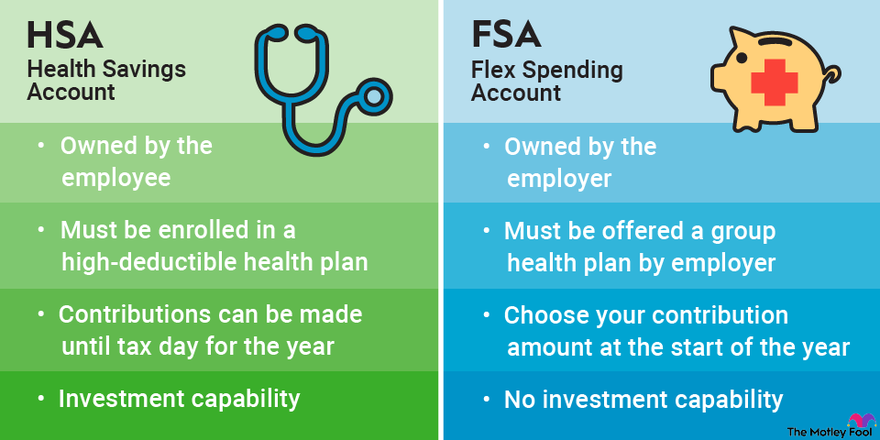

Both a health savings account (HSA) and a flexible spending account (FSA) allow you to pay for medical care with pre-tax dollars, which reduces the cost. With healthcare accounting for 8.1% of Americans' average monthly expenses, these tax shelters are important financial tools.

But while an HSA and FSA sound similar, there are important differences between them.

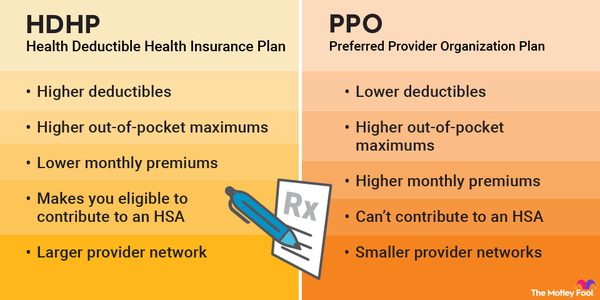

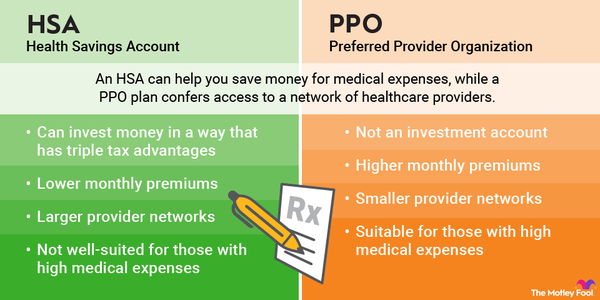

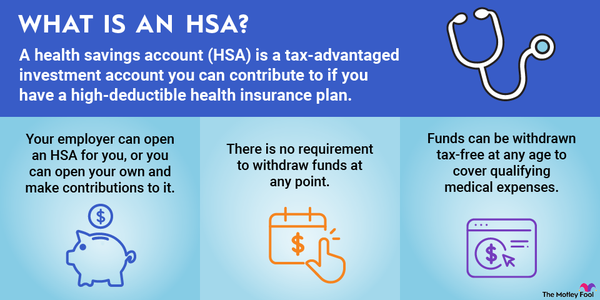

- HSAs are tax-advantaged accounts either you or an employer can open and contribute to if you have a qualifying high-deductible health plan (HDHP). HSAs allow you to make pre-tax contributions and take tax-free withdrawals to pay for covered care. The money in an HSA can be invested and grow over time and can also be withdrawn after age 65 and will be taxed at your ordinary tax rate with no penalties.

- You can also make pre-tax contributions and take tax-free withdrawals from FSAs, but they can only be opened by employers. These accounts serve as a short-term savings account rather than an investment account. You must decide at the start of the year how much to contribute, the money cannot be invested, and it is lost if not used for medical care in the year it is contributed or shortly thereafter.

HSAs provide much more flexibility on how you spend your money, while FSAs allow you to pay for both medical care and dependent care with pre-tax dollars. This guide will help you understand how the rules differ when it comes to eligibility, using account funds, and more.

Key differences between FSAs and HSAs

The biggest differences between FSAs and HSAs are the following:

- Eligibility rules: Only employers offer FSAs, while HSAs can be offered by employers but can also be opened independently. However, FSAs are available to anyone whose company offers one, while you can contribute to an HSA only if you have a qualifying HDHP.

- Tax rules: While an FSA and HSA both allow you to make contributions with pre-tax dollars, an FSA is not the same as an HSA for tax purposes. The HSA contribution limits are different from the FSA limits. HSAs allow catch-up contributions for those 55 and older, but FSAs do not.

- Contribution rules: You must choose how much to contribute to your FSA at the start of the year, while you have the flexibility to make HSA contributions until Tax Day for the year in which the contribution is made.

- Ability to invest: When you make contributions to an HSA, the money is put into an account with a financial institution, such as a bank or brokerage firm, and you can invest your HSA money so the funds can grow. FSA funds cannot be invested.

- Permissible use of the funds: HSAs are intended to cover healthcare only, while there are different types of FSAs, including healthcare FSAs and dependent-care FSAs. Money put into a dependent-care FSA can be used to pay for child or adult day care with pre-tax funds.

