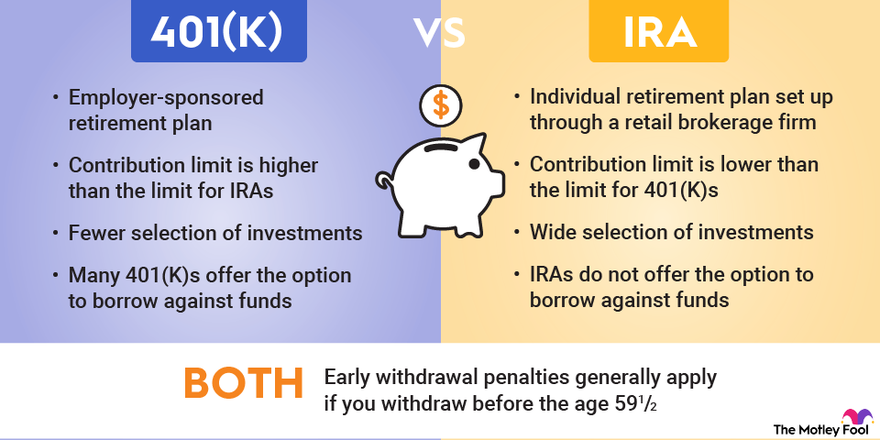

A 401(k) and an individual retirement account (IRA) are both tax-advantaged retirement accounts. While 401(k)s are typically only offered by employers (who often match employee contributions), IRAs can be opened by individuals through any retail brokerage firm.

401(k)s generally allow higher contributions but offer fewer investment options, whereas IRAs have lower contribution limits -- and income caps for high earners -- but offer the opportunity to invest in almost any stock, bond, or mutual fund.

401(k) vs. IRA

If you're debating between investing in a 401(k) or an IRA, the first thing to know is that you don't have to choose. You can invest in both.

Some of the key differences between IRAs and 401(k)s include:

- Account sponsorship: Most 401(k)s are offered through employers, while an IRA can be opened via any retail brokerage. You don't have to depend on your employer to establish an IRA.

- Contribution limits: While limits change annually, the contribution limit for 401(k)s is around three times higher than the contribution limit for IRAs.

- Eligibility rules: There are no upper income limits for 401(k) contributions, but 401(k) plans must pass nondiscrimination tests to ensure that the plan doesn't disproportionately benefit highly compensated employees. Taxpayers who earn above certain income thresholds are ineligible to make tax-deductible contributions to traditional IRAs or to invest in Roth IRAs.

- Investment options: IRAs opened with major brokers offer a wide selection of investment vehicles, while most 401(k)s offer just 20 or fewer investment choices (usually in the form of mutual funds).

- Withdrawal rules: Early withdrawal penalties generally apply to both 401(k)s and IRAs if you withdraw money before age 59 1/2. However, with each type of account, there are different ways to receive exemptions from these penalties. Also, many workplace plans offer the option to borrow against 401(k) funds, while IRAs include no such provision.

Let's take a closer look at some of the rules governing IRAs and 401(k)s.

Contribution limits

A 401(k) has a significantly higher annual contribution limit than an IRA. For 2023 and 2024, the maximum contribution limits for each type of plan are:

| Type of Contribution Limit | IRA | 401(k) |

|---|---|---|

| Standard annual contribution limit | $6,500 (2023); $7,000 (2024) | $22,500 (2023); $23,000 (2024) |

| Additional catch-up contribution limit for those 50 and older | $1,000 (2023 and 2024) | $7,500 (2023 and 2024) |

| Total limit for those 50 and older | $7,500 (2023); $8,000 (2024) | $30,000 (2023); $30,500 (2024) |

Eligibility to make tax-deductible contributions to a traditional IRA phases out for high earners if either the high earner or their spouse has access to a workplace retirement plan. High earners also cannot make Roth IRA contributions unless they use a backdoor Roth IRA strategy.

It's important to note that the 401(k) annual contribution limits apply only to individual contributions, not those from your employer. For example, if you contribute $14,000 and your employer matches up to $6,000, then that's a total contribution for the year of $20,000 -- but only your $14,000 contribution counts toward the annual contribution limit. In 2024, you could still contribute another $9,000 if you're younger than 50.

