Health reimbursement accounts (HRAs) and health savings accounts (HSAs) can reduce the costs of paying for medical care, but there are important differences between these two savings vehicles.

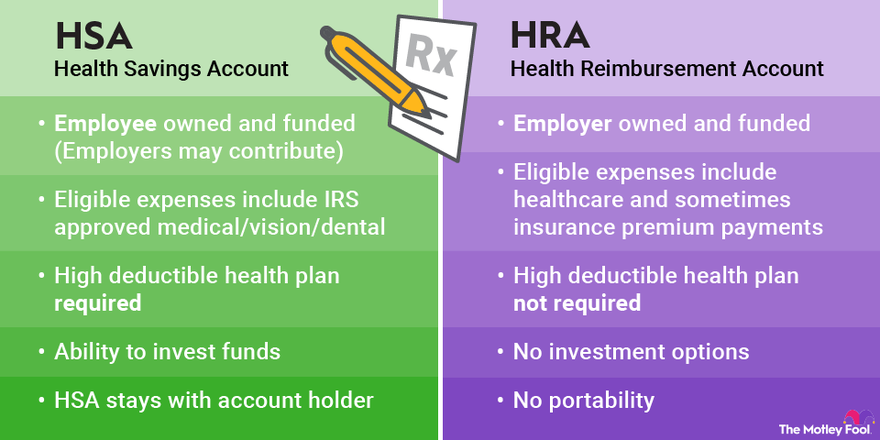

The main difference between HRAs and HSAs is that you own your HSA, while your employer owns and funds your HRA and can impose more limitations on it. You can also make contributions to an HSA and can invest your HSA money so it grows, but you can't do that with an HRA. Let's look at these differences in more detail.

Key differences between HRAs and HSAs

1. Ownership: A health reimbursement account or arrangement (HRA) is an account to which your employer contributes a set amount of money. The money is used to pay for medical care you'd otherwise need to pay for out of pocket.

You are not taxed on the money your employer puts in your HRA, but you cannot invest the money, can only withdraw it for eligible medical services, and will lose it if you leave your job unless you choose COBRA continuing coverage. Your employer may allow unused funds in an HRA to carry over and be used in subsequent years, but it's not required, and your employer can set the rules for what care you can pay for using HRA funds.

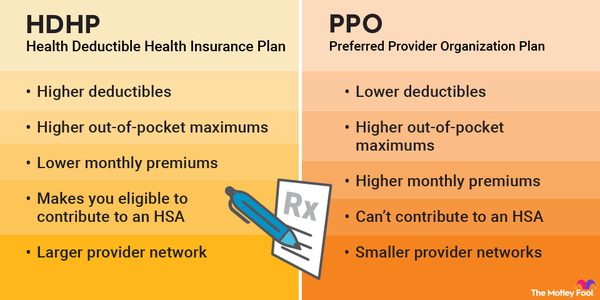

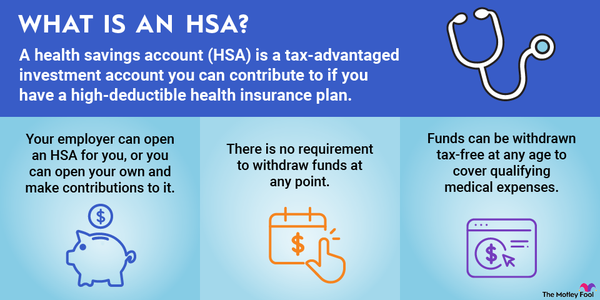

Health savings accounts (HSAs), on the other hand, are accounts to which you and your employer can contribute money. However, you are eligible to contribute to an HSA only if you have a qualifying high-deductible health plan (HDHP). Your employer may offer an HDHP with an HSA as a workplace benefit. Or, if you sign up for individual health insurance coverage and choose an HDHP, you can open an HSA with a brokerage firm or other financial institution.

2. Taxes: With an HRA, your employer reaps the tax benefits since the company is the party contributing money. With an HSA, you reap the tax benefits. You can leave your HSA money invested from year to year, and it will grow tax-free if you don't take it out to pay for healthcare expenses. Also, the HSA is yours to keep even if you leave your job. However, if you withdraw funds for anything other than healthcare costs and you're younger than 65, you'll pay a 20% tax penalty on the money.

HRA vs. HSA eligible expenses

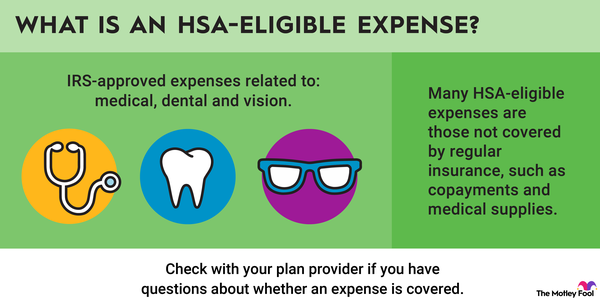

The Internal Revenue Service (IRS) establishes the rules for what counts as HSA-eligible expenses. This includes most medical and dental expenses, eye care, and hearing aids.

The IRS also allows employers to reimburse any medical expenses from an HRA that would be deductible. However, employers can set more narrow requirements. You will need to review your employer's HRA plan documents to determine what you can use the money for.

