Many of us look forward to it for decades -- retirement! Work can be pleasant or even fun, but it's exciting to think of when we can stop working and enter our golden years, perhaps even achieving an early retirement, if we made smart personal finance decisions and met our retirement goals.

If your retirement is here or around the corner, you need to read up on a bunch of retirement-related topics, so that you can make smart moves that keep costs down and let your nest egg last as long as possible.

The following topics are covered below:

- Healthcare costs: Know how much to expect and how to save for it

- Inflation: Learn how to manage how far your money will go, over time

- Social Security: Know how much to expect, how to decide when to take it, and how to increase benefits and avoid reductions

- The best-case scenario: You have enough saved to retire

- The medium-case scenario: You have nearly enough saved to retire

- The worst-case scenario: You don't have enough saved to retire

- Annuities

- Early retirement

- Taxes in retirement: What you need to plan for and how to minimize taxes

- The non-financial side of retirement

- Seeking professional help

Healthcare costs

Know how much to expect and how to save for it

Let's start with healthcare costs, as they're easy to overlook and failing to plan for them can lead to disaster in retirement. Also -- they tend to be steep. One estimate, from Fidelity, is that a 65-year-old couple retiring this year can expect to spend, on average, a total of $315,000 out of pocket on healthcare during retirement, and that doesn't even include Medicare or long-term care costs. (A 35-year-old couple can save that much by socking away about $3,100 in a Health Savings Account (HSA)annually for 30 years, earning a 7% average annual return.)

Fortunately, there are ways to try to shrink your healthcare costs, such as by being as fit and healthy as possible and seeing your doctor for preventive screenings and care.

You can also make use of Flexible Spending Accounts (FSAs), which let you sock away up to $3,050 in 2023 and $3,200 in 2024 on a pre-tax basis to be spent on qualifying healthcare expenses, such as eyeglasses, dental care, certain medications, and doctor visits. The only catch is that most of that money is in the account on a use-it-or-lose-it basis.

The aforementioned Health Savings Accounts are even better, as unused contributions aren't forfeited. Instead, they can remain in the HSA account and can even be invested -- and in retirement, they can be withdrawn penalty-free to be used for anything (though the money will count as taxable income).

The HSA contribution limit for 2023 is $3,850 for individuals and $7,750 for families. The 2024 HSA contribution limits are $4,150 for individuals and $8,300 for families. Those 55 and older can contribute an additional $1,000 in 2023 and 2024. To be able to participate in an HSA, you'll need to have a qualifying high-deductible health insurance plan.

It's also smart to read up on Medicare, as it offers a lot of great coverage beginning at age 65. Don't be late to sign up, though, or you may be charged extra for it for the rest of your life.

Inflation

Learn how to manage how far your money will go, over time

It's important to factor inflation into your retirement planning. After all, if your retirement is 20 years away and you aim to save $1 million for it, that $1 million won't have the same purchasing power in 20 years as it does today.

Over long periods, inflation has averaged about 3% annually, though in some years it can be much higher or lower. That kind of rate can shrink the buying power of your dollar roughly in half over 25 years.

Here's how you might include inflation into your planning: Let's say still 20 years from retirement and you think you could live on the equivalent of a current $50,000 income in retirement. You could take the number 1.03 and raise it to the 20th degree -- by punching buttons such as 1.03 ^ 20 on your calculator -- getting 1.81. Then multiply $50,000 by 1.81, getting $90,306. That's the actual income in 2043 that would have a similar purchasing power as $50,000 in 2023.

You might combat the effects of inflation by holding a lot of dividend-paying stocks, because those dividends tend to be increased from year to year, helping you keep up with inflation -- and the stock price of the stocks themselves is likely to rise over time, too.

If you have, say, $100,000 invested in dividend payers with an overall average yield of 3%, you'll receive $3,000 in dividend income this year. If those payouts grow by an annual average of 5%, in 10 years they will be generating close to $4,900 per year. Other ways to fight inflation include investing in Treasury Inflation-Protected Securities (TIPS) bonds, which adjust their interest rates to account for inflation, and buying annuities with inflation-adjustment features built in.

Social Security

Know how much to expect, how to decide when to take it, and how to increase benefits and avoid reductions

It's vital to know how much income you can expect from Social Security, as for most people, it will make up a big chunk of your retirement income. For context, know that the average monthly Social Security retirement benefit check will be $1,907 as of January 2024, or just under $23,000 per year.

Clearly, that's not going to be sufficient for most people, and that's why you need to start planning, saving, and investing as early as possible. That's just an average, though -- if you earned an above-average income over your working life, you'll collect more.

