Many companies offer a 401(k) to their employees, and a lot of them also offer company matching as an extra incentive. A 401(k) company match is money your employer contributes to your retirement account, usually based on your own contributions and capped at a certain percentage of your income.

Here's a closer look at how 401(k) company matching works and how much you and your employer are able to contribute to your 401(k) each year.

How a 401(k) match works

Employees usually contribute a percentage of their salaries to their 401(k)s, and most employers who offer matching also contribute a percentage of employees' income. Some companies offer dollar-for-dollar matches, whereby the employer contributes $1 for every $1 the employee contributes to their 401(k), but more common are partial matching percentages. This means the company matches a portion of what the employee contributes, such as $0.50 for every $1 the employee puts into their 401(k).

Regardless of the matching structure, your employer will likely cap your match at a certain percentage of your income. For example, your employer may pay $0.50 for every $1 you contribute up to 6% of your salary. So if you make $50,000 per year, 6% of your salary is $3,000. If you contribute that much to your 401(k), your employer contributes half the amount -- $1,500 of free money -- as a match. If the company offered a dollar-for-dollar match instead of a partial match, it would give you $3,000 for the year. You're free to contribute more than $3,000 if you want to, but you won't get any additional match from your company.

Companies often impose a vesting schedule that determines when you get to keep employer-contributed funds if you leave the company. Immediate vesting means you get to keep all your employer's contributions to your 401(k) as soon as you earn them, but this is rare. It's more common to see cliff vesting, whereby you forfeit all your employer-matched funds if you leave the company before you've worked there a certain number of years. There's also graded vesting, whereby your company releases a portion of your match to you every year -- for example, 20% after the first year, 40% after the second year, and so on.

Every company has its own matching methodology and vesting schedule, so talk to your employer if you're not sure how your 401(k) match works.

Contribution limits

You are allowed to contribute up to $23,000 to your 401(k) in 2024 ($22,500 in 2023) or $22,500 ($30,000 in 2023) if you're 50 or older. In 2024, the government also limits the total annual contributions to $69,000 or $76,500 if you're 50 or older, which includes your elected deferrals and employer-matched funds. These contribution limits are $66,000 and $73,500, respectively, in 2023.

Most people don't have to worry about running into these contribution limits, but high earners should be mindful of them. If your company provides a dollar-for-dollar match on up to 6% of your salary and you earn $400,000 per year, you may not be able to claim the full match because that would require you to set aside $24,000, which is more than you're allowed to contribute to your 401(k) in 2023 or 2024 if you're younger than 50.

Related Retirement Topics

The government taxes contributions over the annual limit once in the year you make the contribution and again when you withdraw the funds in retirement. Stay aware of how close you are to the annual limits and withdraw any excess contributions before the tax deadline to avoid the double taxation.

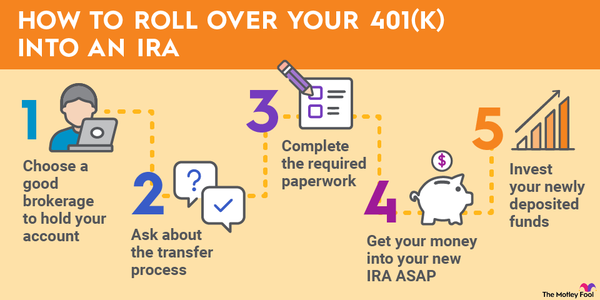

If you find yourself at the annual 401(k) contribution limit for the year and you'd still like to set aside more money for retirement, you can always open an IRA and put some money there as well.

A company 401(k) match is a great supplement to your personal contributions, but you need to understand how yours works in order to get the most out of it. Check with your employer to learn what type of matching system it uses and then aim to get your full match while being mindful of annual contribution limits.