A 457 plan is a type of employer-sponsored, tax-advantaged retirement account available to state and local government employees, and certain (usually highly paid) nonprofit employees. Some 457 plans allow employees to contribute up to 100% of their incomes, and employers may make contributions to 457 accounts as well.

The most common type of 457 plan is the 457(b), and it’s excellent as a retirement savings vehicle. It has high contribution limits, and account holders can use it in conjunction with other tax-advantaged accounts to supercharge their retirement savings.

How does a 457(b) plan work?

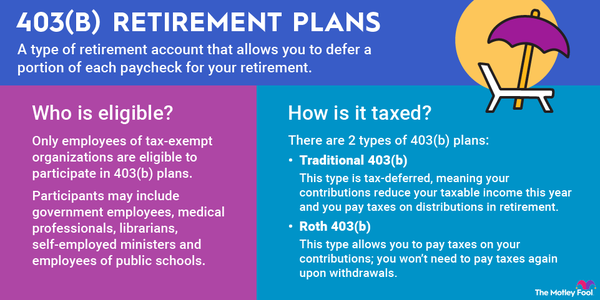

A 457(b) plan is a lot like a 401(k) plan or a 403(b) plan, but 457(b) plans are only available to state and local government employees and employees of qualified nonprofits. Eligible employees can elect to defer some of their salaries by automatic deductions from their paychecks, and that money is put into investment accounts in their names.

Most 457(b) plans offer limited investment options. You’ll typically choose among a set of mutual funds and annuities.

There are also certain fees related to 457 plans of which participants should be aware. Vendor fees, brokerage fees, advisor fees, record-keeping or custodial fees, and administrative fees can all eat into investment returns. Additionally, each mutual fund or annuity has its own fees associated with the investment product. If the fees seem unreasonable, it may be best to explore other investment options or talk to your employer about switching vendors for its 457 plan offering.

457(b) contribution limits

The standard contribution limit for a 457(b) plan is $22,500 in 2023 and $23,000 in 2024. This limit includes both employee and employer contributions.

Participants ages 50 and older may be allowed to make catch-up contributions. The standard catch-up contribution for 2023 and 2024 is $7,500, bringing the total limit for some to $30,000 in 2023, or $30,500 in 2024.

Certain 457(b) plans may allow for a special catch-up contribution. Your 457(b) plan may permit participants in their last three years before retirement to contribute either twice the standard contribution limit or the standard contribution limit plus the amount of the standard limit that the participant didn’t contribute in prior years, whichever is less. Participants who elect to contribute up to the special catch-up limit are not also eligible for the standard catch-up contribution.

Importantly, 457 plan contribution limits are not reduced by contributions to other employer-sponsored retirement plans. So if an employer offers both a 457 and another type of retirement plan, such as a 401(k) or 403(b), then employees can contribute the maximum permissible amount to both accounts in the same year.

Explore Related Retirement Topics

457(b) vs 403(b)

On the whole, 457(b) plans have a lot in common with 403(b) plans. They are both employer-sponsored retirement savings accounts, they have the same standard contribution limits, and they use similar types of investment accounts to grow funds for retirement.

Both types of retirement accounts also offer Roth options, for people who would rather pay taxes now and withdraw funds tax-free when they retire.

The biggest difference between a 457(b) and a 403(b) is that employer contributions to a 457(b) plan count toward the same annual contribution limit as employee contributions. 403(b) plans have much higher contribution limits when taking into account contributions by employers in addition to those by employees.

Another key difference is that 457(b) plan participants can withdraw funds at any time without penalty. They still owe income tax on any withdrawals, but aren’t subject to the usual 10% early-withdrawal penalty that is assessed for some other types of retirement plans.

Other types of 457 plans

While a 457(b) is the most common type of 457 plan, some highly compensated employees may be offered a 457(f) plan. This is a very different plan than the more typical 457(b).

Under a 457(f) plan, the employee doesn’t make any contributions. Only the organization is eligible to contribute to the plan. No contribution limits are imposed on 457(f) plans; the employer can allocate to the plan up to 100% of the employee’s income. In addition, the employee’s right to access the funds in a 457(f) plan is dependent on his or her continued tenure in the job. If the employee is terminated or quits early, then they may lose access to the 457(f) account.

It’s also worth noting that nongovernmental 457(b) plans are available for nonprofit organizations. These plans are also limited to highly-compensated employees; the IRS explicitly prohibits “rank-and-file” employees from participating.

Nongovernmental 457(b)s are distinguished from governmental plans by the restriction that money invested into a nongovernmental 457 plan can only be rolled over into another nongovernmental 457 plan. Additionally, the funds in a nongovernmental 457 account are junior in the capital structure to any outstanding debt obligations held by the employer, so the 457 account funds could be seized in the event of the employer declaring bankruptcy.