The Roth IRA is an individual retirement account that provides tax-free growth and withdrawals to participants who pay taxes on their contributions. While it can help anyone save more money for retirement, a Roth IRA is usually best for people who believe they'll be in the same or a higher tax bracket in retirement then they're in right now. By paying taxes up front, they'll give less of their savings back to the government during retirement.

Most people understand the general idea of Roth IRAs: You put money in now so it can grow, and then you withdraw it later in retirement. But few understand exactly how this type of account makes money or how they can get the most out of their Roth IRA. We'll cover all of that in detail below.

How does it make money?

How does a Roth IRA make money?

A Roth IRA is really just a special home for your savings that helps you minimize your taxes. It doesn't actually make money for you. Your retirement savings grow through a combination of your contributions and investment earnings.

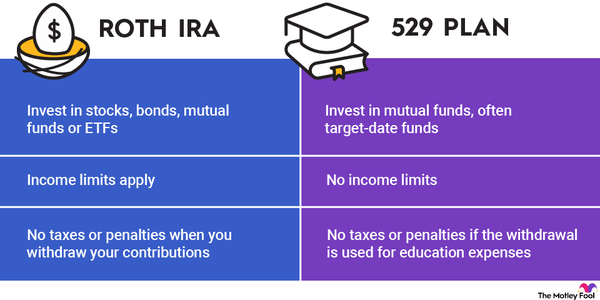

Obviously, the more you contribute to your Roth IRA, the more it will be worth, assuming you're not also withdrawing funds from the account. Contributing routinely is ideal, but you must stay mindful of the annual contribution limits: $6,500 in 2023 ($7,500 if you're 50 or older) and $7,000 in 2024 ($8,000 if you're 50 or older). However, Roths IRAs have income limits, which means certain high-income earners may have lowered contribution limits or may not be able to contribute money directly to a Roth IRA at all.

You place your Roth IRA contributions in various investments that will hopefully increase in value over time and earn you dividends or interest, which you can withdraw tax-free later. This can happen even when you're not actively contributing to your Roth IRA. That compounding growth could be worth thousands of dollars by the time you're ready to retire.

How much your Roth IRA will grow every year depends on how much you're contributing and what you're investing in. It's impossible to predict because the stock market can be volatile, and past performance doesn't guarantee future returns.

What do they invest in?

What do Roth IRAs invest in?

What you can invest in depends on which type of Roth IRA you open and which custodian you use. Most Roth IRAs enable you to invest in the following:

- Stocks: When you invest in a stock, you're purchasing part ownership of a company. Stocks are known to generate larger returns than bonds over the long term, but they can be volatile in the short term.

- Bonds: Bonds are debt. When you buy one, you're lending money to a company or government organization that pays you back over time plus interest. They offer lower, but more predictable, returns than stocks.

- Mutual funds: Mutual funds are baskets of stocks and bonds that you purchase as a bundle. They enable you to quickly diversify without purchasing a bunch of individual stocks and bonds.

- Exchange-traded funds (ETFs): Exchange-traded funds are similar to mutual funds, except ETFs are traded like stocks, whereas you can only buy mutual funds at their price at the end of each trading day.

- Certificates of deposit (CDs): A CD is a special type of savings account most banks offer that requires you to leave a sum of money untouched in your account for several months or years in exchange for a high rate of interest on those funds.

- Money market accounts: A money market account is another type of savings account that offers an above-average rate of interest and limits your monthly withdrawals, although if you're keeping the money in a Roth IRA, you probably aren't intending to withdraw funds until retirement.

You are free to choose which of the above investments you want for your Roth IRA and change how you're investing your money at any time.

What you can't invest in

What can't you invest in with a Roth IRA?

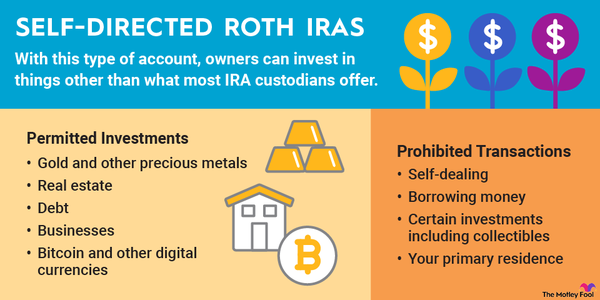

Most IRAs prohibit you from investing in the following things:

- Real estate

- Precious metals

- Cryptocurrency

- LLC membership interest

There is a loophole for those interested in opening a self-directed Roth IRA, though. This is a special type of IRA that enables you to invest in assets you can't normally hold in a retirement account. These accounts are usually best for experienced investors, and they can be a little more difficult to open as fewer custodians offer them.

