The rules of 401(k) retirement plans dictate the size of employee contributions, when you can make withdrawals, and when you owe taxes on your savings, among other things. Failing to follow these rules results in costly penalties, so make sure you're familiar with the information below before you contribute or withdraw any more money from your 401(k) retirement plan.

Withdrawal rules

Because the 401(k) is a tax-advantaged retirement account, the government has rules about when and how you can withdraw funds. Here are some of the most important ones:

Penalty-free withdrawals

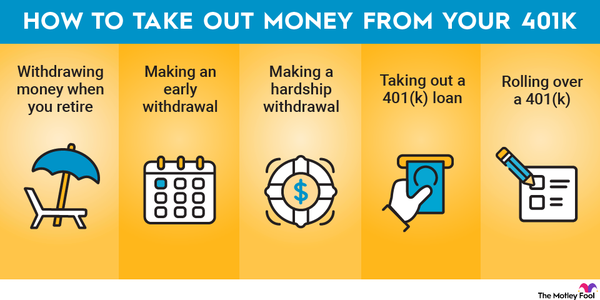

You typically cannot withdraw money from a traditional 401(k) before age 59 1/2 without paying a 10% early withdrawal penalty (on top of taxes). But there are exceptions for qualifying early withdrawals (discussed below), as well as for Roth 401(k) contributions.

With Roth 401(k) distributions, early withdrawals are prorated between your contribution and the earnings share. For instance, suppose you have $10,000 in your account, consisting of $9,000 in contributions and $1,000 in earnings. If you took $5,000 from the account as an early distribution, you'd owe taxes and a penalty on $500 of the distribution, while the other $4,500 would be tax- and penalty-free.

Early withdrawals

Early withdrawals are any 401(k) withdrawals you make before you're 59 1/2. Often they result in a 10% early withdrawal penalty, but there are some exceptions, including:

- Substantially equal periodic payments (SEPPs): SEPPs require you to withdraw a certain amount annually from your 401(k) for at least five years or until you reach 59 1/2, whichever is later.

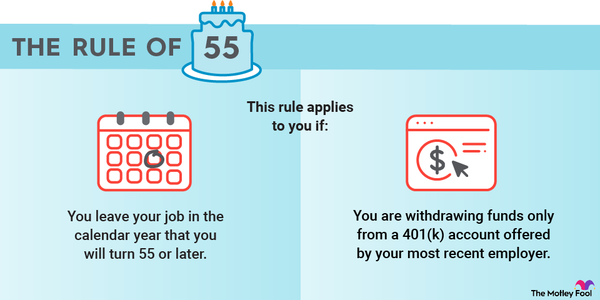

- Rule of 55: If you leave your employer in the year you turn 55 or later, you may take penalty-free withdrawals from the 401(k) you had with that company only. This rule kicks in at 50 for public safety workers such as firefighters and police officers.

- Qualifying medical expenses: If your unreimbursed medical expenses exceed 7.5% of your adjusted gross income (AGI), you can withdraw money from your 401(k) to cover them penalty-free.

- Disability: If you become permanently disabled, you can withdraw your 401(k) funds penalty-free before age 59 1/2.

- Domestic relations court order: You can withdraw funds penalty-free if a court orders you to give money to a divorced spouse or a dependent under a qualified domestic relations order.

- 401(k) loan: A 401(k) loan enables you to temporarily withdraw funds from your 401(k) and pay them back over time with interest. If you fail to pay back everything you borrow, the outstanding balance is considered a distribution and taxed accordingly.

Hardship withdrawals

Hardship withdrawals allow you to take out retirement funds to cover an immediate financial need. They are usually subject to the 10% early withdrawal penalty unless you qualify for one of the exceptions listed above. Some common reasons for hardship withdrawals are:

- Medical bills

- Higher education expenses

- Home purchase

- Avoiding eviction or foreclosure

- Funeral expenses

- Repairs related to damage to a primary home

Not all 401(k)s allow hardship withdrawals, so check with your plan administrator to see if this is an option.

