By the time you're 25, you probably have accrued at least a few years in the workforce, so you may be starting to think seriously about saving money. But saving might still be a challenge if you're earning an entry-level salary or you have significant student loan debt.

By age 25, you should have saved about $20,000. Looking at data from the Bureau of Labor Statistics (BLS) for the fourth quarter of 2023, the median salaries for full-time workers were as follows:

- $712 per week, or $37,024 each year for workers ages 20 to 24

- $1,042 per week, or $54,184 per year for workers ages 25 to 34

Financial advisors often recommend saving 15% to 20% of your income for retirement, emergencies, and major purchases. If you just celebrated your 25th birthday, have earned the median salary of $35,880 for your age group for each of the past three years, and are saving the recommended 15% to 20%, then you should have about $20,000 in the bank.

Your actual earnings and work history may vary significantly, of course. If you're nowhere near that number, don't panic. Saving 15% to 20% of your money is not realistic for many 25-year-olds. Even if you're behind on saving, you still have plenty of time to catch up.

What's a realistic savings rate at age 25?

What's a realistic savings rate at age 25?

The truth is that saving money at age 25 might not be that much easier than saving money at age 21. If you spent the past three years earning the median salary of $32,656, your budget is probably pretty tight. More than likely, saving 20% of your salary is impossible -- unless someone else helps with your expenses.

If you actually have $20,000 saved at age 25, you're way ahead of the national average. The Federal Reserve's 2019 Survey of Consumer Finances found that the median savings account balance was $5,300 across households of all ages, not just 20-somethings.

If you don't have much extra money after paying your bills, don't focus too much yet on saving 20% of your income. Your real goal is to learn to live on less than you earn and save the rest.

How to save money at age 25

How to save money at age 25

Even if you can only save 5% or 10% of your income, that's still a good start if you can commit to increasing that percentage as your income goes up. Follow these tips to boost your long-term savings rate:

Build your emergency fund first

Build your emergency fund first

Your first priority is to save three months' worth of living expenses in an emergency fund. That's money that you keep in a savings account, not the stock market, so that you can quickly access it if you need it.

Eventually, you should have six months' worth of emergency savings. But once you're at three months, you can focus on another financial goal, too. For instance, you could put half of your extra money toward emergency savings and the other half toward investing or paying off debt.

Pay off credit cards before student loans

Pay off credit cards before student loans

Unless you have private student loans with unusually high interest rates, you're probably paying the most interest on any credit card debt you're carrying. Focus on paying off credit cards first and then tackle those student loans.

If you have federal loans, take advantage of the automatic forbearance that remains in effect going into 2023. Put your loan payments toward credit cards and private student loans that are still accruing interest.

Even if you don't have other debt, consider putting the amount you'd currently be spending on federal student loans into a savings account. Since your loans aren't accruing interest during this automatic forbearance period, it makes sense to hold off on paying them, especially as President Joe Biden's plan to forgive up to $20,000 worth of federal loans per borrower remains in limbo.

Budget for health insurance

Budget for health insurance

If you're still on a parent's health plan under the Affordable Care Act, consider yourself warned. You need to budget for and obtain your own coverage by age 26. Start planning for the extra expense now by shopping for an affordable healthcare plan or applying for jobs with companies that offer health insurance.

When you don't have health insurance, one unexpected trip to the ER can drain your savings and leave you with significant debt. If only for financial reasons, don't even consider going without health insurance coverage.

Collect your employer's 401(k) match

Collect your employer's 401(k) match

One of the fastest ways to build retirement savings is to take advantage of a company 401(k) match if your employer offers one. Even if your employer only matches 25% or 50% of your contribution, that's still essentially a 25% or 50% return on your investment for the year.

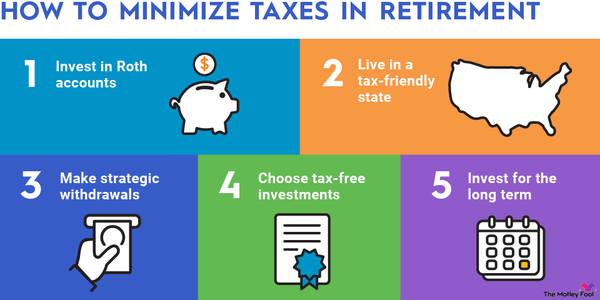

Even if your employer doesn't match your contributions, or you're self-employed, make every effort to invest for your retirement. An individual retirement account such as a Roth IRA is a good choice since withdrawals in retirement, when your tax bracket is likely higher, are not considered income. The money also grows tax-free in your IRA until it is withdrawn.

Take on a side hustle

Take on a side hustle

If you're serious about upping your savings game, or have a big goal like achieving financial independence and retiring early, then you might not want to wait around for pay raises from your employer. A side hustle, which can be anything that generates extra cash, is a great way to increase your savings.

A side hustle may not be doable for everyone, but if you can spare the extra time, it's definitely financially worth it, especially when you are young. The younger you are, the more powerful the effects of compound interest are on the value of your portfolio.

