A 401(k) makes investing for retirement easy with pre-tax contributions withdrawn directly from your paycheck. However, once you've made your contribution, you need to choose the right investments to maximize returns while limiting risk. Most 401(k) plans usually provide a small selection of funds in which to invest, and you'll want to pick an appropriate mix of assets for your age and risk tolerance.

This guide will help you develop a strategy to invest in your 401(k) to make the most of this tax-advantaged retirement account.

1. Contribute enough to max out your match.

Employers often match contributions you make to your own 401(k) plan. For example, your employer might match 50% of your contributions up to a maximum of 4% of your salary.

This is free money, but you can claim it only if you invest at least enough to max out your company's matching funds. This is the only investment option that gives you a guaranteed 100% return on invested funds immediately with no risk, so it's smart to always max out your match before investing in any other retirement accounts.

2. Set your contributions as a percentage of your salary.

There are two general ways 401(k) plans allow people to manage their contributions -- either as a specific dollar amount per paycheck or as a percentage of their salaries. If you have the option to enter your contribution based on a percentage of your salary, it's a good idea to go that route.

If you choose to contribute a percentage of your salary, your contributions will automatically increase as your salary rises over time with yearly adjustments and raises. This can help to scale up your retirement savings goals over the course of your career with minimal intervention on your part.

3. Understand the risks.

Once your contributions and employer matching funds are deposited, they'll need to be invested so your money can grow over time.

Usually 401(k)s allow you to choose investments from a small number of preselected funds, such as index funds, which track major market indexes, or target-date funds, which select a mix of investments appropriate for your age.

Investing in index funds or target-date funds presents less risk than investing in shares of individual companies, but there is always some risk inherent in investing. To minimize the danger of losses, you should build a diversified portfolio of different investments.

You should also generally avoid investing too much -- if any -- of your 401(k) funds in your own employer's stock, if that is an option available to you. Otherwise, if your company experiences financial trouble, you could lose both your job and your nest egg at the same time.

4. Invest based on the time until you'll need the money.

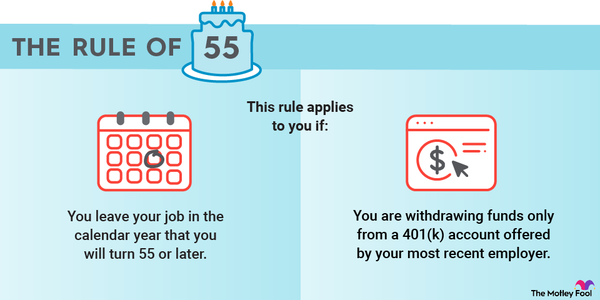

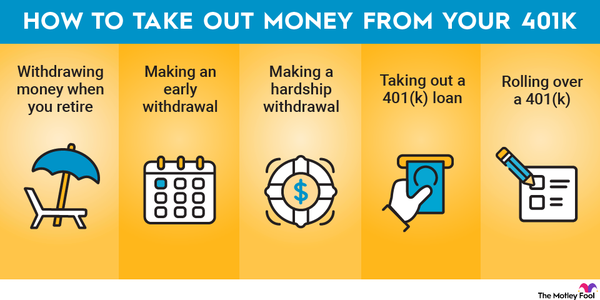

Remember that a 401(k) is a retirement account, so you should plan not to withdraw money until you are at least 59 1/2. If you're fairly young now, that means you have a long investing horizon ahead of you. If you're nearing retirement age, however, your investing horizon is much shorter; you will need to start withdrawing that money soon to fund your retirement.

Keep this timeline in mind when determining your risk tolerance. If you're investing in your 401(k) throughout your career, your willingness to take risks should change over time. When you're younger, more of your 401(k) funds should be invested in the stock market to maximize potential returns. You have time to wait out any downturns. However, as you age, you have less flexibility around market volatility and should shift your funds toward safer investments.

Lower-risk investments such as cash, CDs, money market funds, and bonds present far less risk of loss but also lower rates of return. If you overinvest your 401(k) funds in safe investments like these, you risk missing out on the wealth-building returns of the stock market.

To make sure you aren't taking on too much -- or too little -- risk with your 401(k), consider this simple formula: Subtract your age from 110 and invest the resulting percentage of your 401(k) money in the market. A 20-year-old would have 90% of their money in stocks while an 80-year-old would have just 30% of their assets in the market.

Many 401(k)s offer target date funds. If you invest in one, your portfolio will be rebalanced for you. If you select other investments, you'll need to manually make changes as you age and as your level of risk exposure shifts.

5. Revisit your plan and consider adjustments at least once a year.

One of the best things about using a 401(k) to invest for retirement is that you can put your investments on autopilot. However, this doesn't mean you should simply set up your 401(k) contributions once and forget it forever. You need to make sure you're on track with your retirement goals, that your portfolio remains balanced, and that your investments are performing as expected.

To stay on top of your retirement investing, make a repeating appointment on your calendar to check in on your 401(k) at least once a year.

You should also consider making changes as you reach key milestones in your life and career. If you get a big raise, consider upping the percentage of your salary that goes toward your 401(k). If you pay off your student loans, consider shifting the money you'd been spending there to instead build wealth on your behalf. When you hit key milestone birthdays (such as age 50, when you can start making catch-up contributions), or your kids become able to care for themselves, those are also great times to revisit your plan and make adjustments.

Get started now

Your 401(k) can serve as the cornerstone of a strong retirement strategy. To make that strategy a reality, the most important thing you can do is get started on your investment path as soon as you can. The sooner you start, the more time will be your ally, and the better your chances will be of enjoying a financially comfortable retirement.