The maximum benefit for those retiring in January 2024 at their full retirement age is $3,911, or just under $47,000 per year. (Note that Social Security benefits include regular inflation adjustments.)

To get a better idea of how much you can expect to receive, head over to the Social Security Administration (SSA) website and set up a "my Social Security" account. Once you do, you can click in any time, to see the SSA's record of your earnings, year by year, and to see its estimate of your Social Security benefits, based on when you claim them.

You can claim your benefits as early as age 62 and as late as age 70, with your checks getting smaller if you claim early and larger if you delay. But remember that if you start collecting your Social Security benefits at age 62, your checks might be on the small side, but you'll get many more of them than if you start at age 67 or 70.

If you don't like the expected benefits you're seeing for yourself, know that there are various ways to increase your Social Security benefits. For example, the formula to determine benefits is based on your earnings in the 35 years in which you earned the most. So if you only worked for 31 years, it will be incorporating four zeros, which will bring down your benefits.

If you can work a few more years, you'll end up with bigger checks. Even if you've already worked 35 years, if you're earning much more now than you ever did, by working an extra year or two, you'll be able to have a few years' worth of low incomes kicked out and replaced by higher incomes.

A little coordinating with your spouse, if you're married, can also boost the total sum you both collect from the program.

The best-case scenario: You have enough saved to retire

Now let's look at a few scenarios -- the best-, middle- and worst-case ones if you're planning to retire soon. In the best-case scenario, you'll have saved enough money with which to retire comfortably, a sum that will provide enough income throughout your retirement.

What's enough? Well, how much money you need to retire with differs for different people, as it's based on your health, your expected longevity, your lifestyle, your location, and more.

If you're trying to determine how much money you need to retire with, try thinking about it in terms of annual income instead of a big blob of cash. One rule of thumb is that in retirement, we should aim to live on 80% of our pre-retirement income. That's a rough guide, though.

If you expect to be much more active post-retirement than pre-retirement, perhaps doing a lot of international travel, you may need more. Similarly, if you suspect you might be in poor health and may require a lot of costly care, you may need more. If, instead, you expect to be mostly gardening, walking, and reading, you could get by with less.

Consider all your sources of income, and remember that you may be able to add more sources, such as some passive income. Typical sources of income for many people include Social Security, pension income, dividend income, interest income, annuity income, and rental property income.

If you determine that you'll need $60,000 annually in retirement and you expect $25,000 from Social Security and $15,000 from annuities, that leaves $20,000 in needed income. You can invert and use the 4% rule to convert that into a needed nest egg by multiplying it by 25. (That's because dividing 1 by .04, or 100 by 4, results in 25.) Doing so gives you $500,000.

The medium-case scenario: You have nearly enough saved to retire

A more likely scenario for many people is that they approach retirement with almost enough money. If that looks like you, what can you do? Well, you have some options. A good one is simply delaying retirement and continuing to work at your current job. That offers several benefits:

- You can save and invest more money.

- You'll be delaying taking anything out of your nest egg to live on.

- Your nest egg will have a little longer to grow, untapped.

- You'll end up having to support yourself in retirement for fewer years.

- You may be able to enjoy your employer-sponsored health insurance a little longer, saving some money.

You might also try semi-retiring for a few years. See if you can cut back the hours you work at your current job, perhaps to half-time. Or go ahead and retire from that job, but generate some income on the side via a side gig or two. There are lots of side jobs you might try, such as driving for a ride-sharing company, selling handicrafts online, tutoring kids, pet-sitting, or freelance work.

The worst-case scenario: You don't have enough saved to retire

In the worst-case scenario, you simply won't have enough money socked away to permit you to retire comfortably. If it's any comfort, you're not alone: Fully 34% of workers have saved less than $25,000 for retirement, per the 2022 Retirement Confidence Survey. Yikes.

So what can you do? Well, don't retire now or soon, if you can help it. Try to work at least a few more years than you wanted to, and if you can, work all the way to age 70, at least. That's the age at which your Social Security benefits will stop growing, so you might as well start taking them then.

If your full retirement age for Social Security is 67 and you delay starting to collect until age 70, your benefit checks should be about 24% fatter. That can turn what would have been a $2,000 check into a $2,480 one, upping your annual benefits from $24,000 to almost $30,000. Starting to take Social Security benefits at age 70 will also take some financial pressure off you at that point, perhaps permitting you to work less.

Think outside the box a bit, too. You might rent out some space in your home on a long-term basis. If a boarder pays you, say, $600 per month, that's $7,200 in annual income. You might also relocate -- to a smaller, less costly home or to a less costly part of the country.