HRA vs. HSA comparison chart

The chart below shows the key differences between an HRA and an HSA so you can more easily decide which type of account to use.

| Aspect | HRA | HSA |

|---|---|---|

| Eligibility rules |

Only employers can offer HRAs. Anyone whose employer offers an HRA is eligible for the account. |

Employees or individuals can open HSAs. You must have a qualifying HDHP to be eligible to contribute to an HSA. |

| Contribution rules |

Only employers can contribute. Contributions are tax-deductible for employers and tax-free for employees. |

Employers and individuals can contribute. Contributions are made with pre-tax dollars. |

| Annual contribution limits | Varies depending on HRA type. In some cases, there is no limit on the amount employers can contribute. |

$4,150 for self-only coverage in 2024 ($3,850 in 2023). $8,300 for family coverage in 2024 ($7,500 in 2023) . $1,000 additional catch-up contribution for those older than 55 in 2023 and 2024. |

| Account ownership | Employers own HRAs. Leaving a job means losing access unless you elect COBRA continuation if eligible. | Employees own HSAs and can take them with them when leaving a job. |

| Withdrawal rules | Money in an HRA can be used only for qualifying medical expenses. |

You can withdraw only money you've contributed. You can withdraw money for any reason but will be subject to a 20% penalty plus income taxes if you're younger than 65 and the funds aren't used for qualifying medical purposes. Withdrawals can be made without penalty for any purpose after age 65 and will be taxed at your ordinary income tax rate. |

| Investing rules | HRA money cannot be invested. | HSA money can be invested and grow tax-free. |

| Carryover rules | Varies by plan: Some plans allow money to carry over into the next year. Others are use it or lose it. | Money in an HSA doesn't have to be used in the year contributions are made. It can remain indefinitely in your account and grow tax-free. |

HRA vs. HSA pros and cons

Often, you don't get a choice whether to use an HRA or an HSA. The decision is made for you based on your employer and/or the type of health plan you choose to enroll in. But sometimes you do have the option to decide between the two account types.

If you're considering which account is right for you, you need to understand the pros and cons of an HRA versus an HSA.

HRA advantages and disadvantages

Here are the biggest advantages of an HRA:

- Employers contribute money to an HRA to help you cover health costs. You don't have to make your own contributions, and, in fact, aren't allowed to put your own money into the account.

- There's no maximum annual limit on how much employers are allowed to contribute to your HRA.

- HRA money can help you pay for qualifying healthcare expenses, thus reducing your out-of-pocket costs.

- Money your employer puts into your HSA is not taxable for you.

And here are the biggest disadvantages:

- You can't contribute to your own HRA, so you are reliant on your employer to put money in.

- Your employer owns the account, and you lose your HRA money if you leave your job unless you elect COBRA coverage.

- Money in an HRA cannot be invested and grow year over year.

- In many cases, the money in the HRA must be spent the year it is contributed or you lose it. Employers can, but do not have to, allow some funds in your HRA to carry over to the next year.

Related Investing Topics

HSA advantages and disadvantages

Here are the biggest advantages of an HSA:

- You own and control your HSA, which gives you more freedom and flexibility in managing the account.

- Individuals have the option to open an HSA without an employer if they have a qualifying high-deductible health plan.

- You can contribute money to an HSA up to the annual contribution limits. You don't have to rely on an employer to make contributions for you.

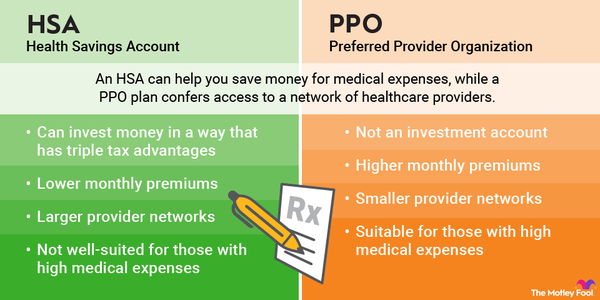

- HSAs provide triple tax benefits. Contributions are tax-deductible in the year you make them, money invested in your HSA grows tax-free, and the money in the account can be withdrawn for qualifying medical expenses without owing taxes.

- You can invest your HSA money and increase the account balance over time by earning returns.

- HSAs aren't use it or lose it. You keep your money even if you don't spend it in the year you contributed it.

- HSAs can help you pay for qualifying medical expenses with pre-tax dollars. They can also serve as a retirement savings vehicle since you can take the money out penalty-free for any purpose after age 65 (although you will be taxed at your ordinary income tax rate if the money is withdrawn for non-medical expenses).

And here are the biggest disadvantages:

- There are relatively low annual contribution limits to HSAs.

- You may have a limited choice of investment options within your HSA, which limits the potential returns you can earn.

- You can contribute to an HSA only if you have a qualifying high-deductible health plan.

If your employer offers an HRA, it will help you keep out-of-pocket costs down because funds your employer contributes to the account cover some of what you'd normally have to pay. But you need to know your plan's rules for what an HRA covers. And, remember, you can't make contributions to this account -- unlike with an HSA -- and, if you leave your job, you can't take unused funds with you.

The good news is that both HRAs and HSAs help make medical care less expensive. Whether your employer offers an HRA or an HSA, it's a valuable workplace benefit. And those who purchase an individual HDHP outside of work should make certain to open an HSA and take full advantage of the tax breaks these accounts offer.