Related investing topics

Save more as you earn more

Save more as you earn more

Even if you're not making the big bucks now, the best thing you can do to make sure your savings rate increases with time is to start planning today for when you make more money. Keep your expenses low and determine what's most important to you.

As your income increases, it's OK if your expenses rise, too. Your costs just need to increase at a slower pace than your income. Set a goal of saving a certain and increasing percentage of your pay with every raise you get. If you can live below your means and avoid lifestyle inflation, then you are well-positioned to make your savings balance soar.

Expert Q&A

Keri Dogan

The Motley Fool: Because of the COVID-19 pandemic, many Americans now fear they won’t be able to retire. What is your advice for someone who may be worried about retiring because of recent financial setbacks?

Keri Dogan: Concern about retirement income is mounting among Americans approaching retirement, with many worried they won’t have enough money to last their lifetime. This is especially true given the uncertain world we live in, due in part to the pandemic, as well as market volatility and inflation so top of mind this past year.

If you are still in your saving years, retirement savers justifiably concerned about the impact of market volatility may be reassured to know there are important arguments that can reinforce one’s faith in looking long-term and not making changes based on short-term economic swings. One of these is the profound impact making continuous contributions over even a relatively short period of time can have on one’s retirement readiness. For example, if you contributed the 2021 maximum $6,000 IRA contribution at age 25 and keep it going all the way to age 70, you would have amassed $1,440,5928 by retirement. Even shorter term, according to Fidelity’s analysis, the average 401(k) balance for people who have been in their same plan with the same employer for just a 5-year continuous period is more than double the average retirement account balance. This can make a huge difference.

If you are near or entering retirement, as a general rule of thumb, Fidelity believes that day-to-day, must-have expenses in retirement like housing, food, and health care, are best covered by lifetime guaranteed income sources, such as Social Security, pensions, or income annuities. If you can afford to, consider paying nice-to-have, more easily adjusted expenses with your withdrawals from savings. Another factor is the age at which you stop working. Most people are eligible to receive Social Security benefits as early as age 62, but those benefits increase if you wait until your full retirement age (usually 67) and rise even more if you delay until age 70. The earlier you retire, the more you will have to rely on savings to meet your income needs, because your Social Security payments will be lower. So, if you retire but can afford to wait to draw down Social Security until you are 67-70, that may be helpful—and also, don’t forget about the possibility of working part time in retirement.

The Motley Fool: According to a recent survey by The Motley Fool, men were most likely to say, "I rely on Social Security benefits a little," while women were most likely to say, "I rely on them a lot." Men were also more likely to be "slightly worried" about losing their benefits, while women were most likely to be "very worried." Why do you think men seem to fare better than women in retirement years and have more confidence in their financial stability? What are the potential implications of this trend?

Keri Dogan: One factor may be that women are more likely than men to live longer, with a statistically good chance of living into their mid-90s. That means, naturally, they need their income to last longer. Longer lives mean more years to enjoy, but it also requires anticipating more expenses in retirement, especially higher health care costs.

Because women are likely to live into their 90s, Social Security is a critical component of retirement income. That is why it is important for women to understand Social Security eligibility to claim maximum monthly benefits. Making the decision as to when to take the initial benefit will permanently impact how much is received monthly.

It also means women have a greater need to have a comprehensive retirement plan in place. And yet, according to Fidelity research, only 68% of women say they do have a financial plan in place. Planning can have a powerful impact on a feeling of financial wellness, and what we have observed is that greater planning leads to an increased sense of confidence in a variety of areas, both short- and long-term. While men tend to feel like their financial lives are more in control than women, women’s confidence matches that of men when they have a plan in place.

The Motley Fool: When asked about the 8.7% cost-of-living adjustment for Social Security benefits in 2023, 55% of respondents said they didn’t think it was enough. Why do you think retirees feel this way when it's one of the biggest COLAs in history? Did the SSA make a mistake in not raising it more?

Keri Dogan: This year's increase is the largest in a generation and is definitely a helpful boost for many retirees, especially those who are looking to live within their Social Security budget.

The increase could help ease the pain of record inflation for many retirees struggling with rising costs for everything from gas to groceries. And while many retirees are not as adversely impacted by inflation in some areas (i.e. gas for travel and food costs, as their needs here may not be as great), they especially feel the pinch when it comes to rising health care costs. We also see that retirees are already adept at reducing their essential and discretionary spending and have been throughout the pandemic.

While the concern retirees may feel about the size of the increase is understandable, one piece of advice for retirement savers—or those in retirement—is to try not to worry too much. Based on what we know about retirees and their satisfaction once they get to retirement, most aren’t spending as much as they could be and yet they’re feeling pretty good about where they are – satisfied with retirement and at the same/higher standard of living compared to pre-retirement. In fact, Fidelity analyzed extensive spending data and found that most people needed to replace between 55% and 80% of their pretax, preretirement income after they stopped working to maintain their lifestyle in retirement.