- Carryover rules: Money in an FSA must be spent in the year it is contributed or it is forfeited. In some cases, you can carry over $640 in 2024 ($610 in 2023) from your current year's FSA into the next year (without affecting contribution limits) or use your funds during a grace period after the end of the year. However, not all FSA plans allow these options. HSA funds, on the other hand, don't have to be withdrawn at any specific time and can remain invested and grow for as long as you'd like.

- Withdrawal rules: FSA money can only be used to cover eligible medical expenses. HSA funds can be withdrawn for other purposes, but withdrawals before age 65 are subject to a 20% penalty plus income taxes if the money isn't used to cover medical care. After age 65, you can take money out of an HSA for anything you'd like and will simply pay taxes at your ordinary income tax rate.

- Account ownership rules: Your HSA belongs to you. If you leave your job, you can take it with you. This is not the case with an FSA, which you forfeit upon leaving your job unless you are eligible for and elect COBRA continuation coverage of your FSA.

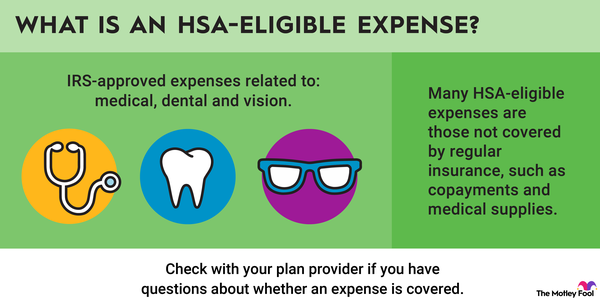

HSA vs. FSA eligible expenses

HSAs and FSAs have similar rules regarding which medical expenses you can pay for with your contributed funds. For example, you can pay for prescription medications, eye care, hearing aids, most types of dental care, chiropractic care, and most other medical services.

However, dependent-care FSAs enable you to pay for many things HSAs do not. For example, you can pay for child care costs, including day care, overnight summer camp, housekeeping expenses related to dependent care, and similar expenses incurred while caring for qualifying dependents.

Related Investing Topics

HSA vs. FSA comparison chart

The chart below provides insight into the key differences between HSAs and FSAs so you can learn the rules for each account.

| Aspect | HSA | FSA |

|---|---|---|

| Eligibility rules |

Employers may offer an HSA, but individuals can open their own. You must have a qualifying HDHP to be eligible to make HSA contributions. |

Only employers offer FSAs. Any employee can contribute to an FSA if their employer offers one. |

| Annual contribution limits |

$4,150 for self-only coverage in 2024 ($3,850 in 2023). $8,300 for family coverage in 2024 ($7,500 in 2023). $1,000 additional catch-up contribution for those older than 55 in 2023 and 2024. |

$3,200 per plan for a healthcare FSA in 2024 ($3,050 in 2023). If both spouses have FSAs, each can contribute this amount. $5,000 total per family for dependent-care FSAs in 2023 and 2024 ($2,500 if married filing separately). If both spouses have dependent-care FSAs, this total is still $5,000. |

| Contribution rules |

Contributions are made with pre-tax dollars. Employers or employees can contribute. You have flexibility in how much to contribute during the year, and contributions can be made until the tax deadline. |

Contributions are made with pre-tax dollars. Employers or employees can contribute. You must determine how much to contribute at the start of the year and the amount cannot change. |

| Account ownership | Employees own HSAs and can take them with them when leaving a job. | Employers own accounts and leaving a job means losing access to the account unless you elect COBRA continuation if eligible. |

| Withdrawal rules |

You can access funds only after contributing. Money can be withdrawn for any purpose, but withdrawals are subject to a 20% penalty plus income taxes if made for anything other than qualifying medical services. After age 65, you can withdraw money for any purpose penalty-free but will be taxed at your ordinary income tax rate. |

You have immediate access to the amount you elected to contribute to the FSA for the year, even if you haven't yet funded your account. Money can be used only for qualifying medical expenses. |

| Investing rules | HSA money can be invested and grow tax-free. | FSA money cannot be invested. |

| Carryover rules | Money in your HSA can remain invested and does not have to be used in the year the contributions were made. |

Money may be lost if not used in the year the contributions are made. Some plans allow you to carry over $640 in 2024 ($610 in 2023) if the money remains unused. Some plans allow a 2 1/2-month grace period to use the money after the end of the year. |

For many people, an HSA offers more flexibility and is a better choice. However, if you do not have a qualifying HDHP and therefore aren't eligible for an HSA, and your employer does offer an FSA, it may be your best option for paying for healthcare expenses with pre-tax dollars.

Pros and cons of an HSA vs. FSA

Here are the key pros and cons of each type of account to consider.

| Pros and Cons | HSA | FSA |

|---|---|---|

| Pros |

Contributions can be invested. Account funds are not "use it or lose it" -- money remains in your account until you choose to withdraw it. You have flexibility to decide how much to contribute during the course of the year. Money can be withdrawn for any purpose without penalty after age 65. |

You don't need a qualifying HDHP to contribute. You can put away pre-tax money not just for healthcare but also for dependent care. You'll get immediate access to the funds you elect to contribute for the year. |

| Cons |

You're eligible for an HSA only if you have a qualifying HDHP. You can access funds only after they've been contributed. |

If you don't use your FSA contribution within the year it is made (or within any applicable grace period), you could lose the contributed funds. FSA money can be used only for medical expenses. Money in an FSA cannot be invested. |

Be sure to consider the advantages and disadvantages of each account type to make the best choices for covering your healthcare needs.