In a perfect world, you would save just as much money as you needed for retirement in your 401(k). But sometimes people end up saving more than they can spend before they die. When that happens, whomever the account owner named as their beneficiary receives the remaining funds in an inherited 401(k). If you've just found out you're inheriting a 401(k), here are a few things you should know.

Funds you put into a 401(k) are usually tax-deferred, which means your contributions reduce your taxable income for the year, but then you owe taxes on your distributions later. If the account owner dies without paying taxes on all their savings, the inherited 401(k) beneficiary becomes responsible for paying the taxes instead. However, they can control to some extent how much they owe by which withdrawal strategy they use.

What happens when you inherit a 401(k)?

When the account owner opened their 401(k), they named their beneficiaries -- the person or people they'd like to receive their retirement funds if they died -- on a 401(k) beneficiary designation form. The primary beneficiary, often the spouse if the account owner was married, will get the money if they are still alive and want to claim it. But if they have passed away or do not want the funds, the money goes to the contingent beneficiaries.

As the beneficiary, you must decide how you'd like to receive your inherited 401(k) funds. The options available depend on several factors, including:

- Your relationship to the account owner

- The account owner's age at death

- When the account owner died

- Your age in relation to the account owner's at death

- Your health

- What the 401(k) plan allows

Inherited 401(k) distribution options

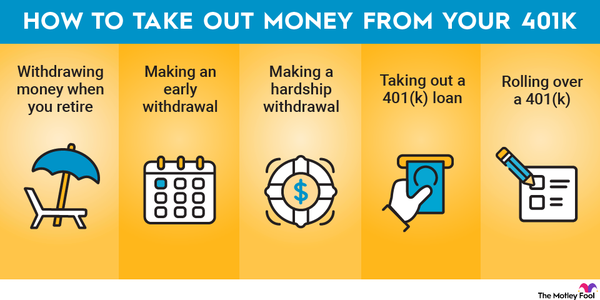

You have the following choices for withdrawing funds from your inherited 401(k). They are discussed in detail below.

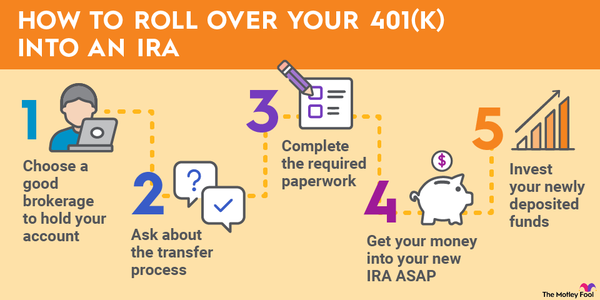

- Roll the money over into your own 401(k) or IRA (spouses only).

- Take a lump-sum distribution.

- Withdraw all funds by the end of five years after the owner's death (only if the account owner died before 2020).

- Withdraw all funds by the end of 10 years after the owner's death (only if the account owner died in 2020 or later).

- Spread the withdrawals out over your lifetime by taking annual required minimum distributions (limited to certain eligible beneficiaries if the account owner died in 2020 or later).

Roll the money into your own retirement account

This is usually the favorite strategy of spouses because it enables them to delay taxes on their inherited 401(k) funds until they withdraw the money in retirement. The government treats an inherited 401(k) that you roll over into your own account as if it had been yours all along, so it can continue growing for months or years before you have to take money out or pay taxes on it.

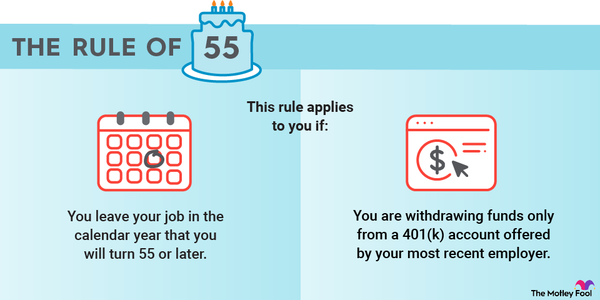

The downside to this approach is that, after you've completed the rollover, you cannot access the money if you are younger than 59 1/2 without paying a 10% early withdrawal penalty plus taxes. So if you think you'll need some money now, this isn't your best move.

Lump-sum distribution

A lump-sum distribution is where you withdraw all the money from your inherited 401(k) at once. This is simple and gives you a large influx of cash, but you must pay taxes on those funds all in a single year. That usually means you end up losing more of your inheritance back to the government than you would have if you'd used one of the other distribution strategies listed here.

Five- and 10-year rules

The five- and 10-year rules enable you to take money out whenever you need it as long as everything is withdrawn from the inherited 401(k) by the end of the fifth or 10th year, respectively, following the account owner's death. The five-year rule applies if the account owner died in 2019 or earlier, and the 10-year rule applies if they died in 2020 or later.

This strategy gives you more flexibility in terms of when you withdraw your money, and it can help you spread the tax liability over a few years. If you're not the account owner's spouse, the 10-year rule is probably your best bet since the federal government tightened restrictions on the life expectancy method (discussed below) for account owners who died in 2020 or later.

But, if the account owner died before 2020, you may prefer the life expectancy method to the five-year rule if you want the most out of your inheritance. The five-year rule may not even be an option for you if the account owner was already taking required minimum distributions (RMDs) before they died.

Life expectancy method

The life expectancy method requires you to take RMDs from the account based on your life expectancy, which you calculate by dividing the total value of the inherited 401(k) by the distribution period next to your age in the IRS Single Life Expectancy Table. For every subsequent year, you subtract one from the distribution period and divide the remaining balance by this new number.

This strategy is popular because it enables you to spread your money out over decades and possibly end up with a lot more than you otherwise would have. It also minimizes the effect the inherited 401(k) funds have on your taxes in a given year. You're always free to take out more money than the RMD if you need to, but you don't have to.

Anyone can use this strategy if the account owner died prior to 2020, but for account owners who died in 2020 or later, only the following individuals can use the life expectancy method:

- Surviving spouses

- Minor children of the account owner (only until they reach the age of majority)

- Disabled or chronically ill individuals

- Anyone who is not more than 10 years younger than the account owner at the time of their death

Not all 401(k) plans allow you to use this method even if you qualify. But if your plan refuses to allow it, you can request the employer do a trustee-to-trustee transfer to an inherited IRA, and then you can use this approach with the IRA.

When a loved one dies, figuring out what to do with an inherited 401(k) probably isn't a top priority, but it's important to decide how you'll handle it as soon as you feel up to it. Your decision will affect your taxes and ultimately how much money you get out of the inherited 401(k), so make sure you weigh the pros and cons of all of your options.