Required minimum distributions (RMDs)

RMDs are the minimum amounts you must withdraw from a traditional 401(k) annually beginning the year after you turn 73. (Prior to the passage of the Secure Act 2.0 in December 2022, RMDs began the year after you turned 72. The law also increases RMD age to 75 in 2033.) You can calculate yours here by dividing the total balance of your 401(k) by the distribution period next to your age.

You're free to take out more than this annually if you want to, but failure to take out at least this much will result in a 25% penalty on the amount you should have withdrawn. If you take action quickly to resolve the issue, the penalty may drop to 10%.

There's an exception to the RMD rule if you're older than 73 and still working as long as you own no more than 5% of the company you work for. In that case, you can delay RMDs from your 401(k) at your current company, but you must still take RMDs from older 401(k)s.

In 2023 and prior tax years, RMDs were mandatory for both traditional and Roth 401(k)s. But starting in 2024, Roth 401(k)s will no longer have RMDs.

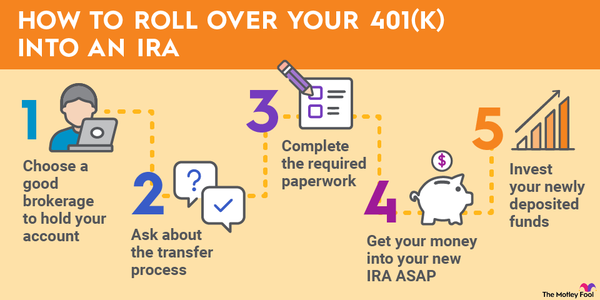

IRA rollovers

You are free to roll over your 401(k) funds to an IRA at any time, although you may incur a one-time fee for doing this. The simplest way is to request that your 401(k) plan administrator directly transfer the funds to your IRA. You'll have to fill out a form stating where you'd like the funds sent, but then your plan administrator will transfer the funds directly so the government doesn't tax you for an early withdrawal.

You can also do an indirect transfer whereby you withdraw all the money from your 401(k) and then deposit it into your IRA yourself. As long as you do this within 60 days of the withdrawal, you won't owe any taxes, but if you fail to deposit the full amount in your IRA before the deadline, the government considers it a distribution.

Contribution limits

The government imposes restrictions on how much you can contribute to your 401(k) annually. Employers that offer a company 401(k) match will also have their own rules about how their matching system works and when you get to keep these funds.

Annual contribution limits

You are allowed to contribute up to $22,500 to a 401(k) in 2023 or $30,000 if you're 50 or older. The contribution limits are $23,000 in 2024 or $30,500 if you're 50 or older.

However, these limits may change from year to year. If you exceed the contribution limits, the government will tax the excess funds twice -- once in the year you make the contribution and again in the year you withdraw funds. You can avoid this by withdrawing the excess before the tax deadline.

Employer matching

Some companies match a portion of their employees' contributions. Dollar-for-dollar matches exist, but they're rare. It's more common to see a company match a percentage of employee contributions, like $0.50 on the dollar. Usually this is capped at a percentage of your income, with 6% being a common limit for a $0.50-on-the-dollar match. Every company has its own matching system, so talk to your plan administrator to learn about yours.

Vesting schedule

Companies that offer an employer match often impose a vesting schedule, which determines when you're allowed to keep your employer-contributed 401(k) funds if you leave the company. Some companies offer immediate vesting, but it's more common to see cliff vesting, whereby you must work for the company for a certain number of years before being allowed to keep any employer-matched funds. There's also graded vesting, whereby your employer-matched funds are released to you gradually over time.

Understanding these basic rules about your 401(k) can prevent you from making a mistake that costs you money. Review the rules above before you make a withdrawal or leave your company to avoid paying unnecessary taxes on your distributions.