Most of Social Security's beneficiaries are happy to collect their monthly checks, but the program isn't providing all of the income a typical retiree needs. The average payment currently stands at a modest $1,976 per month, so a retiree needs their own savings to cover the rest of their ongoing living expenses.

The question is, how? How should someone's retirement savings be turned into reliable passive income? Interest-bearing bonds are an obvious option, but for many people, dividend-paying stocks are at least an equally important part of the mix.

Enter the Schwab U.S. Dividend Equity ETF (SCHD -0.42%), a compelling investment that anyone looking to supplement their monthly Social Security benefits may want to consider.

Here's what you need to know about this exchange-traded fund.

What's the Schwab U.S. Dividend Equity ETF all about?

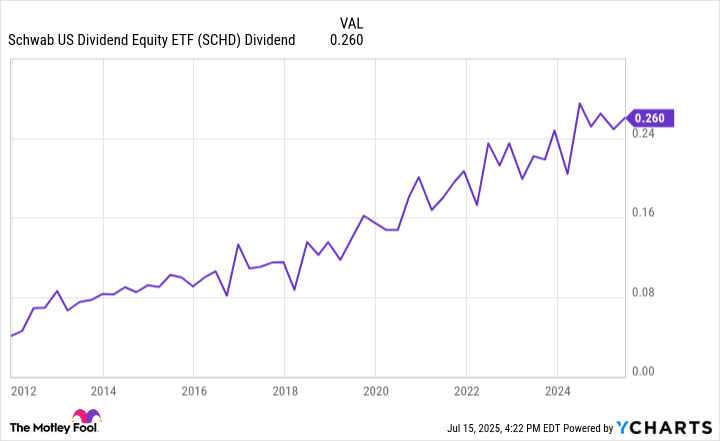

First off, the ETF's trailing-12-month dividend yield of just under 4% is measurably better than what you'll get from an S&P 500 index fund and many other dividend-focused funds. A $100,000 position would net you about $4,000 worth of dividends per year right now.

However, it's also appealing due to the index it tracks. The underlying Dow Jones U.S. Dividend 100 Index screens for 100 high-quality dividend stocks (excluding REITs) with a baseline requirement of 10 consecutive years of payouts. Index constituents also have the highest composite scores based on their return on equity, dividend yield, five-year dividend growth rate, and free cash flow relative to total debt.

Image source: Getty Images.

Its top holdings include Texas Instruments, Chevron, ConocoPhillips, Merck, and PepsiCo, just to name a few. In addition to the high dividend yield, the ETF can also be seen as a value play as its average price-to-earnings ratio is just 16 times trailing earnings. That's well below the S&P 500's trailing P/E ratio of 25.

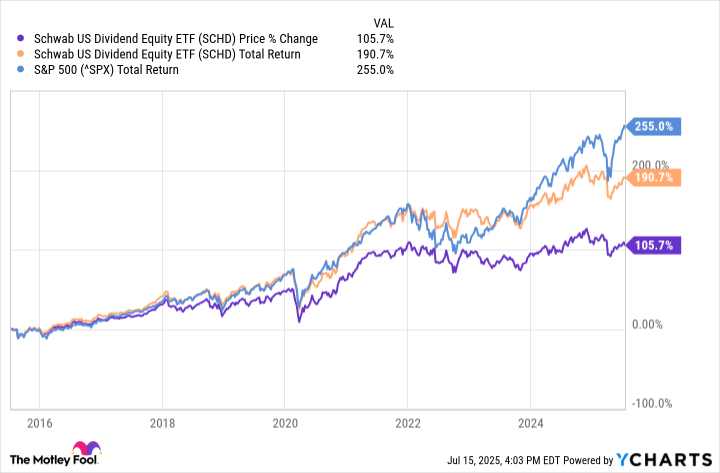

Though the strict screening criteria contribute to the ETF's high yield and rising payouts, the fund has underperformed the S&P 500 over the past decade.

Data by YCharts.

The gap has widened since the beginning of 2024 as recent market trends -- namely the rise of artificial intelligence (AI) -- disfavor the ETF's holdings.

So what about retirees considering a stake in SCHD?

While it's true the Schwab U.S. Dividend Equity ETF does not hold the high-growth AI stocks that have been pushing the broad market to new highs, inflated valuations for many of the S&P 500's biggest stocks and an uncertain economic backdrop already have many market followers sounding alarm bells.

With that in mind, stable dividend payers and value stocks like those in this Schwab ETF can be particularly appealing to retirees looking to supplement their Social Security income. As Morningstar analyst David Sekera explained in the company's recently published third-quarter 2025 market outlook, "Not only are value stocks undervalued on an absolute basis, but they also remain near some of the most undervalued levels relative to the broad market over the past 15 years." He makes a point of adding, "In a market that is becoming overvalued, we see value in the relatively higher dividend yields found in the value category."

And beyond the fund's high yield, its payout has also grown steadily over time as you can see below.

Data by YCharts.

Bottom line? While the Schwab U.S. Dividend Equity ETF may currently be lagging the S&P 500 by a wider margin than usual, those who invest in the fund can count on it to provide steady income while exposing their portfolio to less volatility than the broad market overall. Those are particularly valuable traits that should appeal to retirees hoping to boost their income.