesn't matter how much money you earn.

How IRA investments work

Once you contribute to an IRA, you literally have thousands of investment options. You can choose any stocks, bonds, or funds you'd like, or you can keep some of the money in cash, CDs, or money market accounts.

If you prefer to keep your retirement investing on autopilot, you can choose to invest in index funds or actively managed mutual funds or ETFs. On the other hand, if you have the time and desire to research individual stocks, you can certainly use an IRA to invest in them.

How IRA withdrawals work

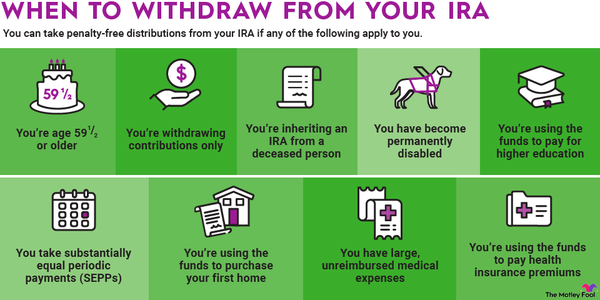

The standard age at which you can withdraw money from your IRA without paying a penalty is 59 1/2. This is considered full retirement age for IRA purposes, and, to be perfectly clear, you can withdraw from your account for any reason after you reach this age.

It's also important to note that there are a few situations in which you can withdraw from your IRA early. One common exception is the ability to withdraw up to $10,000 to be used toward a first-time home purchase for you or a loved one. Also, you can withdraw any amount at any time for qualified higher-education expenses, so an IRA can effectively double as a college savings account.

If you choose to withdraw money from your IRA before reaching 59 1/2 years of age and you don't have an allowable reason, you can face a 10% early-withdrawal penalty from the IRS in addition to any applicable taxes. If you have a Roth IRA, it's important to realize that since you've already paid tax on your contributions, you can withdraw them at any time and for any reason without penalty. But the same withdrawal rules apply to the portion of your account that came from investment gains.

For all non-Roth IRAs, the account owner is required to start withdrawing funds each year starting at age 73. Roth IRAs have no required minimum distribution (RMD) as long as the account owner is alive.

On the topic of withdrawals, it's important to note that you cannot borrow money from your IRA, meaning that there is no such thing as an "IRA loan." Unless a distribution from an IRA is rolled over to another qualified retirement account within 90 days, it will be treated as a withdrawal.

How opening an IRA works

IRAs are offered by most major brokerage firms. Opening an IRA is typically a quick and easy process. While the process varies among brokerages, you'll generally have to fill out a short application to open the account, including some personal information like your Social Security number (for tax reporting purposes). And there are typically several ways to make your initial deposit, such as by mailing a check, drafting from your bank account, and making a wire transfer. You can also typically set up a recurring contribution from your bank account.

Related retirement topics

The Foolish bottom line

The bottom line is that if you know how IRAs work, you can understand why they are an excellent means of saving for retirement, and you will also be able to make a smart decision when it comes to selecting the broker and the type of IRA that are best for you.