When the Federal Reserve announces its latest decision about interest rates on Wednesday afternoon, the agency is widely expected to increase the Federal Funds Rate by 25 basis points, or 0.25 percentage points. You might think that this would mean a similar rise in the interest rates paid by your savings accounts and CDs. However, recent history indicates that you shouldn't hold your breath.

Generally, Federal Reserve rate hikes mean higher savings interest rates

Savings, money market, and CD interest rates aren't directly tied to Federal Reserve interest rate hikes. In other words, there's no rule that says that your interest rate has to increase if the Federal Funds Rate rises.

Image source: Getty Images.

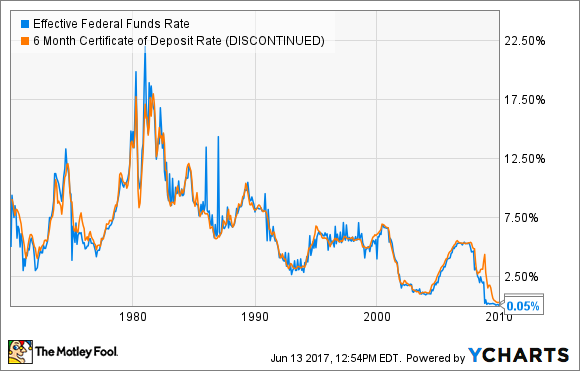

Historically, the Federal Funds Rate, which is what the Federal Reserve will potentially raise on Wednesday, has resulted in higher interest rates on consumer deposits such as savings accounts and CDs. As you can see from this chart, during the 1970-2010 period, the effective Federal Funds Rate and the average 6-month CD rate moved nearly identically to one another.

Effective Federal Funds Rate data by YCharts.

However, consumers have yet to benefit from the current cycle

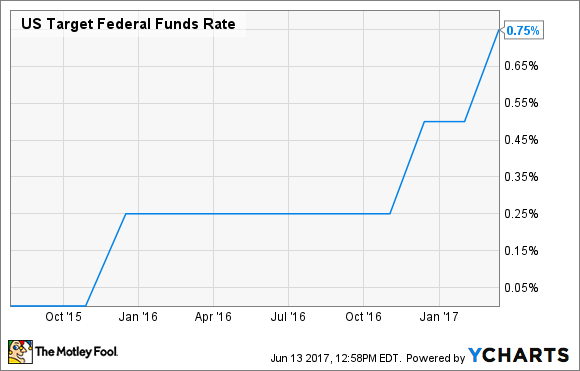

Despite the historical trend, consumers aren't yet benefiting from the latest string of rate increases. Since late 2015, the Federal Reserve has increased rates by 25 basis points (0.25 percentage points) on three separate occasions, from a target rate of 0%-0.25% to the range of 0.75%-1.00%, where it currently sits. If expectations prove to be accurate, the target rate will increase to 1.00%-1.25% on Wednesday.

US Target Federal Funds Rate data by YCharts.

However, deposit interest rates haven't caught up. In fact, interest rates are so low that I've called it a big financial mistake to keep too much cash in your deposit accounts. Here are the national averages for certain deposit products now, and in mid-2015, before the Fed began raising rates:

|

Product |

June 15, 2015 |

June 12, 2017 |

|---|---|---|

|

Savings account |

0.06% |

0.06% |

|

Money market account |

0.08% |

0.08% |

|

Three-month CD |

0.08% |

0.09% |

|

Six-month CD |

0.12% |

0.15% |

|

12-month CD |

0.20% |

0.25% |

|

36-month CD |

0.47% |

0.52% |

|

60-month CD |

0.78% |

0.81% |

Data source: FDIC. Rates are for non-jumbo (less than $100,000) deposits.

As you can see, even with the Federal Funds Target Rate 75 basis points higher, these averages have barely budged. And in the cases of savings and money market accounts, the averages haven't changed at all. Even with a 60-month CD, the higher Fed Funds rate has only translated to a 3-basis-point increase.

Keep in mind that this just refers to the averages, and not to individual banking products. Some online-based savings products in particular are offering significantly higher-than-average rates on savings accounts and CDs, so shop around.

What will the Fed's rate hike mean to your savings account?

It's tough to say. If rates continue to increase, at some point, banks will need to increase the rates they're willing to pay on deposits in order to stay competitive.

However, bank profit margins have been hovering near record lows for some time, and banks can take advantage of the larger spread they can create by raising lending rates and simultaneously keeping deposit rates low. It appears that's exactly what is happening. During the first quarter of 2017, banks as a whole reported nearly 13% higher profits than a year ago.

If recent history is any indicator, I wouldn't count on the banks passing any of the increased lending rates they can charge on to their customers -- at least not until their profit margins have returned to their historically normal levels.