For tens of millions of Americans, their monthly Social Security check is a financial lifeline that they couldn't do without. Of the nearly 61.5 million people receiving Social Security each month, 42 million are retired workers -- and of these retired workers, 61% relies on Social Security to comprise at least half of their monthly income.

Because Social Security income is so important to current retirees, and is expected to be relied on heavily by baby boomers, getting as much out of the program as possible is priority No. 1 for most seniors. This means the usual factors apply if you want to maximize what you'll receive each month. This includes working a minimum of 35 years, earning as much as you can in the years you do work, and waiting as long as is financially feasible to claim benefits.

However, there's another important factor that helps dictate Social Security benefits that is beyond our control: the national inflation rate.

Image source: Getty Images.

The importance of annual cost-of-living adjustments

Social Security beneficiaries usually receive a cost-of-living adjustment, or COLA, every year, which is designed to closely mirror the inflation rate in the United States. The specific tether for Social Security's COLA is the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). The average reading of the CPI-W from the third quarter (July through September) of the previous year serves as the baseline reading, while the average reading from the third quarter of the current year acts as the comparison. If the predetermined basket of goods and services that's measured by the CPI-W rises from one year to the next, beneficiaries receive a commensurate percentage raise, rounded to the nearest 0.1%. In the case where the CPI-W falls year over year, as happened in 2009, 2010, and 2015, benefits remain static from one year to the next. Social Security benefits aren't reduced if the U.S. experiences deflation.

Recently, the CPI-W has been on the decline, having fallen from an annualized rate of north of 2% early in the year to 1.6%, according to data released by the Bureau of Labor Statistics in August for the month of July. This suggested that while a raise was expected in 2018 for Social Security beneficiaries, it would be smaller than initially expected, which is something that retirees have unfortunately been accustomed to over the past decade.

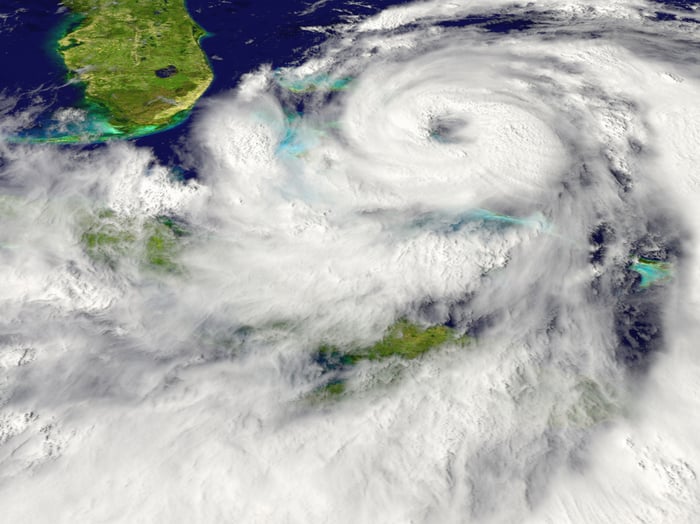

However, that may be about to change because of hurricanes Harvey and Irma.

Image source: Getty Images.

Hurricanes Harvey and Irma should boost Social Security's COLA

Unquestionably, these hurricanes were respective disasters for Texas and Florida, and it's going to take months for some individuals and families to get their lives back together. Initial estimates from AccuWeather peg the damage caused by both hurricanes at a shocking $290 billion, comprised of $190 billion from Harvey and $100 billion from Irma.

But the more immediate impact from the U.S. being hit with this double-whammy is that it's pushed crude oil prices, and thusly prices at the pump, higher. During August, gasoline prices rose by 6.3%, which was the largest one-month increase since January 2017. Though Bureau of Labor Statistics officials were unsure if Harvey was directly responsible for the rising price of gasoline, further gains are expected in gas prices in September as a result of refinery shutdowns tied to Irma's impact.

More importantly, per the BLS' August report that was released last week, the CPI-W increased to 1.9% on an annualized basis from the 1.6% reported in the previous month. This implies that Social Security beneficiaries are in line for a larger benefit increase in 2018 than was expected just a month or two ago.

Just as important is the fact that Social Security's COLA is determined by comparing the third quarter of the current and previous years. This means the weaker inflation data of the second quarter is tossed out the window, and the more robust inflation rate as a result of rising fuel prices will hold more weight toward lifting COLAs for 2018. Understandably, gas prices are far from the only component used to calculate the CPI-W, but fuel-pump inflation will be a critical cog in raising payouts for retirees next year.

Image source: Getty Images.

Still no relief from medical care and housing inflation

Unfortunately, the bump from hurricanes Harvey and Irma still isn't going to ease the sting seniors are feeling from rising medical care and housing/rental inflation. Not counting 2017, medical care inflation has outpaced the COLA beneficiaries have received in 33 of the past 35 years. We've also witnessed housing inflation top Social Security's COLA in recent years. The end result is that even with what could be a 2% or higher COLA in 2018, seniors are likely to see their purchasing power dwindle once again.

For those of you who aren't retired and receiving Social Security benefits as of yet, this is your wake-up call to save more, invest wisely, and ensure that you have a large enough nest egg such that Social Security doesn't become your primary source of income. Remember, in addition to Social Security dollars losing purchasing power over time, the program is also facing a $12.5 trillion cash shortfall between 2034 and 2091, based on its current payout schedule. This means an across-the-board cut to benefits may be possible within the next two decades to sustain the program for generations to come.

Long story short, expect a bigger COLA in 2018, but don't take your foot of the gas when it comes to saving money and investing for your future.