There are also things you can't invest in whether you use a Roth IRA or a self-directed Roth IRA. These include life insurance policies and collectibles such as antiques, artwork, and stamps.

Who manages it?

Who manages a Roth IRA?

You are responsible for deciding how much you contribute to your Roth IRA and what you want to invest your money in. But your custodian dictates which investment options are available to you, so you must choose yours carefully.

All IRAs are required to have a custodian by law. The custodian could be a bank, an insurance company, or a mutual fund company, but brokerage firms are the most popular because they offer a wider range of investments. Your custodian is responsible for holding your assets and making sure all of your investments comply with IRS guidelines, as well as completing necessary reporting requirements.

You are free to change up how you invest your money at any time, and you can switch custodians as well by rolling your Roth IRA over to a new account. There's also no rule that says you can only have a single Roth IRA, although juggling multiple accounts with different custodians can make it more difficult to see what you have and keep track of how close you are to the annual contribution limits.

How do you get the most out of your Roth IRA?

- Know what you want to invest in.

- Choose your Roth IRA custodian carefully.

- Contribute money regularly.

- Stay mindful of your tax bracket.

Know what you want to invest in

What you invest in is largely up to you, but you need to consider your investing experience and your risk tolerance. Some types of investments are well suited to beginners, while others are difficult to turn a profit unless you have specialized knowledge of the industry.

Some investments are also riskier than others. Usually you can afford to invest heavily in riskier assets like stocks while you're younger because your portfolio will have decades to recover from a loss before you need to draw upon it. But as you age, your risk tolerance declines, and then you'll want to move more of your money into less volatile assets such as bonds.

You also have to make sure you're diversified between many investments and sectors. This reduces the risk of serious loss if one of your investments starts performing poorly. Mutual funds, including low-cost index funds, provide a simple way to diversify your investments quickly.

Choose your Roth IRA custodian carefully

Once you have some idea of what you want to invest in, you need to look for a Roth IRA custodian that offers these options. If you think you may want to open other types of investment accounts in the future, like a traditional IRA, a taxable brokerage account, or a 529 college savings account, look for a custodian that offers these as well.

Pay attention to fees associated with your account as these can eat into your profits over time. Your custodian should provide a list of fees, or you can reach out to the company and ask questions about the costs.

Contribute money regularly

You technically have up until the tax deadline for the year -- usually April 15 of the next year -- to contribute to your IRA, but waiting this long deprives you of months of potential investment growth. You're better off making a lump-sum contribution at the beginning of the year or contributing a regular amount each month.

Stay mindful of your tax bracket

Because Roth IRA contributions don't reduce your taxable income for the year, you could end up in a higher tax bracket than you're used to if you've contributed to a tax-deferred account in years past. In that case, you may want to put a little money in a tax-deferred account to keep yourself in a lower tax bracket so you can pay a smaller percentage in taxes on your Roth savings.

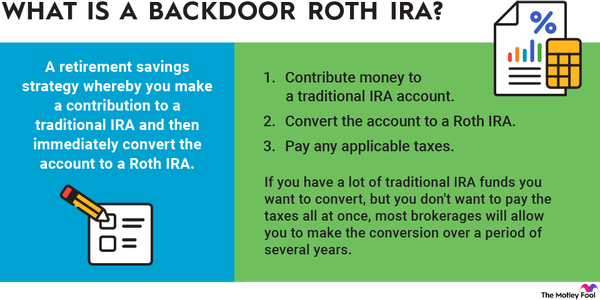

If you're earning less this year than normal, consider converting some of your tax-deferred retirement savings to Roth savings. You will pay taxes in the year you do the conversion, but this may not affect your tax bracket if you're careful about how much you convert at a time.

Roth IRAs give you a lot of freedom to invest in a way that aligns with you preferences. But if you want to get the most out of yours, it helps to understand how they work and what steps you can take to maximize your savings. Review your Roth IRA contributions and asset allocation at least once a year and make any changes you feel are necessary to keep yourself on track for the retirement you want.