Annuities

Speaking of annuities, they're well worth considering for your retirement. A downside of them is that the money you spend to buy them is typically gone and won't be around for you to leave to heirs, but in exchange for that, you can set yourself up to receive regular income for the rest of your life.

It's generally best to focus on fixed annuities, which can start paying you immediately or on a deferred basis, at a future point that you specify, while avoiding variable annuities and indexed annuities, as they tend to have more restrictive terms and may not be as good a deal.

Learn more about annuities before buying one, but you can get an idea of the kind of income fixed immediate annuities offer from the examples below.

| Person/People | Cost | Monthly Income | Annual Income Equivalent |

|---|---|---|---|

| 65-year-old man | $100,000 | $570 | $6,840 |

| 65-year-old woman | $100,000 | $544 | $6,528 |

| 70-year-old man | $100,000 | $651 | $7,812 |

| 70-year-old woman | $100,000 | $616 | $7,392 |

| 65-year-old couple | $200,000 | $960 | $11,520 |

| 70-year-old couple | $200,000 | $1,062 | $12,744 |

| 75-year-old couple | $200,000 | $1,225 | $14,700 |

To get an idea of what a deferred annuity might offer, know that a 65-year-old man would have recently been able to spend $100,000 for an annuity that would start paying him in 10 years, offering $1,138 per month for the rest of his life. Deferred annuities are great tools to help you avoid running out of money later in life.

In times of higher interest rates, annuity contracts will offer bigger payouts, and we're currently in a low-interest rate environment. So consider a "laddering" strategy, where you spend just a portion of the amount you want to spend on annuities first, and then spend another portion in a year or two, when you hope interest rates will be higher, and so on.

Early retirement

While most people have not saved enough for retirement yet, and many enter retirement with too little socked away, there's another group of people -- those who have saved and invested aggressively, and who have a sizable nest egg. Those folks may be able to retire early.

If you're among those ranks and hadn't thought of retiring early, give it some consideration. After all, we only live once, and you don't know how long your life will be. You may be able to start collecting Social Security at 62 and retire then (or earlier), with sufficient income on which to live -- including ample contingency funds for healthcare and other possible needs. Early retirees tend to be in better health than later ones, meaning that they're more able to be active and enjoy pastimes such as travel, gardening, golf, tennis, and so on.

An early retirement may be especially possible for you if you're still quite young. By ramping up your saving and investing, you may reach your retirement goals sooner. The table below shows what might be accomplished:

| Growing at 8% for | $10,000 invested annually | $15,000 invested annually | $20,000 invested annually |

|---|---|---|---|

| 3 years | $35,061 | $52,592 | $70,122 |

| 5 years | $63,359 | $95,039 | $126,719 |

| 10 years | $156,455 | $234,682 | $312,910 |

| 15 years | $293,243 | $439,864 | $586,486 |

| 20 years | $494,229 | $741,344 | $988,458 |

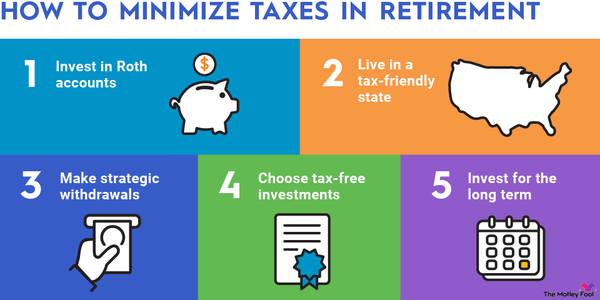

Taxes in retirement: What you need to plan for and how to minimize taxes

Another key concern in retirement is taxes. Here's what you need to know:

- Social Security: Your Social Security income may be taxed if your income crosses a certain threshold.

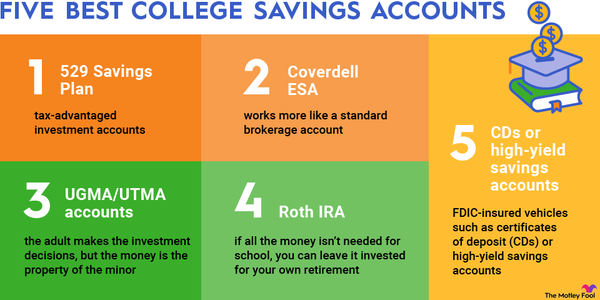

- Traditional IRAs and 401(k) accounts: The traditional forms of these retirement savings accounts let you contribute money on a pre-tax basis, shrinking your taxable income in the year of contribution. In exchange for that upfront tax break, your withdrawals in retirement will be treated as taxable income. (Note that your tax bracket in retirement may be lower than your bracket when you were working.)

