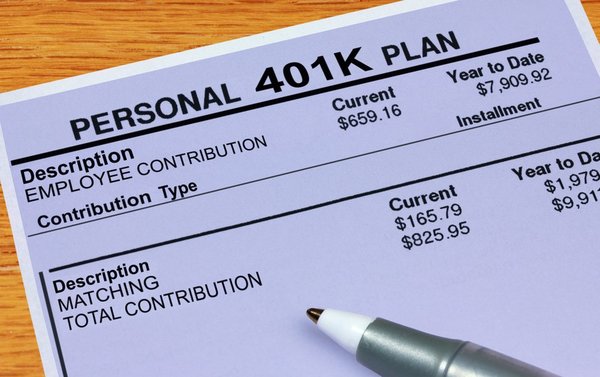

A 401(k) is a tax-advantaged retirement account you can contribute to with pre-tax money. Contributions are usually deducted directly from your paycheck.

Because investing for retirement via a 401(k) plan confers tax advantages, some restrictions are associated with 401(k) withdrawals. If you withdraw funds before reaching age 59 1/2, then you may face early withdrawal penalties.

Here's what you need to know about how withdrawing money from a 401(k) works -- including how much early withdrawals can cost you and which circumstances qualify you for a penalty exemption.

Qualified distributions

Understanding qualified distributions

401(k)s are typically considered as qualified plans and receive favorable tax treatment. A qualified distribution is generally one you receive after you reach 59 1/2. You may withdraw as much money from the account as you'd like once you reach this age.

When you take a qualified distribution from a 401(k) after the age of 59 1/2, you are taxed at your ordinary income tax rate unless you have a Roth 401(k), which is funded post-tax but allows for tax-free withdrawals. You are required to begin taking qualified distributions from your 401(k) after the age of 73 (previously age 72) if you have a traditional 401(k). Under new rules ushered in by the Secure Act 2.0, RMDs will no longer apply to Roth 401(k)s in 2024.

The IRS determines the amount of required minimum distributions (RMDs) based on your age, life expectancy, and the amount of money in your retirement account.

While there are additional rules that apply to Roth 401(k)s for withdrawals to be considered as qualified -- including a requirement that Roth 401(k)s be open for at least five years prior to receiving the first distribution -- these added rules do not apply to traditional 401(k) accounts.

Early withdrawals

Understanding early withdrawals

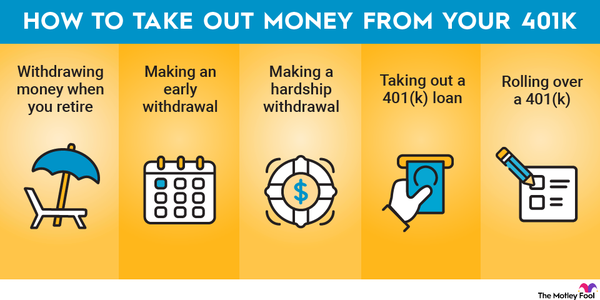

Early withdrawals occur if you receive money from a 401(k) before age 59 1/2. In most, but not all, circumstances, this triggers an early withdrawal penalty of 10% of the amount withdrawn.

For example, taking a $10,000 early withdrawal would require you to pay $1,000 in tax to the IRS. This is in addition to the tax ordinarily assessed on 401(k) withdrawals, which is based on your ordinary income tax rate.

When you withdraw money early from a 401(k), the distributed funds do not remain invested and ceases to earn money from compounding. While many people considering early withdrawals focus on the 10% penalty when considering any added expenses, the opportunity cost of withdrawing funds from your account prior to retirement is likely orders of magnitude greater.

If you withdraw $10,000 from your 401(k) at the age of 30, then your account balance would be almost $107,000 lower at the age of 65 (assuming a 7% average annual return on investment) than if that money had remained invested.

Hardship withdrawals

Requirements for hardship withdrawals

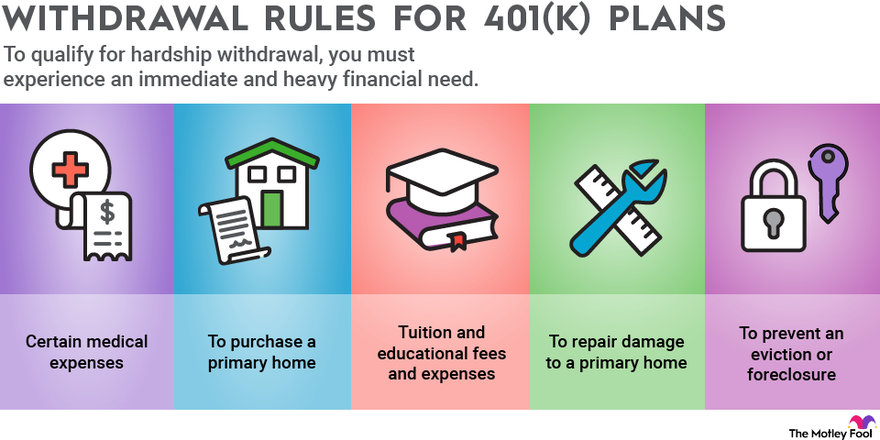

The IRS also allows for penalty-free distributions before the age of 59 1/2 in hardship-related circumstances. To qualify for a hardship withdrawal, you, your spouse, or a dependent must experience "an immediate and heavy financial need" and the amount you are withdrawing must be "necessary to satisfy the financial need."

These are the scenarios the IRS provides that might constitute an immediate and heavy need:

- Certain medical expenses

- Costs associated with purchasing a primary home

- Tuition and educational fees and expenses

- Expenses associated with the repair of damage to a primary home under certain circumstances

- Money necessary to prevent eviction or foreclosure from a primary home

However, your plan administrator may not permit hardship withdrawals regardless of the circumstances. And, the IRS requirements specify that you must not have any other source of funds to cover the "immediate and heavy" expenses.

Related retirement topics

Other ways to avoid the early withdrawal penalty

Other ways to avoid the early withdrawal penalty

You can also receive penalty-free early distributions under certain other circumstances such as if:

- You become disabled.

- You're ordered to pay some of your 401(k) funds to another person (for example, in the case of divorce).

- You accept a series of substantially equal payments for at least five years, or until you turn age 59 1/2.

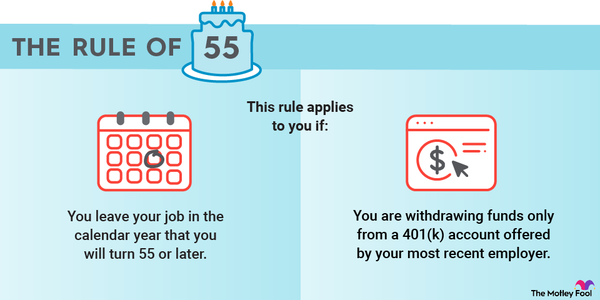

- You leave your job in the calendar year that you turn age 55.

Another way to avoid the early withdrawal penalty is to consider a 401(k) loan instead. If your plan offers them, 401(k) loans are easy to obtain and enable you to borrow from your own 401(k) account and pay yourself back with interest. Provided that you repay a 401(k) loan on schedule, you can avoid the consequences of an early 401(k) withdrawal.