Each and every month, more than $81 billion is paid out in benefits by the Social Security Administration (SSA). Of this money, three-quarters winds up in the hands of retired workers, many of whom lean on Social Security as their major source of income. Or, to put this in another context, America would be facing a serious elderly poverty crisis if Social Security weren't offering a guaranteed monthly payment to seniors who've earned the prerequisite 40 lifetime credits needed to receive a benefit.

The most important Social Security date of the year is nearly here

With more than three out of five aged beneficiaries reliant on the program for at least half of their monthly income, there's perhaps no event that has more significance than the cost-of-living adjustment (COLA) announcement by the SSA, which comes out during the second week of October (Oct. 11 this year). COLA is nothing more than a fancy term to describe the "raise" that beneficiaries will receive in the following year as a result of the rising price of a predetermined basket of goods and services (i.e., inflation).

Image source: Getty Images.

Between the very first Social Security retired worker payout in January 1940 through 1974, Social Security benefits were arbitrarily adjusted by special legislative bills passed by Congress. However, since 1975, as a result of legislation passed by the Nixon administration in 1972, the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) has been the program's inflationary tether. This index measures the spending habits of urban and clerical workers across eight major categories and dozens upon dozens of subcategories to determine the "raise" that all beneficiaries -- retired workers, survivors, and the disabled -- will receive in the upcoming year.

One of the more interesting things you may not realize about Social Security's COLA calculation is that only three months are taken into consideration. The average reading of the CPI-W during the third quarter (July through September) of the previous year acts as the baseline figure, while the average reading from the third quarter of the current years is the comparison. If prices rise year over year, then beneficiaries receive a COLA that's commensurate with the percentage increase, rounded to the nearest 0.1%. If prices were to fall year over year, which has only happened on three occasions (2010, 2011, and 2016) since the CPI-W was tied to the Social Security program in 1975, benefits remain the same from one year to the next. Thankfully, benefits cannot be reduced due to falling prices.

What does Social Security's 2019 COLA look like so far?

So, what can aged beneficiaries who depend on Social Security to make ends meet expect for 2019?

Image source: Getty Images.

As a refresher (because I know how exciting CPI-W data from the Bureau of Labor Statistics can be), here are the CPI-W readings from the third quarter of 2017:

- July 2017 CPI-W: 238.617

- August 2017 CPI-W: 239.448

- September 2017 CPI-W: 240.939

If these figures are added up and divided by three, it yields an average CPI-W for Q3 2017 of 239.668.

Now, here's how the first two months of the all-important third quarter of 2018 have turned out:

- July 2018 CPI-W: 246.155

- August 2018 CPI-W: 246.336

As you can see, these figures are notably higher than the readings from the third quarter of 2017. Although we're still missing data from the month of September (which'll be released on Oct. 11, 2018), the average reading from the third quarter of 2018 so far is 246.246, or 2.74% higher than last year. When rounded to the nearest 0.1%, it yields an increase of 2.7%, which would represent the biggest COLA since 2012.

Predicting September's all-important inflation reading

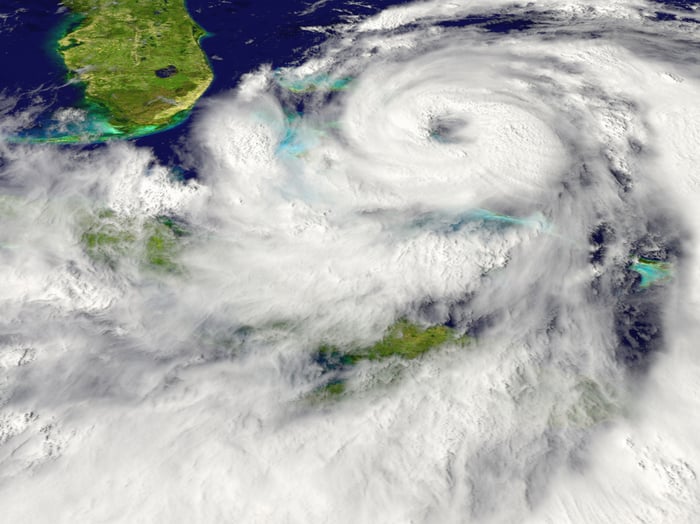

But what about September's inflation data? The biggest question mark is what sort of impact, if any, Hurricane Florence would have on inflation. Even though hurricanes are disasters from a human perspective, they tend to have a positive impact on inflation. When hurricanes strikes land or cross major bodies of water, they can particularly disrupt the energy industry, leading to refinery and/or production shutdowns that ultimately push fuel prices higher.

Image source: Getty Images.

Last year, the refinery and production disruptions caused by Hurricanes Harvey and Irma were singlehandedly responsible for adding what I'd suggest was about 50 basis points in COLA. In other words, instead of Social Security recipients netting a roughly 1.5% COLA in 2018, they received a 2% COLA, thanks in part to double-digit increases in fuel oil and gasoline prices after both hurricanes.

Now, the tricky part in figuring out September's inflation data is that Hurricane Florence didn't hit the Gulf of Mexico, which is generally the worst-case scenario for the energy industry. This makes predicting its impact on the energy industry a bit tougher. However, weekly retail gasoline and diesel prices from the U.S. Energy Information Administration (EIA) may hold some clues.

According to the EIA, we've witnessed a very modest uptick in gasoline and diesel prices over the past month. In the four weeks between the weeks ending Aug. 27 and Sept. 24, the average price per gallon for all grades of gasoline rose from $2.906 to $2.923. Meanwhile, the per-gallon price for diesel increased from $3.226 to $3.271 over this same time frame. Some of this increase could be season-based (i.e., Labor Day travel), and some might be related to Hurricane Florence. Comparatively, weekly gasoline prices ranged from $2.701 to $2.80 in September 2017.

Why does this matter so much? Put plainly, energy inflation and to some extent shelter inflation, provided the bulk of the heavy lifting last year, and they're liable to do the same this year.

So, what's my 2019 COLA prediction? Given that gasoline prices are heading higher, but only by a single-digit percentage from September 2017, and that Florence appears to have only minimally impacted the energy industry, I'll be looking for COLA to come in at 2.8%. Though it's not going to make anyone rich, it's certainly one of the more robust raises seniors will have seen in a long time.