The Federal Reserve's Federal Open Market Committee, or FOMC, is set to meet next week, and another interest rate hike is widely expected. Here's exactly what that means, and how it could affect the interest you pay and receive as a consumer. Although the rate hike is a virtual certainty, there's one component of the FOMC meeting outcome that has the potential to surprise.

What is the Fed expected to do, exactly?

While it's not 100% certain that the Federal Reserve will raise interest rates when it meets next week, it's pretty close.

Image source: Getty Images.

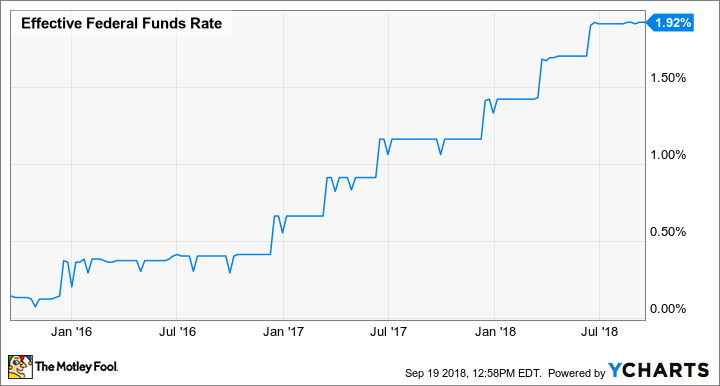

Barring any major surprises, the FOMC is expected to raise its target federal funds rate by 25 basis points, or one-fourth of one percent, to a range of 2%-2.25%. This would be the highest level in over a decade and would mark the eighth quarter-point rate hike of the current cycle.

Effective Federal Funds Rate data by YCharts.

How would another rate hike affect consumers?

There are several key ways consumers could be affected. In a nutshell, any interest rate that's based on the federal funds rate or the prime rate would increase by a corresponding amount.

Credit cards are one big example. Virtually all credit card interest rates are variable, and most are based on the prime rate. So a quarter-point Fed rate hike would mean that your credit card interest rates would jump by the same amount shortly after the rate hike is announced. In other words, if the APR on one of your credit cards is currently 17.49%, you can expect it to rise to 17.74% because of the Fed's action.

Home equity lines of credit, or HELOCs, are a similar story. HELOCs generally derive their interest rates from the prime rate or the rates of short-term U.S. Treasuries. So, as these rates go up, your HELOC interest rate will go up as well.

Interest rates on other consumer loan products like auto loans and fixed-rate mortgages are more difficult to predict. To be clear, these are not directly linked to the federal funds rate or any other benchmark interest rate. However, they do tend to move in the same direction. For example, mortgage rates have risen considerably over the past couple of years, but not to the same extent as the federal funds rate.

Effective Federal Funds Rate data by YCharts.

The same goes for deposit interest rates like savings accounts and CDs. While these tend to move in the same direction as the Fed's actions, there's no rule that says they have to. In fact, the average savings account interest rate in the U.S. has barely budged during the current rate-hike cycle, although some online savings accounts are passing the higher rates on to customers in an effort to grow their business.

The really important thing

As I mentioned, the rate hike is pretty much assumed at this point. According to futures markets, the chance of a rate hike next week is virtually 100%.

However, the FOMC announcement is definitely worth paying attention to, but for other reasons. Specifically, the most important information will be the Fed's predictions of where interest rates will go in the future. The recent trade war issues have added to speculation that the Fed may need to be more cautious than originally predicted, so we'll get a glimpse into how expectations have changed (if at all).

Futures markets are currently pricing in an 81% chance of another rate hike in December, so while this is certainly a high probability, it isn't automatic by any means. As of the last FOMC predictions, which are on a document known as the "dot plot," the consensus called for a fourth rate hike later this year and further increases to a peak of 3.4% in 2020.

Another thing to pay attention to is the language the FOMC uses in its statement that it will issue after the meeting. Recently, language has been rather upbeat in terms of the economy, as well as in regard to the Fed's anticipation of gradual rate increases.

The bottom line is that the Fed's future projections are what's most likely to move the markets next week -- not the rate hike itself.