- Roth IRAs and Roth 401(k) accounts: These accounts offer no upfront tax break, but if you play by the rules, you can withdraw money from them in retirement -- tax-free. That's because you were already taxed on the funds you contributed.

- Investment income: Your other investments face taxes, too. Short-term capital gains (from investments held for a year or less) are taxed at your ordinary income tax rate, while long-term capital gains get taxed at 0%, 15%, or 20%. Dividend income from most stocks held for more than 60 days is generally taxed at 0%, 15%, or 20%, as well.

- Interest income: Most interest income is treated as ordinary income and is subject to taxation. Treasury bonds and bills only face federal taxes, while corporate bonds are generally taxable at the federal, state, and local levels. Municipal bonds tend to be tax-free at the federal level.

The non-financial side of retirement

As you plan for your retirement, venture outside the financial realm a bit and think about how you will spend your days. Know that many retirees are surprised to discover that they feel a bit restless and perhaps even depressed once they no longer have the structure of their working days -- and have lost the opportunities to socialize with others that work offered, as well.

Aim to stay active physically and socially when you're retired, and you might start getting into some activities and groups even before you retire, to help make the transition to retirement smoother. Staying fit and healthy can keep you happier, too, and should keep healthcare costs down. Exercise and volunteering are some activities that keep most people's spirits up.

Related Retirement Topics

Seeking professional help

Finally, as retirement planning is so vital -- and can be so complicated -- don't avoid getting help. It can be well worth employing a financial advisor to review your finances, make recommendations, and help you understand how to best manage your money throughout retirement. A good advisor may even save you much more than you pay for their services. Ask around for strong recommendations of advisors or find a local fee-only advisor via the NAPFA.org website.

Don't leave your retirement up to chance, hoping for the best. Spend some time learning about and planning for retirement, in order to enjoy yours fully, with minimal financial stress.

Expert Q&A on Retirement Planning

Rita Assaf

The Motley Fool: In 2019, the average retirement account savings for American households was $65,000 with the average American under 35 having $13,000 saved for retirement. Why do you think this average is so much lower than what experts typically expect Americans to have?

Rita Assaf: Coming out of the pandemic, we’ve actually seen some powerful signs that younger people are more optimistic and driven to save for the future, compared to older generations. In general, younger generations have had more exposure to workplace savings plans and we’ve seen a lot more democratization of investing. It’s now easier to get started to save and invest with mobile apps and access to information has spread as well as we see saving and investing topics in social media. Younger generations have also seen their parents and grandparents weather recessions and are much more aware of their financial life.

Additionally, younger generations are leading the way when it comes to taking action toward retirement saving, with the number of IRA account openings in Q3 2022 for Gen Z increasing by 83% when compared to Q3 2021 and the number of Millennial accounts increasing by 25%. Furthermore, Millennial Roth IRA accounts with a contribution increased by 5.8% year-to-date.

The Motley Fool: There are no hard and fast rules about when to retire or how much we should have saved, but what three pieces of advice would you give someone who is just starting their first retirement savings account?

Rita Assaf: Planning for retirement is the biggest goal we invest in throughout our lives. While it might seem daunting, it’s beneficial to start saving for retirement as early as you can to make sure your money has the greatest potential for growth over time. When thinking about retirement, it's important to set a goal and start saving early to maximize your efforts, as the growth potential of just one year’s contribution can have a significant impact on your retirement savings.

As a general rule, these are the three actions that can make the biggest impact on retirement readiness for those saving in their twenties or thirties:

- Save as much as you can: Young people today are 30 or more years away from retirement. At this point, your retirement plan should really be focused on determining how you are saving on a regular basis and what accounts those savings should be put into based on tax and investing considerations. To help determine that, Fidelity suggests aiming to save at least 15% of your pre-tax income each year, which includes any employer match, with a goal to save 10 times (10X) your pre-retirement income by age 67. Breaking this down by age, aim to save at least 1x your income by age 30, 3x by 40, 6x by 50, and 8x by 60.

- Increase contributions over time: If starting off saving 15% of more of your income isn’t possible, small increases over time can make a big difference. If you have access to a 401(k) with a company match, try to save to at least your company match level. If you don’t save to that level, it’s like leaving free money on the table. A great way to regularly increase your contributions to your retirement savings is to do it if and when you get a raise each year. Get in the habit of increasing your contribution rate by 1% each year until you get to the 15%.

- Review your asset mix: Getting your investment mix right—investing for growth— from the start, can make a big difference. You want to make sure your money is working for you and has potential for growth. Make sure you have the right mix of stocks, bonds and cash based on your how far you are from retirement, and how comfortable you are taking potential risk in your portfolio.