The total annual contribution limits for a 401(k) with the inclusion of employer contributions in 2023 are:

- $66,000 for people younger than 50.

- $73,500 for those who are 50 and older.

The total annual contribution limits for a 401(k) with the inclusion of employer contributions in 2024 are:

- $69,000 for people younger than 50.

- $76,500 for those who are 50 and older.

The table below presents the maximum combined total contributions allowed for 2023 and 2024:

| Age of Employee | IRA | 401(k) Combined Limit for 2023 | 401(k) Combined Limit for 2024 |

|---|---|---|---|

| Younger than 50 | N/A | $66,000 | $69,000 |

| 50 or older | N/A | $73,500 | $76,500 |

Unfortunately, when you leave your job you are no longer allowed to contribute to the 401(k) sponsored by your former employer. Instead, you must make a choice among keeping your 401(k) account as is with that company, rolling it over to an IRA, or rolling it over to your new employer's 401(k) plan.

Withdrawal rules

Since both 401(k) and IRA plans are intended to help you save for your later years, there are penalties assessed for withdrawing money early. In general, if you withdraw funds from either a 401(k) or an IRA before the age of 59 1/2, a 10% early withdrawal penalty applies. However, there are some important differences in the rules governing IRA and 401(k) withdrawals.

First and foremost, it's possible to withdraw money in the form of a loan from a 401(k) but not from an IRA. Borrowing against your retirement account has significant downsides, but it does enable you to tap these funds without incurring the early withdrawal penalty.

On the other hand, with an IRA there are more scenarios in which you may withdraw money early without incurring the 10% penalty. The table below shows when you can withdraw money penalty-free from each type of account:

| Reason for Withdrawal | 401(k) | IRA |

|---|---|---|

| Becoming totally and permanently disabled | Yes | Yes |

| Incurring qualified higher-education expenses | No | Yes |

| Purchasing a home for the first time (up to $10,000) | No | Yes |

| Incurring unreimbursed medical expenses exceeding 7.5% of income | Yes | Yes |

| Paying health insurance premiums while unemployed | No | Yes |

| Called to active duty as military reservist | Yes | Yes |

| Leaving your job during or after the calendar year you turn 55 | Yes | No |

If you think you may leave your job in your mid-50s, then a 401(k) offers more flexibility due to the Rule of 55. But if you want your retirement account to cover education expenses, insurance premiums if you lose your job, or part of a home purchase, only an IRA provides those options penalty-free.

Cost

As many as 95% of workers pay 401(k) fees, according to a survey conducted by TD Ameritrade and Pontera (formerly FeeX). The average fee is 0.45%; however, fees can vary substantially by the type of investment account.

Because 401(k) plans offer limited investment options, you may be restricted to only buying shares in mutual funds, which often charge higher fees than other types of securities accessible with IRAs.

By contrast, investments in IRAs typically come with few or no fees. Most brokers don't charge a fee to open an IRA account and have eliminated commissions on trades. You can compare IRA providers to identify those that don't impose fees. Plus, with a broader choice of investment types, you may also save money in fees by choosing low-fee exchanged-traded funds (ETFs) for your IRA's portfolio.

Flexibility

Most 401(k) plans offer the choice of investing in just 20 or fewer mutual funds, according to BrightScope. A minority of 401(k) plans can now be established as self-directed accounts -- meaning you can invest in many different types of securities, the same as you could with a typical brokerage account -- but self-directed 401(k)s are not the norm.

An IRA is more like a typical retail brokerage account in that your investment options are not restricted. If unrestricted investment choice is important to you, then an IRA is your best alternative. However, some investors appreciate the simplicity of having only a few investment funds from which to choose, in which case a 401(k) may be preferable.

Ultimately, as you compare all of the differences between IRAs and 401(k)s, you may decide that you prefer one over the other, or you may opt for both. Either way, the important thing is that you're saving now for your later years and building a diversified portfolio of sound investments that will provide for you in retirement.